The markets, that grand theatre of human folly, now wobble under the weight of tariffs-a modern-day tariff tango, if you will. One might expect such economic contortions to provoke panic among retailers, yet here we find a curious counterpoint. While some flail in the fiscal abyss, others glide with the nonchalance of a man who has just discovered a £5 note in his sock. TJX Companies, it seems, has mastered the art of dancing with chaos.

Retailers reliant on discretionary spending, those delicate creatures of consumer whim, now face a gauntlet of reduced foot traffic and eroded margins. Target, for instance, has plummeted to multiyear lows with the grace of a deflated balloon. Yet amid this desolation, TJX thrives, its guidance raised with the optimism of a man who has just won a bet on a horse named “Folly.”

A Guideline Gambit Amid Tariff Tides

On August 20, TJX unveiled financial results that would make a Victorian moralist blush with admiration for their precision. Sales surged 7% to $14.4 billion, while same-store sales outperformed expectations by a margin that suggests management has been indulging in prophetic tea leaves. Diluted earnings per share climbed 15%, a figure so robust it could double as a life preserver in these choppy waters.

With such buoyancy, one might expect a modest confidence boost. Instead, TJX has elevated its fiscal year guidance, a maneuver as audacious as a monocle-wearing investor betting on the stock market during a thunderstorm. The new targets-3% comparable sales growth, $4.52-$4.57 EPS, and a 11.4% pretax margin-assume tariffs will persist as if they were an unwelcome houseguest who has overstayed their welcome but refuses to leave.

| Metric | New Full-Year Guidance | Previous Guidance |

|---|---|---|

| Comparable sales growth | 3% | 2% to 3% |

| Diluted earnings per share | $4.52 to $4.57 | $4.34 to $4.43 |

| Pretax profit margin | 11.4% to 11.5% | 11.3% to 11.4% |

TJX’s strategy is as deceptively simple as a con man’s smile. It thrives on the misfortunes of others-buying excess inventory at bargain prices, then peddling it to bargain hunters who mistake frugality for sophistication. It is a dance of economic irony: the more retailers falter, the more TJX flourishes, its success built on the rubble of competitors’ overstocked warehouses.

Valuation: A Balloon on the Brink of Bursting

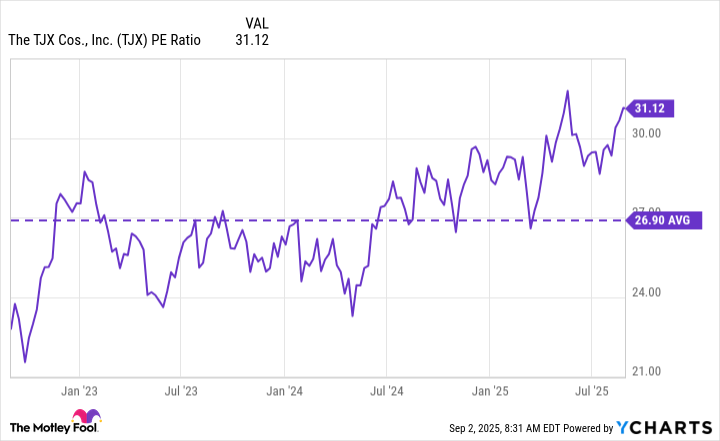

TJX’s share price, up 13% this year, now trades at a P/E ratio of 31-a figure that suggests investors are paying not for current performance, but for a future that may yet prove as illusory as a mirage in the Sahara. The company’s guidance hints at single-digit growth, yet the market demands a premium that borders on the absurd. One might liken it to a costume ball where the guests arrive in their finest, only to discover the venue has been repossessed.

Is TJX Stock a Golden Goose or a Paper Tiger?

The question of investment is as fraught as a dinner party with a guest who insists on discussing politics. TJX’s business model is sound, but its valuation demands a faith in future growth that borders on the religious. If it delivers, investors will hail it as a safe haven; if it falters, a correction may arrive with the speed of a falling guillotine.

Yet in these uncertain times, one must admire the company’s audacity. It is a rare beast that can raise guidance while tariffs loom like a thundercloud. The market’s elevated expectations may yet prove premature, but for now, TJX’s stock remains a curious blend of optimism and hubris-a financial farce with the potential to outlast its punchline. 🎩

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-03 12:44