In the grand theatre of enterprise artificial intelligence, C3.ai (AI) has long held a position of prominence, having graced the stage as one of its earliest performers in 2009. Its repertoire boasts over 130 turnkey applications, each crafted to assist businesses across nineteen industries in their pursuit of technological advancement. Yet, like any noble house whose fortunes falter, recent events have cast a shadow upon this once illustrious name.

Thomas Siebel, the patriarch and founder, recently withdrew from his duties as CEO, citing health concerns. His absence, much like the departure of a seasoned dowager from a bustling drawing room, has left a palpable void. For Mr. Siebel was not merely an overseer but an active participant in the delicate art of deal-making-a role that, when relinquished, inevitably disrupts the harmony of commerce.

Indeed, the company’s latest performance, revealed in the fiscal first quarter of 2026, proved to be a lamentable affair. Revenue plummeted, losses soared, and the stock price, ever sensitive to such misfortunes, collapsed by 33% within a month. Yet, amidst these trials, a new figure steps forward-Stephen Ehikian, a gentleman of considerable experience, who now assumes the mantle of leadership. Could this transition herald opportunity, or is it but another chapter in a tale of woe?

The Art of Adoption

Not all enterprises possess the means or mastery to fashion artificial intelligence from scratch, and thus C3.ai offers its ready-made solutions with a grace akin to a well-tailored gown-adaptable yet elegant. Oil and gas magnates employ its Reliability application to foresee equipment failures, while bankers utilize Smart Lending to expedite loan approvals. Such conveniences are further enhanced by partnerships with giants like Amazon Web Services and Alphabet’s Google Cloud, rendering the deployment of AI both cost-effective and commodious.

A New Captain at the Helm

Alas, even the most promising vessels may founder under adverse winds. The fiscal first quarter witnessed revenue of $70.3 million-a figure far below the forecasted range of $100 million to $109 million and a 19% decline year-over-year. This shortfall, coupled with an 85% surge in net loss to $116.7 million, has set tongues wagging among investors, who view shrinking revenues as a harbinger of diminished returns.

Mr. Siebel himself confessed that the results were “unacceptable,” attributing them to his own reduced involvement and the restructuring of the sales department-a process now complete, though its scars linger. Management anticipates further declines in the second quarter, suggesting that recovery will require both time and tact.

Yet, one cannot overlook the potential of Mr. Ehikian, whose pedigree includes founding two successful AI ventures. With Mr. Siebel remaining available for counsel, particularly in matters of sales, there exists a glimmer of hope that the ship may yet be righted.

To Invest or Not to Invest?

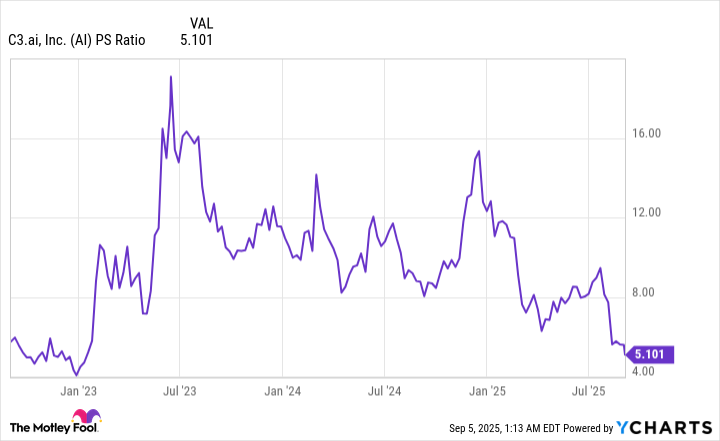

C3.ai presently trades at a price-to-sales ratio of approximately 5.1, a valuation near its lowest ebb in three years. To the contrarian eye, this presents an intriguing proposition: might the stock’s apparent cheapness compensate for the risks inherent in its current state? Yet, prudence dictates caution, for should revenues continue their downward spiral, even a modest valuation shall prove no safeguard against further losses.

Moreover, the necessity of slashing expenses looms large, and should those cuts encroach upon growth-oriented endeavors such as marketing, the path to redemption may grow yet more arduous. Thus, while the allure of bargain-hunting tempts the bold, wisdom advises patience until C3.ai demonstrates a return to sustainable prosperity. After all, in matters of investment, as in matrimony, haste often leads to regret 🧮.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- USD RUB PREDICTION

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

2025-09-08 12:07