Ah, Broadcom (AVGO), that peculiar beast of silicon and software, has once again danced its jittery jig atop the stock market stage. On a Thursday not so long ago, it unfurled its third-quarter fiscal 2025 results-an assemblage of numbers so glistening and grand that the stock leapt over 4% in after-hours trading. Should this newfound altitude hold, Broadcom will ascend to an all-time zenith, boasting a year-to-date surge surpassing 35%. A triumph? Perhaps. But let us not be too hasty in applauding such fleeting fireworks.

No, dear reader, for beneath these dazzling digits lies a far richer tale-a tale of transformation, ambition, and the relentless hunger of machines. You see, Broadcom is no mere peddler of chips; it has morphed into something far more curious: a hybrid creature straddling semiconductors and software, with one eye fixed firmly on the glittering prize of artificial intelligence. And if the auguries are correct, this unlikely titan may soon claim its place among the “Ten Titans,” those colossal growth stocks destined to breach the $2 trillion mark by 2028.

Who are these Ten Titans, you ask? Allow me to introduce them:

- Nvidia

- Microsoft

- Apple

- Alphabet

- Amazon

- Meta Platforms

- Broadcom

- Tesla

- Oracle

- Netflix

Together, they compose a staggering 38% of the S&P 500, a veritable oligarchy of wealth and power. Yet within this elite cadre, Broadcom stands out-not merely for its size but for the peculiar alchemy of its ambitions. It is a company that whispers promises of tomorrow while clutching tightly to the machinery of today. For those brave enough to wager on its future, Broadcom offers a beguiling proposition indeed.

The Marvelous Machines of Broadcom

Once upon a time, Nvidia reigned supreme in the realm of gaming and professional visualization. But lo! The winds shifted, and data centers became the new battleground. In much the same way, Broadcom has shed its skin, transforming from a humble semiconductor merchant into a chimera of circuits and code. Its acquisition of VMware-a feat accomplished less than two years ago-was nothing short of inspired timing. As AI fever swept through the tech world like wildfire, VMware placed Broadcom squarely at the heart of virtualization and cloud management.

In the latest quarter, infrastructure software accounted for a whopping 43% of Broadcom’s revenue. And who do we thank for this bounty? Why, VMware, of course-the goose that laid the golden algorithm. Beyond software, however, lies another marvel: the XPU, or eXtended Processing Unit, a custom-built contraption designed to dazzle hyperscale cloud customers. These XPUs now comprise 65% of Broadcom’s AI revenue, flanked by Tomahawk Ethernet switches and Jericho routers, which weave together vast networks of computational might.

The Hyperscalers’ Feast

But what drives demand for these fantastical devices? Ah, therein lies the secret sauce. Broadcom boasts a coterie of core customers-three giants whose names remain shrouded in mystery, though whispers suggest Alphabet and Meta Platforms lurk among them. Recently, Broadcom converted one of its top prospects into a qualified customer, securing a jaw-dropping $10 billion order for AI racks. Such is the stuff of corporate legend.

This bonanza contributes to a backlog swelling to $110 billion, a figure so absurdly large it could choke a lesser company. Yet Broadcom marches onward, projecting $6.2 billion in Q4 AI revenue alone-a sum that would account for 35.6% of total revenue. Just two quarters prior, AI revenue stood at a mere 29%. How quickly the tides turn!

| Metric | Q1 Fiscal 2025 | Q2 Fiscal 2025 | Q3 Fiscal 2025 | Q4 Fiscal 2025 (Projected) | Fiscal 2025 Total (Projected) |

|---|---|---|---|---|---|

| AI semiconductor revenue (in billions) | $4.1 | $4.4 | $5.2 | $6.2 | $19.9 |

What sorcery is this? In just three years, Broadcom’s AI revenue has ballooned from $3.8 billion to a projected $19.9 billion-a fivish-fold increase that defies comprehension. Truly, the company is drunk on its own success, spinning ever faster toward the dizzying heights of the $2 trillion club.

The Path to Two Trillion

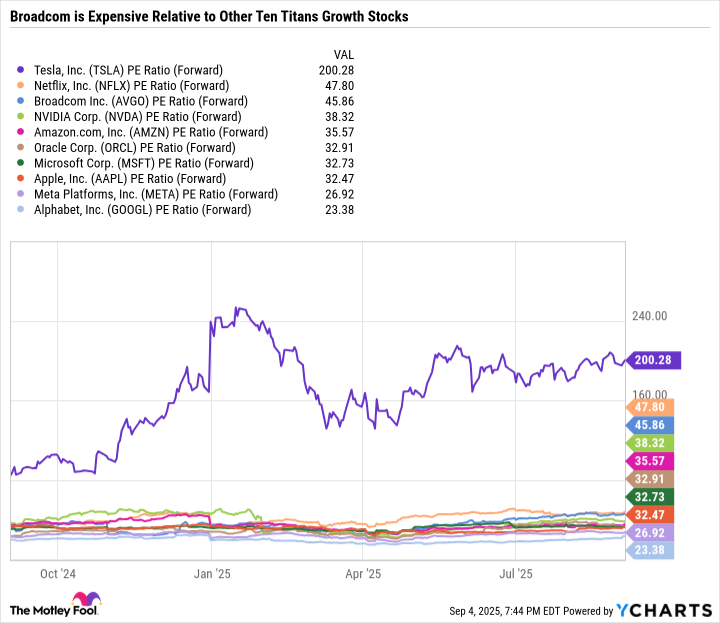

And yet, dear reader, beware. There is danger lurking in these lofty ambitions. Broadcom’s market cap currently sits at $1.44 trillion, meaning it must swell by 39% to reach the coveted $2 trillion milestone. While earnings growth appears robust, the specter of valuation looms large. With a forward price-to-earnings ratio of 45.9, Broadcom is priced like a rare truffle plucked from the forest floor. Will investors continue to savor its flavor, or will they grow weary of its exorbitant cost?

Still, there is magic here-a dark, intoxicating magic that draws investors like moths to a flame. Broadcom’s diversification across data centers, cloud computing, telecom, enterprise software, and more makes it a formidable force. It is not a pure-play AI stock like Nvidia, nor is it as staid as Microsoft. Instead, it occupies a peculiar middle ground, growing faster than many peers yet still tethered to the whims of Wall Street.

Broadcom: To Buy or Not to Buy?

So, should you hitch your wagon to this runaway train? That depends. Broadcom is a stock built for perfectionists, for those who relish complexity and crave exposure to multiple industries. Its AI ambitions are undeniably bold, but remember: even the brightest stars can dim. Should Broadcom falter, its fall will be swift and merciless.

For now, though, it remains a tantalizing prospect-a megacap marvel spinning tales of tomorrow while rooted firmly in today. If you possess both courage and patience, consider taking a bite of this peculiar pie. Just don’t forget to chew carefully. 😏

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- USD RUB PREDICTION

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

2025-09-08 16:28