Let’s talk about the YieldMax MSTR ETF (MSTY)-the financial equivalent of ordering a “healthy” kale salad and then whispering, “Surprise me with truffle fries.” It’s the investment version of corporate small talk: everyone’s doing it, but nobody really knows why. Let’s unravel this crypto-ETF Rube Goldberg machine, shall we?

- Start with a basic index fund like Vanguard S&P 500 ETF (VOO). It’s the financial equivalent of a minivan: safe, reliable, and utterly unexciting. You get 1.2% dividends, which is about as thrilling as a tax audit. DRIP it, and you’re just… more minivan. S&P 500 (^GSPC) is the stock market’s version of “Here for the ambiance.”

- Now, what if you want to feel the *tingle* of risk? Enter Bitcoin (BTC), the financial equivalent of a reality TV contestant who thinks they’re Warren Buffett. Volatility? Oh, it’s just your portfolio’s new BFF. But let’s be real: You’re not buying Bitcoin for the stability. You’re buying it because your cousin’s roommate’s ex said it’s the next “synergy-driven innovation.”

- Still not enough chaos? Try a iShares Bitcoin Trust ETF (IBIT). It’s like ordering a crypto smoothie-same ingredients, just blended with Wall Street’s finest corporate jargon. You get Bitcoin exposure without the hassle of, you know, *actually owning Bitcoin*. Because nothing says “simplicity” like a 0.4% fee and a 10-page prospectus.

- Then there’s Strategy (MSTR), the company that took its balance sheet and said, “Let’s turn this into a Bitcoin playground.” Michael Saylor’s move is like if a librarian suddenly started selling rare books to buy a yacht. Now Strategy’s market cap is 50% “Here’s my Bitcoin,” and 50% “Let me explain this in a 20-slide PowerPoint.”

- And finally, we arrive at YieldMax MSTR ETF. It’s not just Strategy stock-it’s the financial equivalent of betting on a horse that’s also a magician. The fund uses options to generate income, which sounds fancy until you realize it’s just Wall Street’s way of saying, “We’ll take some of your money to… do stuff.” Monthly yields hit 7.1%? That’s like your budget airline suddenly offering first-class service. But here’s the catch: If the market sneezes, your ETF might need a respirator.

Why Your Payouts Will Feel Like a Rollercoaster Designed by a Toddler

Let’s be clear: MSTY’s payouts are about as stable as a TikTok trend. They’ve swung from $1.09 to $4.42 per share-because nothing says “trust” like a monthly check that fluctuates more than your dating app profile. The fun part? This volatility isn’t random. It’s just Bitcoin’s mood swings, filtered through a corporate finance funnel. Imagine if your paycheck depended on how many likes Michael Saylor got that day.

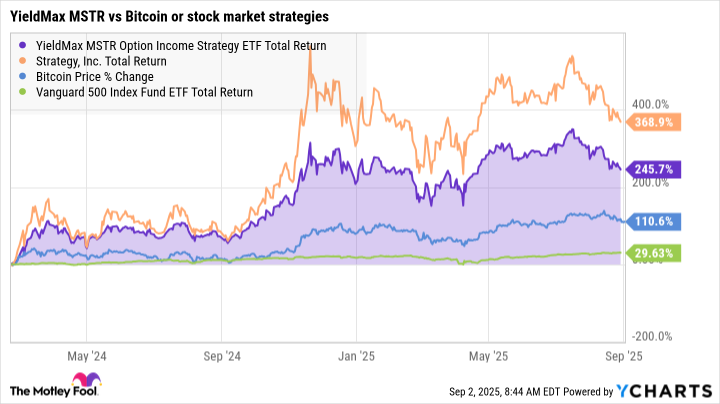

But here’s the twist: Even with a 26.9% price drop since inception, MSTY’s total return tripled. How? Because reinvesting those dividends is like getting a loyalty reward at a casino-except the house *sometimes* lets you win. Contrarians love this stuff. It’s the financial equivalent of buying a “discount” toaster that also roasts almonds.

MSTY vs. MSTR: The Corporate Workout Class

If Strategy is the gym enthusiast who does 100 push-ups a day, MSTY is the person in the corner doing “modified” reps with a water bottle. The ETF’s total return has outpaced Strategy in some stretches, but not by much-like comparing a spin class to a Peloton commercial. Both are sweaty, but one’s more likely to crash if the Wi-Fi dies.

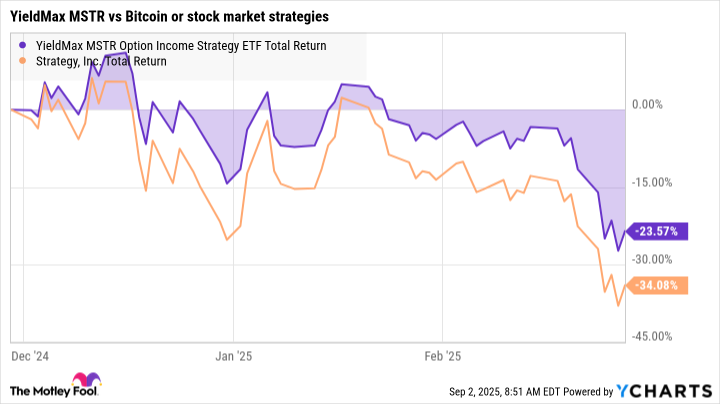

During the December 2024-February 2025 slump, MSTY’s downturn looked less like a freefall and more like a “gentle decline” compared to Strategy’s “abandon all hope.” It’s the difference between a corporate retreat team-building exercise and a reality show elimination round. MSTY’s your boss who “pivots” instead of panicking.

Your One-Year Playbook: Or How to Bet Against the Bitcoin Hype Machine

So, where’s MSTY headed in 12 months? Well, if Bitcoin hits $1 million by 2030, MSTY might get a free coffee. If the crypto winter arrives early, MSTY could be the financial equivalent of a “pivot to video” strategy. The truth? This fund is for people who think “high risk, high reward” sounds like a Netflix documentary about a failed startup.

Contrarians take note: If everyone’s betting on Bitcoin’s next moonshot, MSTY’s your way to short the hype. It’s not about predicting the future-it’s about profiting from the panic and the hype. Just don’t expect it to feel like a “normal” investment. More like a corporate team-building retreat where the only goal is not to look clueless.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-03 16:22