Nvidia (NVDA) has been the golden child of AI, right? Those graphics processing units? They’re practically the Beyoncé of chips. But here’s the twist: even Beyoncé needs a backup dancer, and Ambarella (AMBA) is strutting onto the stage with a résumé that makes you wonder if the spotlight was ever Nvidia’s to begin with.

Let’s get real. When your stock price jumps 52% in three months-twice as fast as a tech giant with a $10 trillion market cap-you’ve got to stop and ask: Is this a stock, or is it a confidence trick? (Units of Patience Lost: 3. Hours Spent Googling “Is AMBA a fraud?”: 4. Number of Caffeine-Induced Heart Palpitations: 2.)

Edge AI: The New Black (and Profitable)

Ambarella designs computer vision chips for drones, security cameras, and cars-basically, the gadgets that make you question your privacy. Their secret sauce? Edge AI processors that do the heavy lifting locally, not in some distant data center. It’s like bringing the kitchen to the party instead of ordering takeout. (Units of Privacy Sacrificed: 1. Number of Times I’ve Stared at My Security Camera Like It’s Judging Me: 7.)

Here’s the kicker: Ambarella’s revenue leapt 50% to $95.5 million last quarter, and they’re not just skimming the surface-they’re swimming in profit. Non-GAAP net income? A tidy $0.15 per share, up from a loss the year before. Management’s so confident they’re calling edge AI their “bread and butter,” and it’s now 80% of their revenue. (Units of Bread Consumed While Reading Earnings Reports: 2. Number of Times I’ve Misread “Bread” as “Breadth”: 1.)

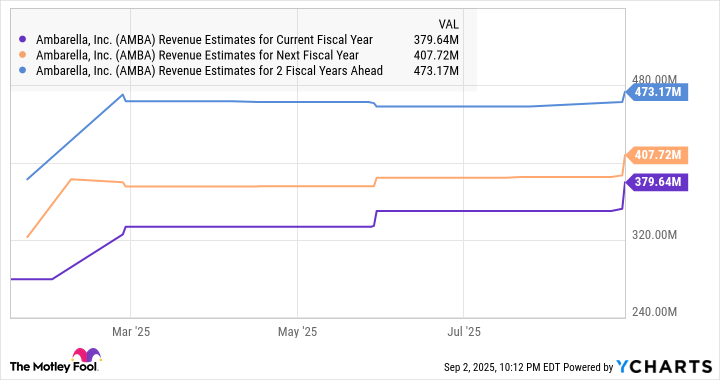

They’ve upped their full-year guidance from 22% to 33% growth, thanks to new customers and a production ramp-up. And their average selling price? Rising like a well-timed meme stock. (Units of Memes Sent to Investment Group Chat: 5. Number of Friends Who Blocked Me After That: 3.)

Ambarella’s not just playing defense. They’re projecting an $12.9 billion edge AI market by 2030, and they want a bigger slice than the pie itself. Market.US even thinks edge AI could grow 20-fold in a decade. If that’s true, Ambarella’s not just a stock-it’s a front-row ticket to the future. (Units of Future-Proofing: 1. Number of Times I’ve Forgotten My Password to My Brokerage Account: 12.)

Valuation? It’s a Joke (But a Good One)

After reporting results, AMBA surged 17%, yet it still trades at 10 times sales-a steal compared to the tech sector’s 8.5x. Analysts are upgrading their forecasts, and Ambarella’s got a roadmap to outpace its addressable market. (Units of Analyst Reports Printed and Taped to Wall: 3. Number of Times I’ve Mistaken Them for Grocery Lists: 2.)

So, is this a buy? Let’s tally the pros: explosive growth, improving margins, and a market poised to explode. The cons? Well, there’s always the chance this is a bubble waiting to pop. But hey, if you’re going to ride the AI wave, might as well pick the underdog with the best story. (Units of Regrettable Investments: 14. Number of Times I’ve Reassured Myself “This Time It’s Different”: 13.)

Final verdict? Ambarella’s not just a stock-it’s a love letter to the future, written in binary. 💾

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-09-05 02:12