Ah, Warren Buffett. If ever there were a figure who could make the business world sit up and take notice, it’s he. This master of monetary alchemy, the great conjurer of Berkshire Hathaway, who has steered the ship with a steady hand for nearly six decades, has managed, through the most trying of financial tempests, to yield a compounded annual return of a neat 20%. That, my dear reader, is no small feat. When the S&P 500 flounders about in its wobbly 10% annual returns, ol’ Warren sails on, like a well-mannered boat in a tempestuous sea.

Yet, now, when the market appears poised on the precipice of a delightful September tumble, there’s a soft murmur, almost an imperceptible cough from Mr. Buffett. You see, he’s been a rather quiet seller of stocks in recent quarters, adding to a rather large nest egg of $344 billion at Berkshire Hathaway. And there’s something about that amount of cash that makes one wonder if perhaps it is a subtle warning. Could it be, just possibly, that the stock market is about to dip into the financial equivalent of a wading pool, its edges frothy with overzealous speculation?

September: The Month That Wasn’t

Now, September. Ah, September. The month when investors often find themselves scratching their heads and wondering if they’ve perhaps been a bit too hasty with their summer spending. It’s a month, historically speaking, that has not been particularly kind to investors, as evidenced by the data from the last five years. In four of those years, the S&P 500 was seen losing anywhere from 3% to 9%. Last year, however, it managed a rather sprightly 2% gain. This, however, has all the staying power of a thimble of tea in a tempest.

But what’s this? A certain Berkshire Hathaway honcho has been sitting back, not partaking in the fevered AI stock rush, nor scrambling with the rest of the pack, and instead, like some sort of serene financial Zen master, has been carefully building his cash hoard. For Mr. Buffett, the idea is rather simple: you don’t buy stock simply because it’s fashionable. No, no, no! He waits for those companies that may be overlooked by the more exuberant investors-companies that may look a tad less polished but are, in fact, diamonds in the rough.

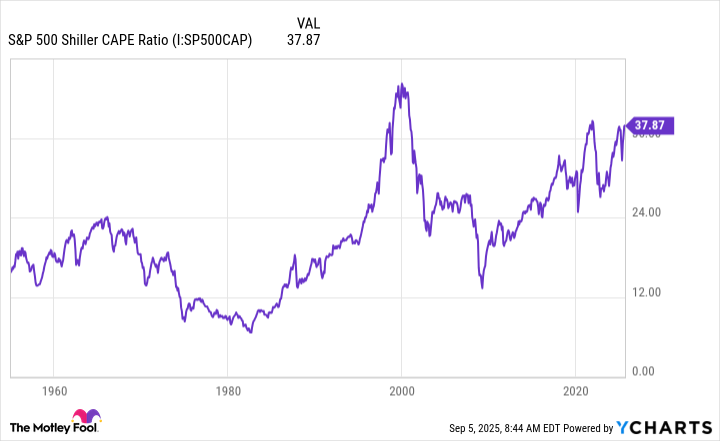

This brings us back to that ever-growing cash pile. A cool $344 billion. It’s not exactly the sort of sum one would acquire after a weekend rummaging through the sofa cushions. Buffett’s tactics, in short, suggest that the stock market has grown a bit too cocky for its own good. With valuations stratospherically high, the chance of a rather abrupt market hiccup is lurking about, awaiting its moment to strike. And with the S&P 500 Shiller CAPE ratio now hanging about at levels it’s only reached twice in its rather illustrious history, well, it’s time to hold on to your bowler hat.

The Shiller CAPE Ratio: A Mysterious Figure

The Shiller CAPE ratio-an acronym that could only have been devised by someone with a penchant for sounding important-is a particularly delightful little creature. It measures a company’s earnings over a decade, adjusted for inflation. And right now, that ratio is making even the most seasoned investors clutch their pearls. It’s telling us that, yes, the stock market is rather dear, and not in the charming sense. In fact, it’s a bit like buying a ticket for the theatre only to discover that you’re sitting in the nosebleed section, but still paying full price. Quite the dismal experience, what!

What, Then, Should One Do?

Now, dear reader, comes the truly pressing question: what to do in the face of this dilemma? Should one, as Mr. Buffett might suggest, remain patient and wait for an inevitable correction? Absolutely. A wise investor knows that a keen eye on valuations is a better compass than chasing the latest craze, however tempting the dance may be. But here’s the rub: while September’s track record may be decidedly iffy, it doesn’t mean we ought to throw in the towel entirely. No, far from it! As Mr. Buffett would no doubt suggest, the market is a fine place to be, just not at any old price.

If the market follows its historical pattern and takes a little tumble this September, well, that’s when the true value investors can put on their shopping hats and head to the metaphorical stock market sales. A stock purchased at the right price, and held long enough, will almost always, with a little patience and a touch of luck, turn out to be a winning proposition. So, my dear friends, don’t be deterred by September’s somewhat gloomy outlook. If anything, consider it a rather splendid opportunity to fill your metaphorical shopping cart with stocks that are priced to go!

And so, as we stand on the precipice of another month, let’s keep a level head and remember the wise words of Mr. Buffett: buy stocks with caution, but never forget that the darkest clouds may conceal the most delightful silver linings.

💼

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Gold Rate Forecast

- You Should Not Let Your Kids Watch These Cartoons

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- USD RUB PREDICTION

2025-09-08 03:38