Caterpillar (CAT), that venerable institution of the industrial world, is not your typical growth stock. Rather, it is a company of some renown, best known for its vehicles with claws and grousers-bulldozers, mining trucks, and crawlers, to name but a few. A most picturesque lot, one might say, though their chief charm lies in their utility rather than their aesthetics.

Yet with share prices hitting new heights of optimism, a once-impossible prospect has taken root in the minds of investors: Can Caterpillar, that stalwart of the earthmoving trade, quintuple by 2030? Let us, with the levity of a well-timed tea party, examine this question.

What needs to happen for Caterpillar’s share price to quintuple in five years?

To achieve a fivefold increase by August 2030, Caterpillar’s share price (minus dividends) would need to compound at a rate of approximately 38% annually. A moonshot, indeed, for a cyclical company of such considerable stature, with a market cap that would make even a well-stocked pantry blush.

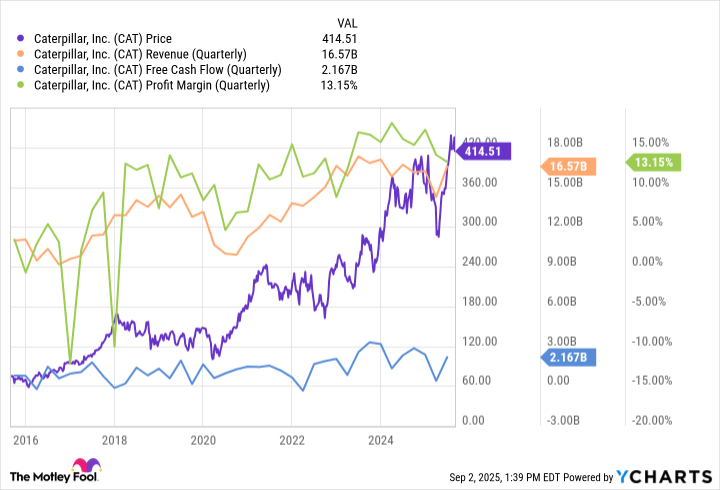

For context: Over the last five years, Caterpillar’s compound annual growth rate (CAGR) has been a modest 24%, with share prices rising by nearly 180%. A most commendable feat, though one that would require a dash of alchemy to surpass.

But what, one might inquire, would need to transpire for such a feat? Let us imagine a scenario where profits explode with the vigor of a well-fed parrot. Picture, if you will, a commodity supercycle that accelerates orders for mining trucks, coinciding with a global construction boom, all while price inflation drives both top- and bottom-line growth. Add to this a sustained AI boom, spurring demand for power generation equipment in data centers, and the emergence of new technologies, such as autonomous construction robots, which might persuade investors to value an industrial company as if it belonged to the tech elite.

In short, a perfect storm of tailwinds, as if conjured by a conjurer’s wand. Yet, as with all such spectacles, the reality is often less theatrical.

The reality check, however, is that total sales and revenue have been on a gentle decline, with the company anticipating a loss of $1.5 billion to $1.8 billion due to tariff-related expenses. A dashedly inconvenient predicament, to be sure.

Caterpillar’s business, being cyclical, is tied to the ebb and flow of economic growth, as the chart so eloquently illustrates.

Thus, the question remains: can Caterpillar’s share price quintuple in five years? A possibility, yes, but one that would require a confluence of circumstances as improbable as a well-timed tea party in a storm. The company is already trading at a forward price-to-earnings ratio of 22.5, a premium for an industrial stock that typically cycles between 15 and 18. A most curious valuation, if one may say so.

Caterpillar may yet be a buy for modest growth, but one would not expect it to explode with the vigor of a fireworks display. A most prudent conclusion, if one may say so.

🚜

Read More

- 21 Movies Filmed in Real Abandoned Locations

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Tainted Grail: The Fall of Avalon Expansion Sanctuary of Sarras Revealed for Next Week

- XRP’s $2 Woes: Bulls in Despair, Bears in Charge! 💸🐻

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

2025-09-06 11:22