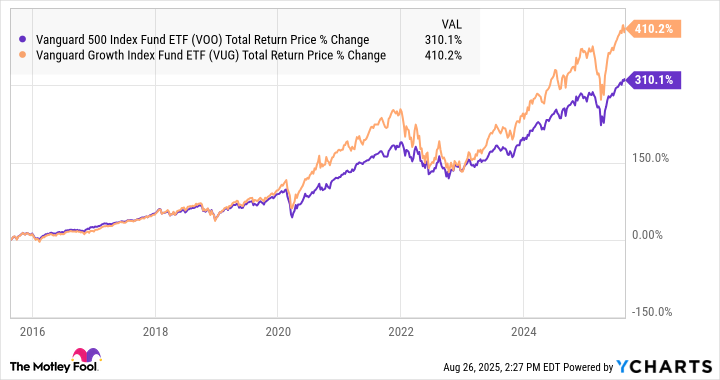

Ah, the good old stock market, where fortunes are made and lost faster than a mouse can scurry away from a hungry cat. For the past decade, the S&P 500 index has been a most reliable companion for those with a taste for risk and a fondness for the dramatic. Indeed, if you’d tossed a tidy $1,000 into the market back then, you’d now be sitting pretty with more than four times that amount in your lap. But, my dear investor, there’s more to the story. A lot more.

For instance, consider the Vanguard Growth ETF (VUG). If you had the foresight, or perhaps the luck, to place your faith in it ten years ago, that humble $1,000 would now be worth a spectacular $5,100. That’s a truly marvellous return, clocking in at 17.7% annually. Quite the stellar performance! If only we could all say the same about our childhood dreams.

Why Did Growth Stocks Soar Like a Hot Air Balloon?

The short, somewhat unsatisfying answer is: tech. Big, shiny, brash, and as beloved as an oversized chocolate bar on a lazy Sunday afternoon. You see, the spectacular rise of the stock market has been largely driven by those megacap technology companies – the big, beefy bullies of the business world. We’re talking about the likes of Nvidia (NASDAQ: NVDA) and Microsoft (NASDAQ: MSFT). And the Vanguard Growth ETF, it seems, has been particularly fond of these monstrous tech giants.

In fact, the Vanguard Growth ETF and its cousin, the Vanguard S&P 500 ETF (VOO), share the same top holdings. But here’s the twist: the Growth ETF gets rather close and personal with the tech stocks. It shuns the value stocks that make up the S&P 500, giving an extra dose of tech-heavy magic to its portfolio. Allow me to illustrate the absurdly high stakes of this game:

| Company | Percentage of Vanguard Growth ETF Assets | Percentage of Vanguard S&P 500 ETF Assets) |

|---|---|---|

| Nvidia | 12.6% | 8.1% |

| Microsoft | 12.2% | 7.4% |

| Apple (NASDAQ: AAPL) | 9.5% | 5.8% |

| Amazon (NASDAQ: AMZN) | 6.7% | 4.1% |

| Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) | 6% | 3.8% |

| Meta Platforms (NASDAQ: META) | 4.6% | 3.1% |

| Broadcom (NASDAQ: AVGO) | 4.4% | 2.6% |

It’s not just the numbers that dazzle. It’s the sheer force of concentration in these tech stocks that turns a humble fund into a roaring juggernaut. A full 62% of the Vanguard Growth ETF’s assets are parked firmly in the tech sector. Compare that with the S&P 500’s relatively tame 34%, and you’ll see why the Growth ETF has been feasting like a gluttonous ogre.

As you can imagine, this tech-heavy strategy has been a golden ticket for investors, leading to hefty rewards. But, as with all feasts, there’s a price to pay. Are you ready to chase the next big thing, or are you more interested in the quieter, more reliable growth of less flashy assets? Time, as ever, will tell. Until then, my dear value investors, hold on to your hats, and your portfolios! 🧐

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-03 13:46