Over the past decade, the S&P 500 Index has demonstrated an extraordinary capacity for wealth generation. An initial investment of $1,000 in the Vanguard S&P 500 ETF (VOO), assuming dividend reinvestment, would have grown to approximately $4,100 as of today-an annualized return of 15%. While such figures are compelling, they merit closer examination through the lens of capital allocation and market dynamics.

Underlying Drivers of the S&P 500’s Performance

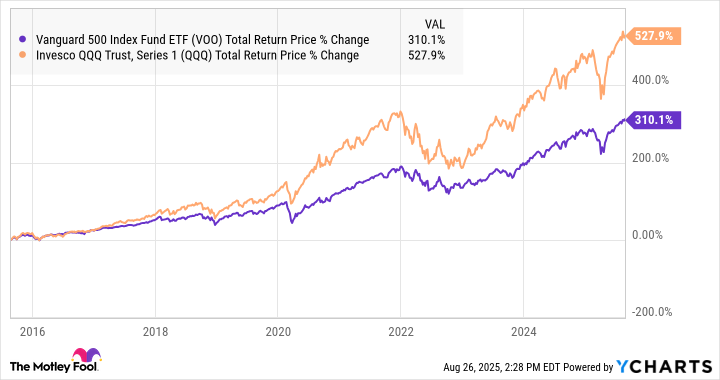

To understand this remarkable trajectory, one must consider both macroeconomic tailwinds and sector-specific contributions. The index had already rebounded significantly from its 2009 financial crisis lows by the start of the decade in question. Achieving a total return of 310% on top of that recovery underscores the resilience and adaptability of the U.S. equity markets.

A granular analysis reveals that technology-driven large-cap equities have disproportionately influenced these gains. The emergence of trillion-dollar megacap tech companies-once a rarity but now numbering eight-has redefined the landscape of valuation multiples and earnings growth. Below is a comparative overview of the five largest holdings within the Vanguard S&P 500 ETF and their respective performances over the past decade:

| Company (Symbol) | % of S&P 500 | 10-Year Total Return |

|---|---|---|

| Nvidia | 8.1% | 32,230% |

| Microsoft | 7.4% | 1,270% |

| Apple | 5.8% | 843% |

| Amazon | 4.1% | 802% |

| Alphabet | 3.7% | 566% |

| S&P 500 | 100% | 310% |

Notably, even the least performant among these megacap stocks surpassed the broader index by a significant margin. This divergence raises questions about concentration risk and the sustainability of such outsized returns.

Forward-Looking Considerations

While historical performance provides valuable context, it is imperative to approach future projections with caution. Historically, the S&P 500 has delivered annualized returns in the range of 9% to 10% over extended periods. Against this backdrop, the current decade’s 15% annualized return appears anomalous and contingent upon specific conditions unlikely to persist indefinitely.

- Valuation Multiples: Elevated price-to-earnings ratios across key constituents suggest potential downside risks should earnings growth decelerate.

- Regulatory Headwinds: Increased scrutiny of monopolistic practices among leading tech firms could impact profitability margins.

- Market Dynamics: Shifts in consumer behavior or technological innovation may alter the competitive landscape, favoring new entrants.

In conclusion, while the S&P 500’s recent performance offers a compelling narrative, prudent investors must remain vigilant. Future returns will likely hinge on a confluence of factors, including regulatory developments, geopolitical stability, and corporate governance practices. As always, diversification remains paramount in navigating uncertain waters. 🌊

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- The Weight of First Steps

- Opendoor’s Stock Takes a Nose Dive (Again)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-06 17:33