Let’s talk about SentinelOne (S)-the cybersecurity company that’s basically the “fetch” of AI-powered protection. Its Singularity platform guards clouds, endpoints, and employee identities like a caffeinated parrot with a firewall. And yes, it’s AI-driven, so it can spot threats faster than your boss spots your “just one more minute” Slack message. But here’s the kicker: this stock is down 75% from its 2021 peak, which was basically the cybersecurity version of a reality TV show crash. Wall Street, though, is now throwing confetti like it’s the finale of The Office. Why? Let’s dive in.

On Aug. 28, SentinelOne released Q2 2026 results that made its stock soar 9% post-hours. But let’s not forget its 2021 valuation-soaring like a crypto influencer’s ego. Now, it’s grounded and cheaper than a $5 smoothie. The good news? Analysts are all “buy” and no “sell,” which is Wall Street’s way of saying, “Trust us, we’ve never lost money before.”

Singularity: The Cyber Olympics Gold Medalist

SentinelOne’s AI is the reason we’re here. It’s like having a 24/7 intern who never sleeps, never complains, and doesn’t need a raise. But when human help is needed, the Storyline feature writes incident reports so detailed, they could win a Pulitzer. And the one-click remediation? It’s like hitting “undo” on a bad breakup-except the network gets back together with itself instantly.

Then there’s Purple AI Athena, the company’s Yoda of cybersecurity. It uses “advanced reasoning” to tackle threats, which is just a fancy way of saying it’s better at this than your average corporate jargon-spewing manager. In MITRE’s 2024 Evaluations, Singularity outperformed peers with perfect accuracy and 88% less noise. Translation: It’s the quiet kid in class who still gets an A+.

Revenue Growth That’d Make Your Mom Proud

SentinelOne’s Q2 revenue hit $242.2 million-up 22% YoY and just shy of its own guidance. Its ARR crossed $1 billion, which is impressive if you consider ARR is basically the financial version of a LinkedIn headline. The company even bumped its full-year revenue guidance from $998.5 million to $1 billion, which is like raising your hand in a Zoom meeting and saying, “I’m doing better than I thought.”

While it’s smaller than CrowdStrike and Palo Alto Networks, it’s growing faster. And if you’re wondering why? Maybe because its competitors are stuck in the “innovation theater” phase of their quarterly reports. SentinelOne’s adjusted profit also jumped 277% to $13.2 million-proof that sometimes, accounting magic works better than actual magic.

Wall Street’s Bullish Bet

Of the 39 analysts covering SentinelOne, 21 say “buy,” three say “overweight,” and 15 say “hold.” No one says “sell,” which is Wall Street’s version of a group hug. Their average price target is $23.20 (25% upside), but the high is $30-62% higher. If you’re keeping score, that’s the difference between a “maybe” and a “let’s do this.”

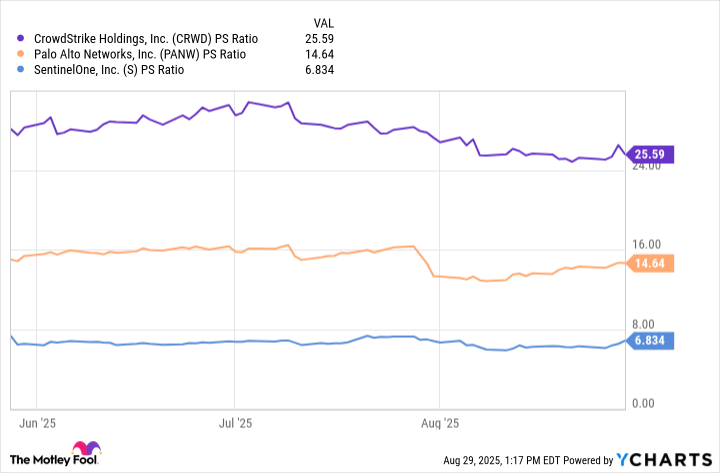

SentinelOne’s P/S ratio has dropped from 120 to 6.8 since 2021-like going from a champagne toast to a budget soda. And compared to its peers, it’s the bargain bin find of the cybersecurity world. With a $100 billion total addressable market and just $1 billion in ARR, this company has more runway than a 747 at JFK.

As a business historian, I’ve seen this dance before: overhyped tech, a crash, and then a comeback. SentinelOne’s story is a case study in resilience. And as a Tina Fey fan? Well, let’s just say Wall Street’s bullishness is less of a gamble and more of a “fetch” command. 🛡️

Read More

- Gold Rate Forecast

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- TON PREDICTION. TON cryptocurrency

- 39th Developer Notes: 2.5th Anniversary Update

- ‘The Conjuring: Last Rites’ Tops HBO Max’s Top 10 Most-Watched Movies List of the Week

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- New Sci-Fi Movies & TV Shows Set to Release in December 2025

2025-09-02 11:51