When contemplating an investment in Pfizer (PFE), it is, of course, crucial to take into account the ever-so-glamorous 6.9% dividend yield-a number so compelling that even the most cynical investor may momentarily set aside their reservations. Yet, the allure of fat dividends is but a fleeting dalliance. Beneath the beguiling sheen of profitability lies the inevitable reality: a company grappling with the ordinariness of its own mortal limitations.

1. Wall Street’s Tired Worries Over the “Norms” of Business

Pfizer, of course, is a pharmaceutical giant, which means that the drugs it manufactures are as complicated as the finest French pastries. Years of research, trials, and regulatory approval are required before the company can launch a product-an arduous process that invites a certain protectionist benevolence from the government in the form of patent monopolies. How kind of them, really. Yet these monopolies, like all monopolies, are temporary. And when that magic period expires, the competition-like a swarm of eager locusts-descends with cheaper generics. The inevitable “patent cliff,” one might call it, is fast approaching, and naturally, investors have been abuzz with concern. How quaint.

To compound this rather dreary tale, the current regulatory environment in the U.S. has added a layer of uncertainty. Washington’s disapproving glare now falls squarely upon the pharmaceutical sector, which, understandably, has sparked considerable unease amongst the investor class. This, of course, has led to a noticeable dip in Pfizer’s stock performance. Ah, yes, the high dividend yield-nothing more than a consolation prize for suffering stockholders.

However, let us not be fooled. Drug development, much like any venture of substantial ambition, is a patchwork of triumphs and failures. Regulatory shifts, while perturbing, are hardly a new phenomenon. Pfizer has weathered such storms before and will likely continue to do so. So, while it is not unreasonable to be concerned, the idea that this is a harbinger of the company’s demise is as exaggerated as a retirement speech at the end of a rather undistinguished career.

2. The Dividend Dance: Pfizer’s Cut and Merck’s Constancy

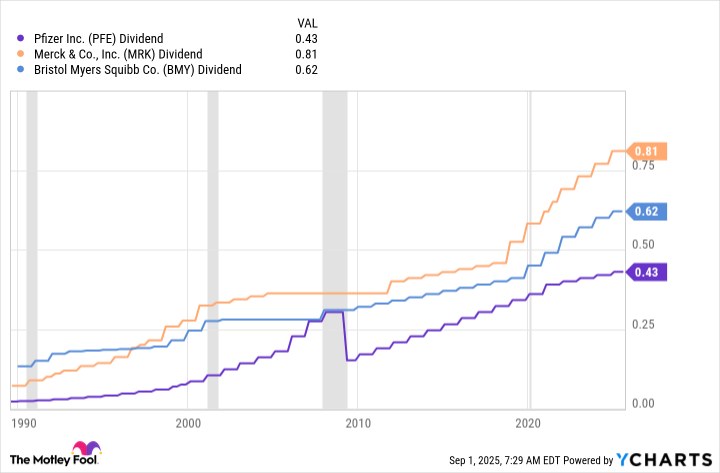

MRK), for example, has managed to maintain a steadily increasing dividend yield despite less fanfare. A dull but persistent ascent-a slow, inexorable rise to mediocrity.

If dividends, in all their serene predictability, are what you seek, then Merck’s steady hand at the tiller may be a safer bet. Pfizer’s dividend history, punctuated by moments of weakness, may be a less palatable choice for those who have grown weary of the excitement brought on by corporate uncertainty.

3. The Accidental Wisdom of Real Estate Investment Trusts

And so, we come to a rather remarkable consideration: Why invest in Pfizer at all? Surely, there are other avenues for those who wish to partake in the grand pharmaceutical spectacle without all the attendant risks. Enter the world of Alexandria Real Estate, a real estate investment trust (REIT) that offers a 6.4% yield. You may be asking: Why would a REIT-those humble custodians of office spaces-be of any interest to an investor with a predilection for drug stocks? The answer, surprisingly, lies in the company’s business model, which involves leasing research facilities to healthcare companies, including the likes of Pfizer’s competitors. While Pfizer itself is not the largest tenant, others such as Eli Lilly and Moderna make up the bulk of Alexandria’s rental income.

PFE”>

The Reluctant Survivor

So, what are we to make of all this? To be blunt, investing in Pfizer today is hardly an egregious error, particularly for the more risk-tolerant investor. Yet, the company’s dividend history is not without its blemishes, and those who are inclined toward more consistent returns may find comfort elsewhere. Moreover, if one finds the capricious nature of the pharmaceutical world too vexing, there are less volatile options, such as Alexandria, which offer exposure to the sector without all the unpleasant fuss. The choice, as always, is yours-but do not be fooled into thinking that Pfizer, in all its current splendor, is the only game in town.

In conclusion, Pfizer is fine-though hardly a beacon of unmitigated brilliance in the pharmaceutical world. A safer, steadier option may lie elsewhere, should one be so inclined to seek it. 📉

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-04 14:44