Nvidia (NVDA) shares have executed a rather impolite sprint past 1,100% since AI became the toast of Silicon Valley in 2023. Now perched at $4.2 trillion market cap – quite the hat trick for a chipmaker – one might reasonably ask if the party’s still in full swing. The answer, darling, appears to be yes.

The quarterly missive from Santa Clara arrived with all the gravitas of a butler announcing dinner. Revenue surged 56% to $46.7 billion, with data centers accounting for 88% of the spoils. CEO Jensen Huang, ever the showman, insists we’re merely at the first act of a decade-long spectacle worth trillions. How tiresome for the competition.

Blackwell Ultra Makes Its Debut – Curtain Up on Act II

The H100 GPU, once the belle of the ball, now finds itself as obsolete as a monogrammed handkerchief in the age of AI reasoning. These newfangled models – GPT-5, Claude 4, and their ilk – require 1,000 times more tokens than their one-trick predecessors. Enter Nvidia’s Blackwell Ultra GB300, delivering 50 times the H100’s oomph. It’s rather like upgrading from a penny-farthing to a rocket-powered unicycle.

Early adopters include the usual suspects: OpenAI, AWS, Azure, and Google Cloud. One can almost hear the clinking of champagne flutes as these titans queue for the latest silicon confection. The second-quarter shipments, naturally, went off without a hitch – a minor miracle in these turbulent times.

Huang’s Trillion-Dollar Daydream

Alphabet’s splurging $85 billion on capex next year. Meta’s practically throwing confetti with $72 billion earmarked. Amazon’s eyeing $118 billion – positively vulgar in its extravagance. Microsoft, ever the gentleman, plans to outspend them all in fiscal 2026. Together, these four spend more than the GDP of Belgium. And Nvidia, darling, stands at the champagne fountain’s apex.

Jensen Huang’s crystal ball reveals $4 trillion in AI infrastructure spending by 2030. A staggering figure, though one must admit the mind boggles more at the prospect of explaining such sums to shareholders than at the sums themselves.

The Pricing Paradox

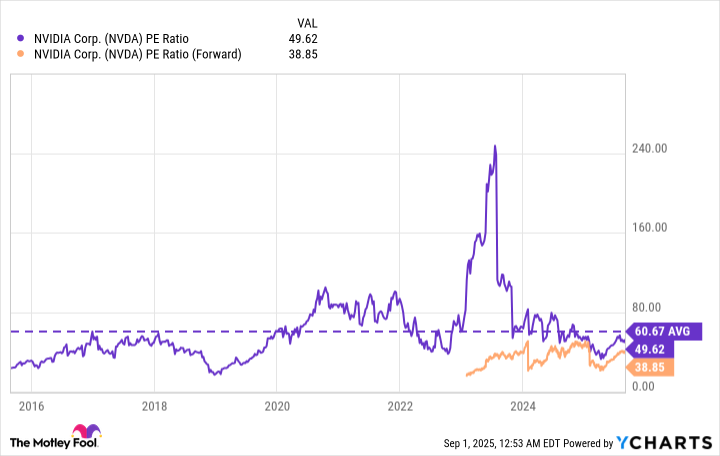

Trading at 49.6 times earnings – a discount to its 10-year 60.6 average – NVDA appears almost reasonable. Forward P/E of 38.7 based on $4.48 EPS estimates for fiscal 2026 suggests the stock must rise 56% just to reach its historical valuation. One might call it a bargain, though “bargain” feels déclassé in this context.

Next year’s Rubin architecture promises 3.3x Blackwell Ultra performance. Wall Street’s crystal ball already prices in 41% EPS growth to $6.32 by fiscal 2027. The plot thickens like a proper English cream sauce.

Investors, it seems, are about to enjoy the finest seats at the AI opera. With Rubin’s debut and $4 trillion in infrastructure spending looming, the third act promises spectacle enough for Coward himself. Now where’s that smelling salts? 🚀

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-03 11:46