The 20th century promised flying cars by now. Instead, we got TikTok and traffic. But hold your horses-electric air taxis might finally turn those Jetsons-era dreams into reality. Or, you know, another corporate-sponsored fantasy where the only thing taking off is your stock price.

Enter Archer Aviation (ACHR), the company building electric vertical takeoff-and-landing (eVTOL) aircraft that promise to whisk you above gridlocked cities. FAA approval is allegedly “just around the corner,” though bureaucracies have a habit of turning “just around the corner” into a three-season Netflix series. These aren’t your grandpa’s noisy helicopters-they’re quieter, nimbler, and theoretically less likely to crash into your rooftop mailbox.

At $8.52 a share, is this the golden ticket to financial freedom? Or is Archer just another startup selling moonshots in a stock ticker?

How Electric Air Taxis Work (And Why They Sound Like a Netflix Pitch)

Archer’s Midnight eVTOL looks like something Elon Musk might sketch on a napkin after a long day of tweeting. Instead of one giant rotor, it’s got a bunch of tiny ones, powered by batteries. Think of it as a Tesla for the sky-except you’re not driving. You’re paying someone else to do it while you sip champagne and pretend you’re in a James Bond movie.

Partners like United Airlines are already plotting routes. Imagine zipping from downtown Manhattan to JFK in 10 minutes instead of an hour. For wealthy passengers, this could be a $500 “premium” experience. For the rest of us? Probably a $500 Uber ride to nowhere.

Archer’s selling each Midnight for $5 million, and they’ve got hundreds of orders. But FAA certification? That’s moving slower than my Wi-Fi on a Friday afternoon. Once approved, they’ll crank up production-and hope cities like LA, New York, and Abu Dhabi don’t realize air taxis are just helicopters with better branding.

Archer’s Ambitious Plans (Or How to Spend $450 Million on a Dream)

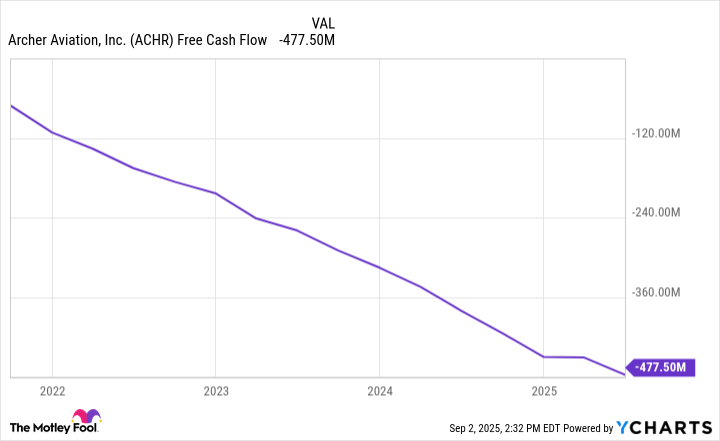

Right now, Archer’s revenue is about as exciting as a spreadsheet. But they’ve got big plans: sell their first commercial taxi to the UAE this year, get FAA approval, then ramp up to 50 planes a year. Fifty planes at $5 million each? That’s $250 million in revenue. Problem is, they’re currently burning $450 million in free cash flow. It’s like ordering a $250 pizza and eating it with a $450 appetite.

Even if they hit $2 billion in revenue in a decade, margins will be thinner than a corporate PowerPoint. A 10% profit margin gets you $200 million in earnings-enough for a forward P/E of 28. But that’s assuming no dilution, no delays, and no lawsuits. Realistically, this could be the financial equivalent of a reality TV show where everyone’s a winner… until they’re not.

Can This Stock Make You Rich? (Spoiler: Probably Not)

Archer’s $5.6 billion market cap makes it one of the most overvalued pre-revenue companies since the dot-com bubble. It’s like buying a ticket to Mars because the brochure says “epic views”-except the rocket’s still in the blueprint phase. If they succeed, investors might cash in. But if the FAA says “nope” or production hits a wall, this could be the next WeWork, where the only thing flying is the CEO’s optimism.

Electric air taxis are cool. I’d ride one just to say I did. But coolness doesn’t pay bills. Archer’s valuation is a rollercoaster built on hope, hype, and the hope that cities won’t sue them into oblivion. For growth investors, the question isn’t just “Will this stock take off?” It’s “Can it sustain flight long enough to matter?”

🚀

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- PLURIBUS’ Best Moments Are Also Its Smallest

- 39th Developer Notes: 2.5th Anniversary Update

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

- Top ETFs for Now: A Portfolio Manager’s Wry Take

- Stellar Blade Is Right To Leave Its PlayStation Exclusivity Behind, And Here’s Why

2025-09-05 17:03