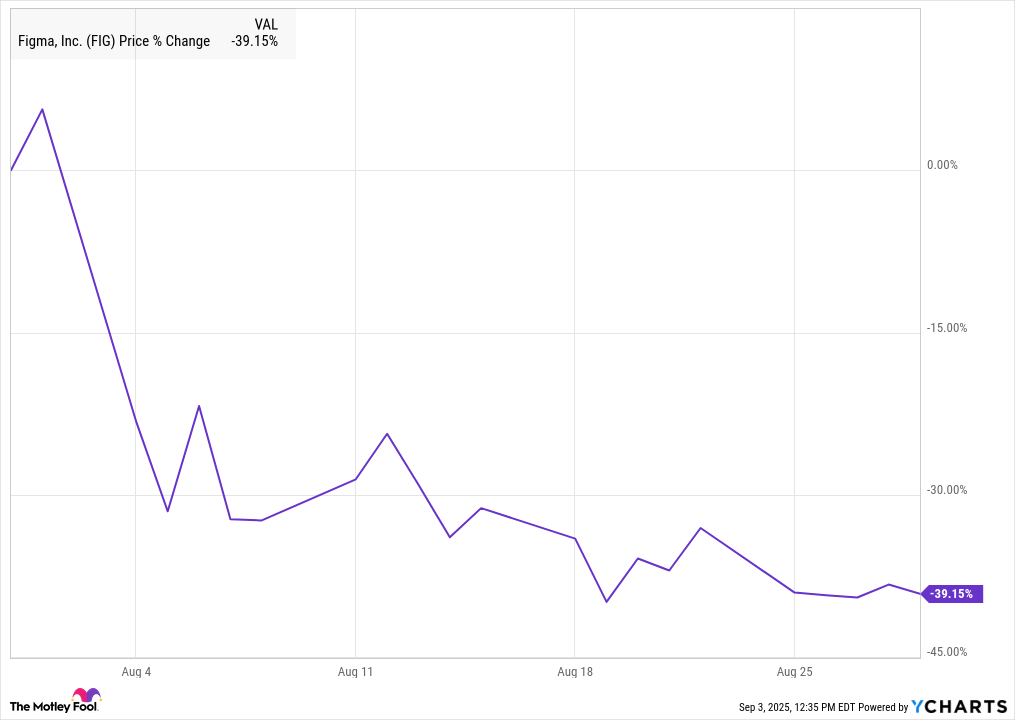

When Figma (FIG) leapt from its IPO perch like a startled crow on July 31, it left a trail of glittering feathers in its wake-only to find itself entangled in the thorny brambles of market arithmetic. By month’s end, the stock had surrendered 39% of its splendor, as if the very air had turned to bureaucratic red tape, snuffing out the incense of its opening-day euphoria.

Observe the chart below: a serpentine descent, a pirouette of panic, then a weary shuffle to the rhythm of Wall Street’s metronome. The stock, now clad in the tattered finery of equilibrium, limped through August’s calendar like a court jester who’d misplaced his scepter.

Figma’s First Dance with the Invisible Hand

An IPO, dear reader, is not a coronation but a masquerade ball where the guests wear masks of greed and hope. Figma’s stock, having tripled on its opening day-a feat akin to a peasant leaping over the Tsar’s palace-was destined to face the grim reaper of gravity. By August 1, it soared to $142.92, a gilded peacock strutting across the exchange floor, only to be tripped by the shoelaces of profit-taking IPO acolytes.

The days that followed were a slow waltz of disillusionment. Trading volume, once a roaring fire, dwindled to embers. Analysts, those modern-day soothsayers, scribbled their verdicts in ink that smelled of compromise: Piper Sandler, with its “overweight” rating and $85 target, praised Figma’s “differentiated” platform as if it were a rare Stradivarius. Meanwhile, Goldman Sachs, that grumpy old curmudgeon, muttered about “limited visibility” and revenue growth that danced like shadows in a candlelit crypt.

The Oracle of Earnings

Today, Figma stands at the precipice of its first earnings report as a public entity-a moment that will decide whether it is a phoenix or ash. The Street whispers of $248.7 million in revenue, a sum that glimmers like a mirage, and $0.08 per share in profits, a breadcrumb tossed to shareholders by the fickle gods of capitalism.

Yet for all its troubles, Figma remains a jewel in the crown of absurdity. Its price-to-sales ratio of 36 is a gilded cage, yes, but within it lies a company that profits, that grows, and that once nearly belonged to Adobe-a union thwarted by the spectral hand of antitrust law. One imagines the acquisition papers still rotting in some Moscow archive, their ink bleeding into bureaucratic oblivion.

The future? Ah, the future is a surreal ballet. Valuation may be a millstone, but Figma’s story is written in the same ink as all market fables: part truth, part delusion, and a dash of demon fire. 🐍

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

2025-09-03 21:08