It is said, in the shadowy corners of the Guild of Alchemists and Venture Capitalists, that there exists a crystal ball-not the kind used by fortune tellers, but rather one powered by GPUs. And if you peer deeply into its glowing depths, you might glimpse something resembling the future. For Nvidia (NVDA), this isn’t so much prophecy as it is quarterly earnings reports.

Consider this: the great hyperscalers-those titanic entities whose data centers hum like colossal hives-are set to spend $600 billion on their digital fortresses by year’s end. But hold onto your abacuses, because by 2030, they’re projected to throw around $3 trillion to $4 trillion globally. Yes, *trillion*. That number has more zeroes than a novice accountant’s first day at work.

This is not merely an expansion; it is an explosion, a financial supernova fueled by silicon and algorithms. Some might call such projections fantastical, but Nvidia does not operate in the realm of guesswork. No, they are closer to wizards-or perhaps engineers with slightly better job titles-who sit alongside their biggest clients, divining needs years before those needs even know they exist[^1]. This gives them what can only be described as an “unfair advantage,” though fairness has never been particularly high on capitalism’s list of priorities.

A Slice So Large It Could Feed An Entire Kingdom Of Servers

And now we come to another revelation from Nvidia’s latest announcement, delivered during their conference call with all the fanfare of a royal proclamation: roughly 35% of every coin spent building these data cathedrals ends up in Nvidia’s coffers. Imagine, if you will, an AI overlord announcing plans to spend $50 billion on new facilities. Thirty-five percent of that? Oh yes, dear reader, that’s $17.5 billion flowing directly into Nvidia’s treasury.

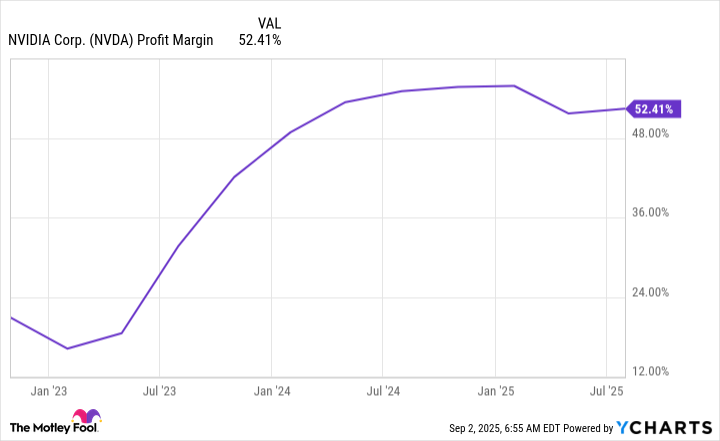

But let us pause here for dramatic effect. If the company’s visionaries are correct about that $3 trillion to $4 trillion figure-and why shouldn’t they be, given their track record?-then simple math tells us Nvidia could rake in annual revenues between $1 trillion and $1.4 trillion by the decade’s close. To put this in perspective, Walmart currently reigns supreme with $685 billion in revenue, while Amazon trails just behind at $670 billion. And yet neither boasts profit margins anywhere near Nvidia’s dazzling 50%. Half of every dollar earned becomes pure profit-a feat that would make even the most miserly dragon jealous.

If we assume Nvidia maintains this margin-and why wouldn’t they, when the market seems intent on handing them buckets of gold?-then their forecast suggests profits ranging from $500 billion to $700 billion. Alphabet, currently the crowned champion of U.S.-listed companies, generates “only” $115 billion annually. So imagine, if you dare, Nvidia achieving five times that amount. Or more.

What does this mean for shareholders? Ah, now there’s the rub-or rather, the jackpot.

The Stock Price: A Mathematical Marvel or Just Plain Magic?

Currently trading at 49 times trailing earnings and 38 times forward earnings, Nvidia stock already carries a hefty price tag. But should the company achieve its lofty goals, then assigning it a P/E ratio of 50 times trailing earnings against $700 billion in profits yields a valuation of $34.3 trillion by 2030. Let that sink in: $34.3 trillion. Even dragons hoard less treasure than that.

Today, Nvidia stands atop the corporate world with a market cap of $4.2 trillion. But imagine it ballooning to $34 trillion-a figure so large it could buy several small countries and still have change left over for lunch. Even taking a conservative approach-a mere P/E ratio of 30 and assuming profits hit only the lower bound of estimates-the company would still swell to $15 trillion. Three and a half times its current size. Not bad for a company peddling chips instead of magic spells.

Of course, these numbers strain credulity. They are projections built upon projections, stacked higher than pancakes at a dwarven breakfast buffet. Yet even if reality delivers only half of what Nvidia envisions, the returns remain tantalizing. Few companies are better positioned to ride the crest of the AI wave than Nvidia. Its dominance in crafting the tools of tomorrow ensures it will continue to feast upon the banquet of progress[^2].

Investing in Nvidia today requires patience, foresight, and perhaps a touch of madness. But history shows us that those who bet on innovation often reap rewards beyond measure. So take heed, ye daring souls: the path ahead may twist and turn, but the destination promises riches untold. And remember, in the grand theater of finance, sometimes the best investments are those made with both eyes wide open-and maybe one finger crossed 🐉.

[^1]: The process involves neither tea leaves nor tarot cards but instead relies heavily on spreadsheets and PowerPoint presentations. Truly, the modern age is a marvel.

[^2]: Though whether progress itself will eventually grow weary of being feasted upon remains an open question. Philosophers at the Unseen University of Coders are reportedly working on a paper addressing this very issue.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

2025-09-05 13:04