One does not typically invest in a company for its fleeting triumphs, much like one does not plant an oak expecting shade by sundown. Yet, when stocks rise sharply-as Shopify (SHOP) has by 30% and Netflix (NFLX) by 37% this year-it invites quiet contemplation. These numbers, though modest by Wall Street’s fevered standards, whisper of something enduring beneath the market’s capricious applause.

Their true allure lies not in momentum, but in the peculiar resilience of their foundations. Consider two ships navigating different seas: one, a merchant vessel carving trade routes through the tempest of e-commerce; the other, a galleon laden with stories, still golden despite the barnacles clinging to its hull.

1. Shopify

Shopify’s world is a bazaar where every vendor shouts louder than the last. Competitors circle like gulls over breadcrumbs, yet Shopify persists-less a colossus than a patient gardener tending its soil. Its platform, as simple as a well-worn ledger, allows even the technologically timid to open shop. A merchant might add inventory with the same ease one might stir jam into tea, while its app store offers customization akin to tailoring a coat to fit an eccentric uncle.

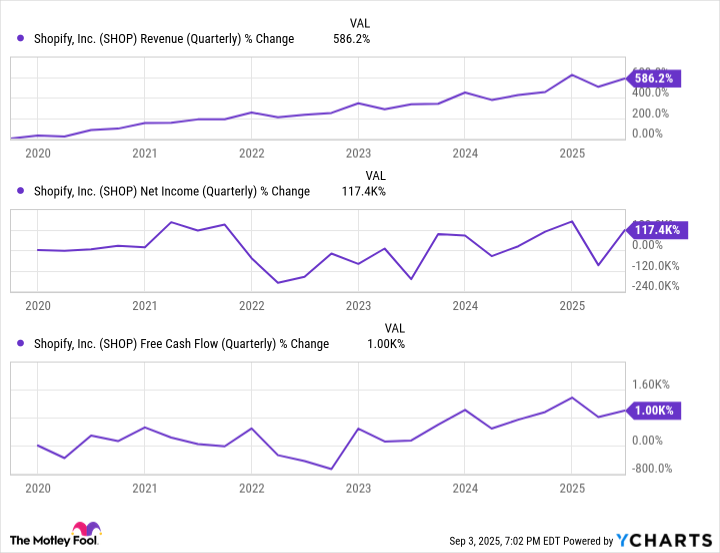

The e-commerce tide has lifted its coffers for over a decade, though profitability remains a guest who arrives late to the feast. AI tools now promise smoother sailing, yet one wonders if the captain still counts spare planks below deck. The U.S., its largest market, trails global leaders in digital commerce penetration-a paradox for a nation that invented the shopping mall. In 175 countries, Shopify sails on, its moat fortified by brand loyalty and the inertia of habit. Whether it becomes a titan or merely survives the next storm is a question for a more certain age.

Progress, like a candle in the wind, flickers. The decade ahead may yet write Shopify’s name in the annals of commerce, though its shares might just as easily gather dust alongside other hopeful ventures. Such is the market’s way-equal parts alchemy and arithmetic.

2. Netflix

Netflix reigns over streaming as a fading monarch might rule a kingdom-still acknowledged, yet shadowed by newer, louder courts. Only YouTube rivals its viewing hours in America, though that platform resembles a bustling fairground more than a curated gallery. Once, Netflix’s red envelope symbolized revolution; now, its algorithms suggest romances while subscribers debate whether to cancel.

Its financials gleam like polished silverware, yet $650 billion in potential revenue feels as distant as a mirage. Last year’s $39 billion seems a modest harvest for a field so vast. The ad-supported tier, introduced with fanfare, feels less like reinvention than a reluctant compromise-a dance with the devil of mass appeal.

Cable television, that wheezing giant, persists in the corners of the land. Older generations cling to it as one might to an heirloom clock, stubbornly ticking away the old time. Netflix’s revolution, then, remains incomplete-a half-written symphony. Its shares may yet rise, though perhaps not as high as the dreams pinned to them.

The market, like life itself, offers no guarantees. These companies march forward, their fates as uncertain as spring’s first bud. One invests not for certainty, but for the quiet thrill of betting on persistence. 🍃

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- 10 Hulu Originals You’re Missing Out On

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- Sandisk: A Most Peculiar Bloom

- Here Are the Best Movies to Stream this Weekend on Disney+, Including This Week’s Hottest Movie

- Actresses Who Don’t Support Drinking Alcohol

2025-09-05 11:40