There are so many nuggets of wisdom that investing legend Warren Buffett freely hands out, and other great lessons you can learn by following his trading activity.

During the past few months, investors have been noting his cash position and selling activity. Berkshire Hathaway, that paragon of financial prudence, has been accumulating a cash hoard as if preparing for a grand soiree. It built up its largest-ever cash position in the 2025 first quarter, though it has since retreated slightly, leaving it still in the vicinity of record levels. The company’s net selling activity, meanwhile, has persisted for the 11th consecutive quarter, a feat as perplexing as a man attempting to dance the waltz in a room full of penguins.

There are all sorts of things to learn here. During the past few decades, Buffett has repeatedly stressed that frothy markets are a setup for a decline. His best plays have been waiting for a plunge and then diving right in, picking up the pieces of great companies that couldn’t withstand the fall. He bought Bank of America, one of his largest positions, after the mortgage crisis at a great price, and he bought supermarket giant Kroger when it was struggling and the stock was dirt cheap. A dash of patience, and voilà! A fortune made with the ease of a man plucking a plum from a tree.

Recently, he struck again, buying shares of UnitedHealth Group when it plummeted on near-term concerns. It’s likely to bounce back and create shareholder value for Berkshire Hathaway’s shareholders. A dashedly clever move, what!

But while armchair analysts discuss the implications of Buffett’s wait-and-see approach, I see his biggest lesson as something completely different. Imagine, if you will, a young investor, Mr. Jones, who fancies himself a master of the market. Alas, he is but a mere mortal, and the market, that fickle beauty, is not easily tamed. Enter the Jeeves-like strategy of consistency: keep adding to your portfolio, no matter the weather.

In it to win it

With the hullabaloo about the extraordinary selling activity, it’s easy to miss the buying activity. But throughout the past 11 quarters, Buffett and his team have found what to buy every, single quarter. A feat as remarkable as a man winning a race without breaking a sweat. And that’s the biggest lesson for investors.

You can’t time the market, and you have to be in it to win it. The most efficacious strategy, as our friend the investor might discover, is to keep adding to one’s portfolio with the diligence of a man watering his garden, regardless of the weather. Even in a market that looks overvalued and inflated, there are always going to be bargains, like UnitedHealth. But you don’t need the biggest bargains to make the market work in your favor. Buffett recently explained that while he used to be more interested in deep value and cheap prices, Charlie Munger, his longtime business partner, steered him away from that. “Add…wonderful businesses purchased at fair prices,” he credits Munger with telling him, “and give up buying fair businesses at wonderful prices.”

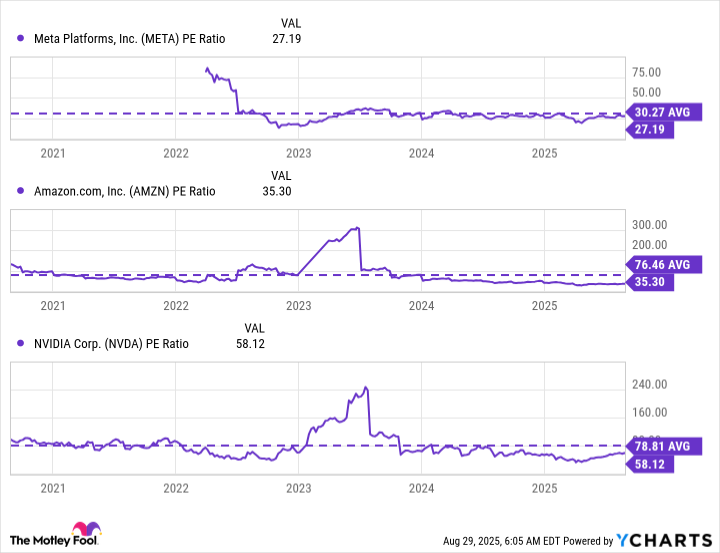

There are plenty of great businesses at fair prices on the market at all times. In the 2025 second quarter, Berkshire Hathaway started six new positions and added to five others. Excellent companies like Amazon, which Buffett owns, Meta Platforms, and Nvidia are trading at a discount to their five-year average price-to-earnings (P/E) ratios. A veritable smorgasbord of opportunity, if you’ll pardon the metaphor.

For sure, expect there to be dips, corrections, and plunges. Expect that you will not buy stocks at the lowest prices. Be prepared to overlook that and keep adding funds to your positions. Over time, your portfolio will grow. That’s how you build wealth, and you will thank yourself later. A lesson as timeless as the changing of the seasons.

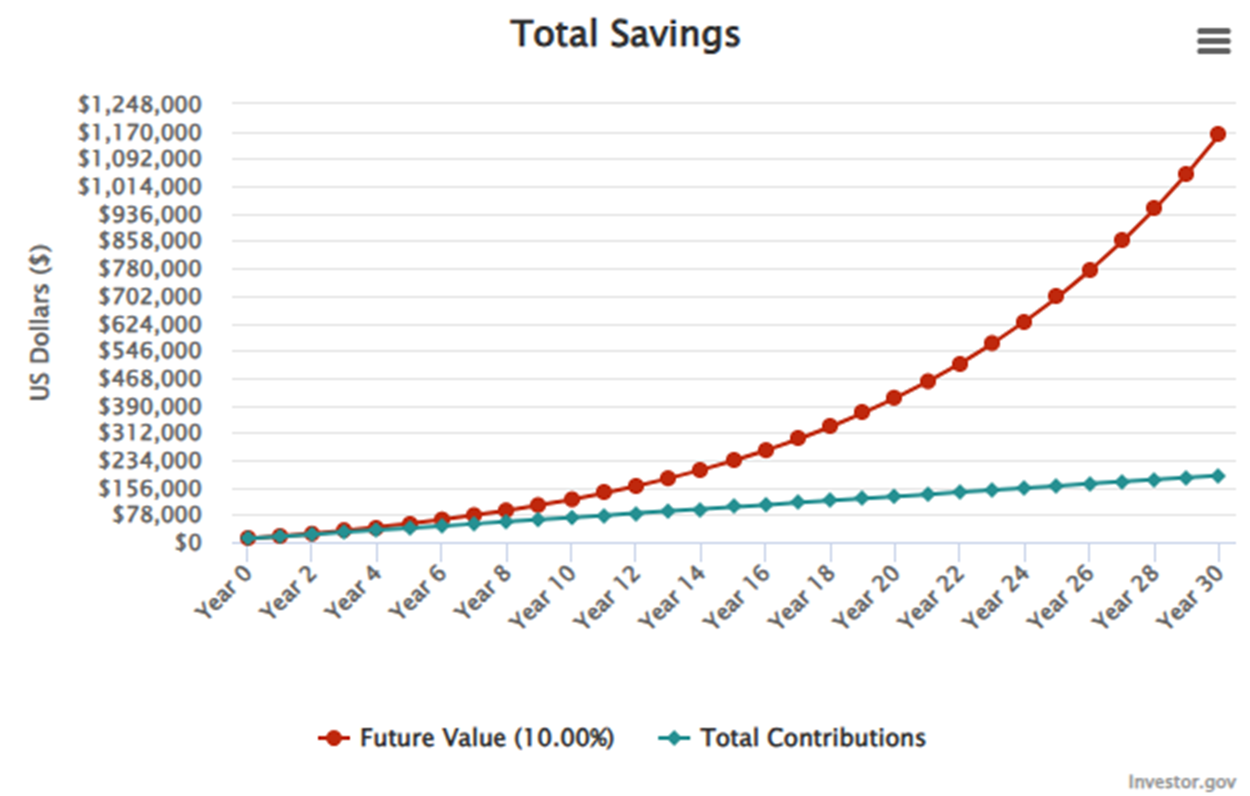

Let’s look at a theoretical example. Even if you had just invested in a fund that tracks the S&P 500, over 30 years, with a base of $10,000 and adding $500 monthly, you’d end up with more than $1 million. A feat that would make even the most jaded investor blush with pride.

That’s using an interest rate of 10%, which is below the average S&P 500 annualized gain of 10.85% during the past 20 years. It includes all of the markets’ corrections and crashes during that time, with no timing of the market and no special purchases of deep bargains. Just consistent additions, no matter what’s happening. A testament to the power of perseverance, if ever there was one.

This is for the average investor who isn’t Warren Buffett. This is a Buffett-sanctioned approach as well, since he knows most people don’t have his day job, and he recommends purchasing index funds for most investors. But this scenario is less about the index funds and more about the consistency. A lesson as simple as it is profound.

Buffett’s most important lesson for investors is to stay in the market, whether it’s rising or falling, and to keep buying great stocks when they have fair prices. A piece of advice as sound as a well-timed toast at a wedding.

📈

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-03 12:45