Hyperliquid (HYPE) is making quite the impression, as if it were the only thing keeping crypto alive. Monthly revenue? Over $110 million. Trading volume? A staggering $2.5 trillion. One might wonder if they’ve discovered the secret to infinite wealth or simply found a very elaborate way to burn money.

They call it the crypto “killer app,” which sounds impressive until you realize it’s probably just another shiny thing to distract us all, while the risks and doubts quietly sip their tea in the corner.

Hyperliquid Surges – Like a Rocket or a Firecracker? 🎆

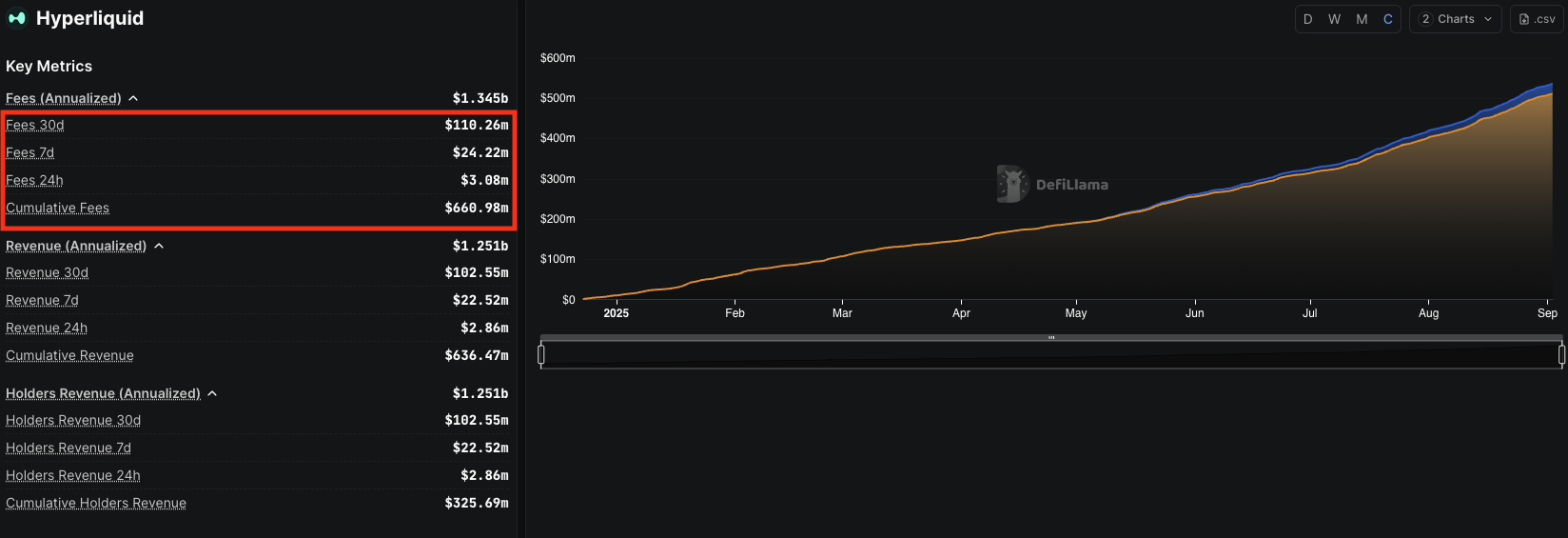

In the last month, Hyperliquid’s bank account grew by more than $110 million, bringing its grand total close to $661 million-an impressive feat for a platform that’s not even holding your money. According to DefiLlama, even as people yawn through the “slow summer,” fees keep climbing. Because who needs a summer vacation when you can earn millions pointing at graphs?

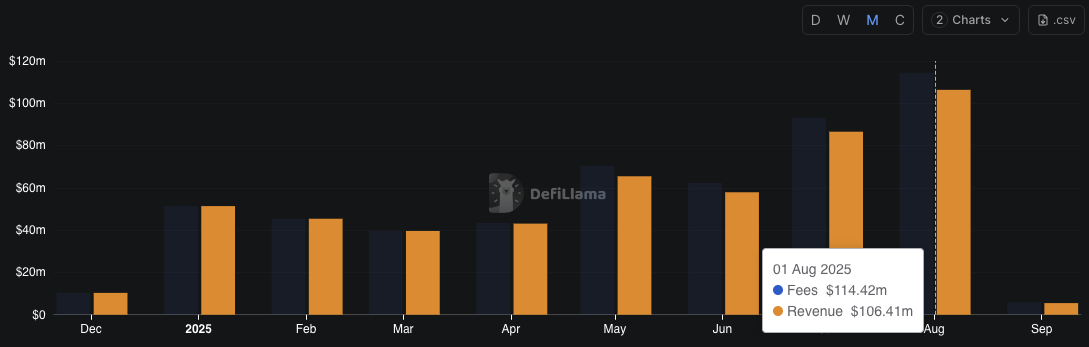

In August, revenues hit $106 million and fees $114 million-trumping July’s $86 million and $93 million. It’s almost like Hyperliquid is competitive in the “who can make the most money” game. At one point, it accounted for a third of all blockchain profits. Yeah, that’s humble bragging for you.

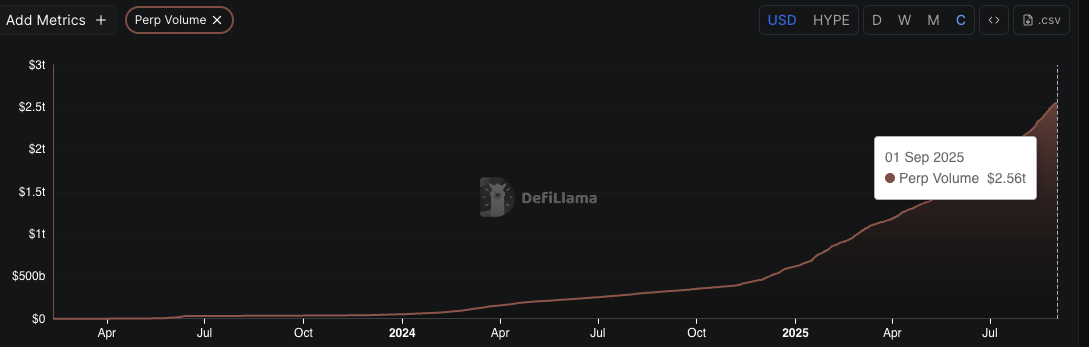

And if you thought that was enough, imagine a number: over $2.5 trillion of perpetual trading volume. Even during summer’s supposed “lull,” someone there was clicking “buy” and “sell” more than a trillion dollars in activity. Amazing, isn’t it?

This scene stands in stark contrast to Solana’s DEXs, which are pretty much limping along after their memecoin frenzy. Will Clemente aptly points out that while Solana’s activity is declining, Hyperliquid’s is “trending up and to the right”-like a child with a crayon drawing their future.

Is Hyperliquid the Next Big Thing? Or Just a Meme Waiting to Die? 🎭

The recent surge has everyone talking, some with optimism and others with a healthy dose of skepticism. Its straightforward interface, reminiscent of legacy exchanges, helps it grow fast. Some even think it might become crypto’s “killer app.” Or maybe just the latest shiny distraction.

On the flip side, caution is advised. Critics highlight risks like central control, potential outages, and lack of safeguards. Recently, Hyperliquid had a brief frontend blackout-interesting, because the backend kept humming happily, probably counting the millions.

“If Hyperliquid crashes, can users still withdraw their funds? Or will it turn evil and steal everything?” wondered Ryan on X, breaking the mood with a healthy dose of paranoia. 🙃

Meanwhile, competitors like Lighter are warming up, bringing features like order verification and unified yield-margining to spice things up. The race to dominate the perp DEX scene is getting hotter than a summer’s day in Moscow.

Despite the noise, Hyperliquid’s vast user base and revenue keep it on top, provided it keeps up with its roadmap. If it hits all its milestones, it might just keep defining what’s next in crypto, or at least give us something to snack on while we wait.

As of now, HYPE is trading around $44.63. Resistance at $50-$51 could push it further, if only the market feels like cooperating-targets are $55, $58, and the magical $73, if luck-or momentum-says so.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-03 03:15