In the intricate tapestry of modern finance, exchange-traded funds, or ETFs, emerge as a remarkable vehicle, granting investors a chance to partake in the grand themes of our time with a single, unassuming transaction. As evening moonlight softly illuminates the pathways of our capitalistic endeavors, so too do these funds illuminate the opportunities available in technology stocks, pharmaceutical innovators, or the broad swath of the S&P 500. Whatever your thematic inclination might be-be it prudent or whimsical-there lies, assuredly, an ETF poised to meet your desires.

In recent years, amidst the cacophony of digital progress, the rise of artificial intelligence (AI) has stirred both excitement and trepidation in equal measure, akin to an indeterminate gust of wind reshaping familiar landscapes. Notably, a certain fund, inspired by the sagacious insights of Dan Ives-a luminary among technology analysts at Wedbush-has emerged from the chrysalis of financial innovation. This ETF, deftly crafted by the asset management arm of Wedbush Funds and launched in the early days of June, has since soared, amassing an impressive 11% increase, much like a phoenix ascending towards the sun.

Hence arises a crucial inquiry: should astute investors gaze with earnestness upon the Dan Ives Wedbush AI Revolution ETF (IVES) as we traverse the landscape of 2025? Let us embark upon this exploration together.

The Virtues and Vices of ETFs

Allow us to ponder further upon the essence of ETFs. These funds encapsulate within them a multitude of stocks, creating a communion of varied investments that collectively represent a singular theme. With the acquisition of a mere share-or indeed, several-you embrace the confluence of myriad enterprises. Such a mechanism, dear investors, bestows upon you manifold advantages: one is spared the arduous labor of selecting stocks individually, as the ETF fulfills this task with diligence, while also mitigating risk through the dispersion of investments (when one stock falters, others may cling to the mantle of stability). Yet, there exists a caveat; should an individual stock within the fund ascend into spectacular heights, the resultant rewards will be diluted in comparison to direct ownership.

Nonetheless, contemplating these dualities, ETFs manifest as a commendable addition to the portfolios of discerning investors, where ETF acquisition harmonizes splendidly with the age-old art of stock selection.

Turning our gaze towards the fund in question, we find it proffering immediate access to a diverse assembly of both current champions and prospective victors in the realm of AI. The fund hosts thirty distinct holdings, ranging from the foundational architecture of AI to its applications in addressing real-world tribulations. Such diversity affords investors the coveted opportunity to reap potential rewards throughout this burgeoning AI epoch.

As we stand steadfastly rooted in the now, the foremost stocks within this fund-the titans of Alphabet, Nvidia, and Broadcom-may resonate with familiarity. Yet, there too lie names of lesser renown, such as the data engineering firm Innodata and the innovative nuclear technology enterprise Oklo, reminding us that wisdom often lurks in the unlikeliest of places.

Intriguingly, within the nascent days of its inception, the fund flourished, amassing $100 million in assets under management within the span of merely five trading days. Now, it boasts over $500 million-a testament, perhaps, to both hype and substance.

Deliberations for the Discerning Investor

Our contemplative inquiry leads us to a pivotal question: should astute investors indeed keep a watchful eye on this ETF as we advance toward 2025? It is prudent to acknowledge that ETFs incur expenses, articulated through expense ratios, and the wise investor would be well served to select those which maintain an expense ratio below 1% in pursuit of optimal returns. In this realm, the Ives fund greets us with an expense ratio of a commendable 0.75%.

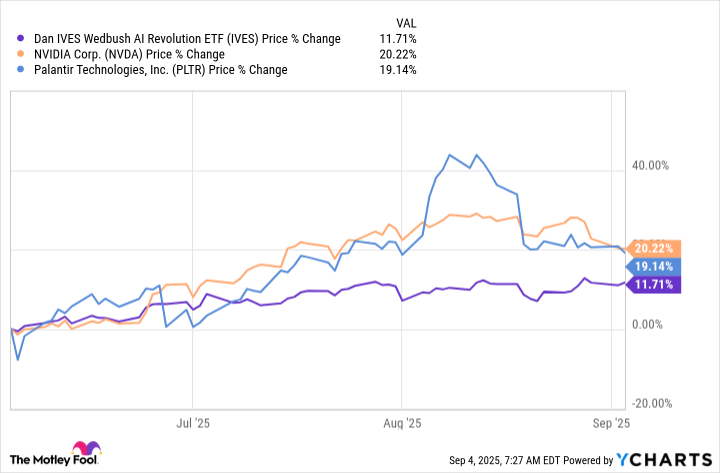

Regarding its performance, the ETF continues to ascend, achieving double-digit growth. If the firms within the realm of artificial intelligence continue to enrich the narrative with favorable disclosures amidst a robust infrastructural investment discourse, this propitious momentum might persist. However, let us not overlook the allure of individual stock selection, as certain singular AI stocks-like Nvidia and Palantir Technologies-might have rendered superior returns, showcasing the tantalizing power and potential of selective investment.

Consequently, the art of investment beckons the discerning investor to consider a dual approach: to weave into their narratives a few choice AI stocks-chosen from your rigorous assessments-while simultaneously securing shares in the Ives ETF. Conversely, for those who tread cautiously and find solace in certainty, the Ives ETF may serve as their anchor, offering a safe berth amidst the turbulent seas as one navigates investments in other cherished industries.

In conclusion, dear comrades in the journey of wealth accumulation, it would be sagacious to regard the Ives ETF with a watchful eye as the AI revolution unfolds before us-perhaps, indeed, the gains we witness are only the initial tremors of a much grander seismic shift. 📈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Sandisk: A Most Peculiar Bloom

- Here Are the Best Movies to Stream this Weekend on Disney+, Including This Week’s Hottest Movie

- Black Actors Who Called Out Political Hypocrisy in Hollywood

- Actresses Who Don’t Support Drinking Alcohol

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- Meta: A Seed for Enduring Returns

- Micron: A Memory Worth Holding

2025-09-05 11:37