Dear Diary,

Let’s start with a confession: I bought Nvidia (NVDA) at a “rational” price in March, only to watch it crash when Trump’s tariffs hit like a rogue wave. Then it bounced back 30%-and now I’m wondering if I’m the only one who still thinks this is a stock to own. Spoiler: Probably not. But here’s the thing-being a market skeptic doesn’t mean I’m immune to the siren song of AI hype. It means I listen to it while wearing earplugs and a scowl.

Units of Self-Doubt Accumulated: 8. Times I’ve Checked My Portfolio Since 8 AM: 27. Hours Spent Googling “Is This a Bubble?”: 3.5.

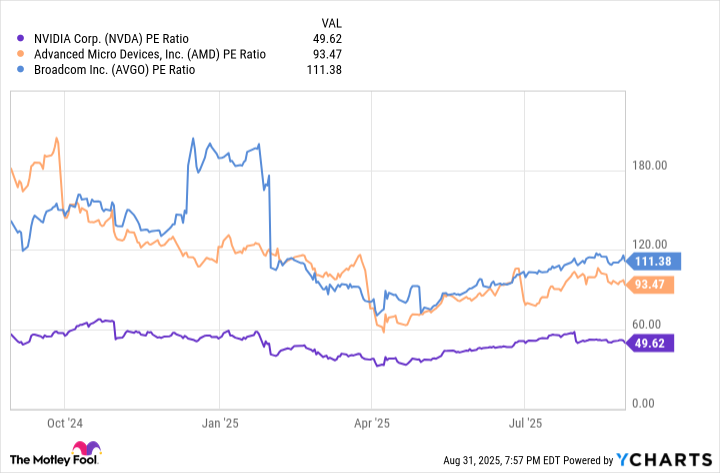

Gauging Nvidia’s P/E Paradox

The P/E ratio, that beloved albatross of value investors, is supposedly lower than AMD and Broadcom. Great. But let’s not forget: A P/E of 50 isn’t exactly thrift store territory. It’s just… less stupid than its peers. For context, last year’s P/E was higher when the stock was at all-time highs. So, is this a bargain or a truce between greed and desperation? I’m leaning toward the latter.

And yet, here we are. Q2 results: Net income up 59% to $26.4 billion, revenue up 56% to $46.7 billion. But data center revenue missed expectations-by $300 million. That’s not a typo. That’s the kind of shortfall that makes you wonder if the “AI boom” is just a fancy name for “we’re all pretending we understand machine learning.”

Then there’s the China factor. The U.S. government banned AI chip sales there, which means Nvidia excluded the region from its Q3 forecast of $54 billion. That’s a 54% increase from last year’s $35.1 billion. Impressive, yes-but also a bit like saying, “I’m doing great at losing money!” Management’s prediction of $3 trillion in AI infrastructure spending by 2030 is equally thrilling. Let’s just hope they’re not counting on aliens to foot the bill.

Still, for all my skepticism, I can’t ignore the numbers. Or the fact that management’s optimism feels less like hubris and more like a well-rehearsed script. Maybe I’m wrong. Maybe this is the next Microsoft. But if history teaches us anything, it’s that the stock that “everyone’s talking about” usually ends up being the one you sell at a loss, then buy again at triple the price-just to spite yourself.

Final Takeaway (for now): If you’re thinking of buying Nvidia, do so with the caution of someone buying a used car from a guy in a parking lot. And remember: The only thing more unpredictable than the market is your ability to ignore your own advice. 🤔

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- TON PREDICTION. TON cryptocurrency

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Ray J Pushes Forward With Racketeering Accusations Against Kim Kardashian and Kris Jenner

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Elder Scrolls 6 Fans Got Excited When The Game Awards Showed Mountains

2025-09-03 19:33