In a world where money hums like a mischievous toad in a top hat, there exists a peculiar breed of companies that hand out golden eggs-dividends-while wearing suits stitched from confidence and balance sheets. These firms, like clockwork tricksters, promise less volatility than the market’s jolly old rollercoaster. Here, then, are two such conjurers whose tricks might last a decade or two-or until the rabbit in the hat finally notices the hole.

1. American Express: The Sly Fox with a Ledger

American Express (AXP), that sly fox in pinstripes, has been tucking golden eggs into Warren Buffett’s pocket for decades. Berkshire Hathaway, that great financial grizzly, once tossed $1.3 billion at Amex like confetti and now clutches a $47.6 billion pile of glitter, all while pretending not to care about reinvesting dividends.

Today, Amex gifts shareholders $0.82 per share each quarter-a 1% yield, modest as a mouse’s whisker but reliable as the moon’s pull on the tides. It doesn’t splash about with annual raises, no, but it tiptoes upward, like a thief in a pinstripe suit. By 2025, Berkshire will pocket $479 million in dividends-nearly 37% of its original wager. One might call it a heist. Or a very polite robbery.

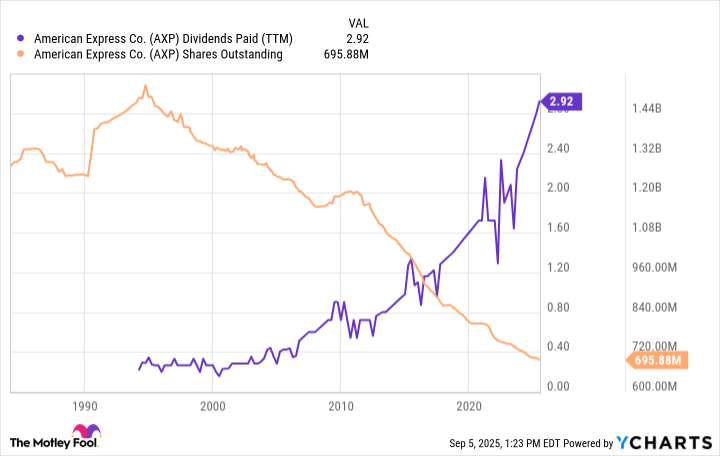

Amex also delights in shrinking itself, like a sorcerer turning shareholders into pygmies. Berkshire’s stake? It’s grown from 10% to 21.8% without so much as a second investment since 1995. The share count? Reduced by 13.6% in five years, with 68 million more shares waiting to vanish like smoke.

And what of growth? In Q2 2025, Amex declared $17.9 billion in revenue-a record, like a magician pulling a rabbit from a hat but with more spreadsheets. Net income dipped 4%, true, but it’s a small stumble for a company that still waltzes with 8%-10% revenue growth and $15.00-$15.50 EPS. At 22.7 times earnings, it’s pricier than a five-star toadstool, but then again, who counts the cost when the toad keeps laying eggs?

2. The Walt Disney Company: The Wizard Who Forgot His Spellbook

The Walt Disney Company (DIS), that once-mighty wizard of entertainment, stumbled through a pandemic, a CEO change as graceful as a sack of potatoes, and a dividend pause that made shareholders weep into their Mickey Mouse ears. But lo! In 2024, it returned with a semi-annual $0.50 per share-0.8% yield, a payout ratio of 13.7%, and the desperate hope of a conjurer who’s lost his wand.

Yet Disney, that silly putty of a company, has bounced back. Q3 2025 brought $23.7 billion in revenue and $1.9 billion in free cash flow-a 2% and 53% jump, respectively. It’s slashing debt (now $36.9 billion, down 15%) and buying back shares like a glutton at an all-you-can-eat thimble buffet.

Management, now armed with a new spellbook, predicts “double-digit” growth in entertainment operating income and $5.85 adjusted EPS-a 18% leap. At 18.6 times trailing free cash flow, it’s cheaper than a child’s balloon at a carnival. One might say Disney’s castle is creaking, but the moat still runs deep, and the dragons are napping.

Are These Stocks Worth a Decade of Patience?

In a world where CEOs vanish like ice cream on a hot day and markets wobble like a drunkard’s dance, it’s wise to be skeptical. But these two-Amex, the fox, and Disney, the half-drowned wizard-have claws and spells enough to outwit the wolves. For those who wish to sit back, collect golden eggs, and laugh as the corporate villains trip over their own feet, these names are as good as a promise… or at least as good as a promise from a toad with a calculator. 🐔

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- USD RUB PREDICTION

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

2025-09-08 10:46