There’s something oddly satisfying about watching a billionaire tinker with his portfolio like a mad scientist in a lab of numbers. Steve Mandel, the man behind Lone Pine Capital, has spent the past decade turning his hedge fund into a case study in market alchemy. While most funds shuffle papers and hope for the best, Mandel has conjured returns that make the S&P 500 look like a timid librarian. When he starts rearranging his chessboard-selling Microsoft, buying Amazon-it’s time to lean in and see what the wizard is up to.

In Q2, Mandel trimmed his Microsoft position by 5%, a move as subtle as a thunderclap in the quiet world of stock portfolios. The proceeds? Funneled into Amazon, a stock that’s quietly swelled 800% over the past decade. Now, I know what you’re thinking: “Amazon? Isn’t that just the place where people buy socks and send Grandma birthday cards?” Ah, but you’d be mistaken. Beneath its e-commerce skin lies a beast of a different stripe-one that’s chewing up the AI landscape with the enthusiasm of a toddler with a box of Legos.

AWS: The Unlikely Hero of AI

Let’s play a little game. Close your eyes and picture Amazon. What do you see? A warehouse? A delivery van? A screen full of “Recommended for You” products? Now open your eyes. Chances are, you missed the part where Amazon’s cloud computing division-Amazon Web Services, or AWS-is quietly funding half the AI revolution. It’s like discovering your neighbor’s hobby farm is actually a secret biotech lab.

Cloud computing, for the uninitiated, is the digital version of renting a room in someone else’s mansion instead of buying a shack. Training AI models requires computational power that could power a small country. Most companies can’t justify building their own data centers (unless they’re Elon Musk, apparently), so they rent space from AWS. And rent they do. In Q2, AWS revenue hit $30.9 billion, growing at a stately 17%-not as brisk as Microsoft Azure’s 30%, but remember: AWS is the elephant in the room. It’s bigger, older, and still manages to out-earn its rivals by margins that would make a Wall Street banker weep with envy.

AWS accounted for 18% of Amazon’s revenue but a staggering 53% of its operating profit. That’s not just a business-it’s a profit machine disguised as a cloud service. And the best part? It’s being turbocharged by AI. Every time a startup or Fortune 500 company rents a few gigabytes of computing power, AWS gets richer. It’s like charging admission to the AI circus.

But here’s the rub: Microsoft is also a solid AI player. So why would Mandel trade down from Redmond to Seattle? Let’s put on our portfolio manager hats and dissect this.

Margin Magic and the Long Game

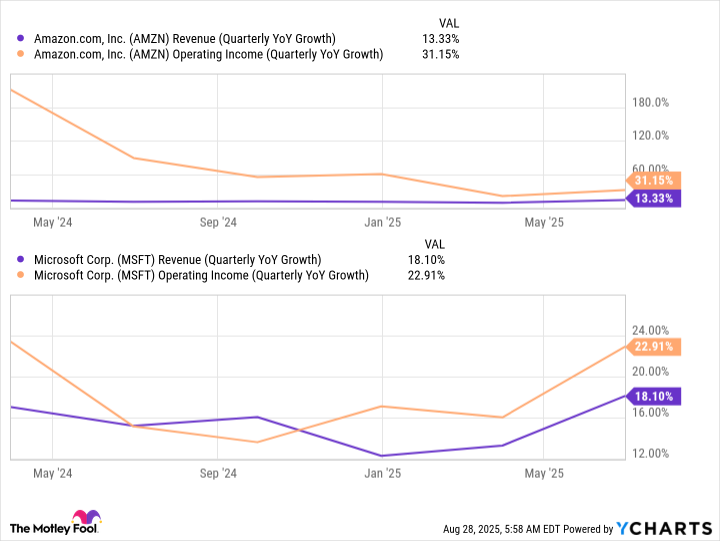

Both Amazon and Microsoft trade at premium valuations, but Amazon’s margins are on a slow, steady climb. Think of it as the difference between a sprinter and a hiker. Microsoft’s growth is explosive but finite; Amazon’s is methodical, like a glacier grinding its way to the sea. AWS and Amazon’s advertising business-two of its fastest-growing units-are the engines behind this margin expansion. While the company’s overall revenue growth may seem pedestrian, its operating income is sprinting ahead. It’s the financial equivalent of squeezing more juice from the same orange.

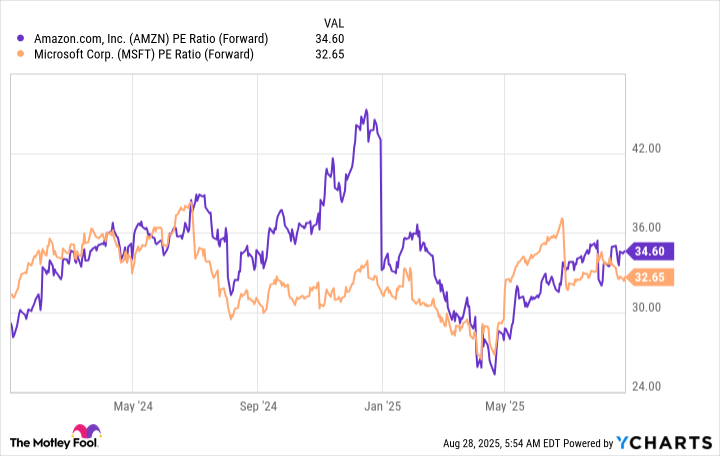

Take a look at the numbers. Amazon’s operating income growth is outpacing Microsoft’s, and with both stocks trading at similar forward P/E ratios, it’s a classic case of “same price, better punch.” For a long-term investor, this is the kind of trade that makes you feel like you’ve found a $20 bill in your old jeans. Microsoft isn’t going anywhere, but Amazon’s profit trajectory looks sharper, like a chef’s knife versus a butter knife.

This isn’t to dismiss Microsoft-far from it. It’s a titan in its own right. But Mandel’s move suggests he sees Amazon as the better long-term play. After all, if you’re going to bet on AI, you want to back the horse that’s not just running but gaining ground on the track itself.

So, should you follow suit? Not blindly, of course. But if you’re a patient investor with a taste for companies that turn complexity into cash, Amazon’s AWS division is a compelling story. And if Steve Mandel’s right, we’re not just talking about a good investment-we’re talking about a front-row seat to the next industrial revolution. 🚀

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-01 03:17