As one adjusts one’s cashmere scarf against the first whispers of autumn, it seems rather gauche to ignore the U.S. stock market’s recent theatrics. The S&P 500 (^GSPC), bless its little heart, has risen by a tidy 9.6% year-to-date and an almost indecent 33% since April. All this, mind you, on the back of investors’ collective swoon over artificial intelligence-a darling so dazzling that even the most jaded among us might be tempted to applaud.

And yet, dear reader, as champagne corks pop and portfolios swell, there lingers the faintest whiff of ennui. What is one to do when the market behaves like an overeager debutante at her first ball? Shall we cling to our winners with the desperation of a dowager clutching her pearls? Or should we tiptoe into the bargain bin, where hidden gems languish like forgotten novels in a country house library? Rest assured, I shan’t advocate for any rash decisions; instead, let us review our holdings with the detached elegance of a seasoned hostess assessing her guest list.

Here, then, are five stocks that strike me as particularly fetching this September-each with its own peculiar charm, much like guests at a well-curated soirée.

A Subscription to Microsoft’s Future

Demitri Kalogeropoulos (Microsoft): “Ah, Microsoft,” I hear you sigh, “must we endure another ode to this titan?” Indeed, it does seem tiresome to praise a company already worth over $3 trillion, but what can one do when faced with such undeniable allure? The software giant has just wrapped up a fiscal year brimming with triumphs: revenues surged by 15%, profits leapt higher still, and operating income reached a princely $129 billion. A profit margin of 46%? My dear, it positively reeks of efficiency.

Wall Street, ever the excitable puppy, wags its tail madly at Microsoft’s prospects in AI, cloud computing, and subscription services. No wonder the stock has more than doubled since mid-2020. True, trading at 37 times earnings might raise an eyebrow or two, but consider the diversity on offer: enterprise software, gaming, consumer tech-all under one roof, like a well-stocked chateau.

But the pièce de résistance, darling, is the cash flow. With $136 billion generated in the past year alone, Microsoft can indulge in aggressive growth investments while maintaining a generous dividend and indulging in the occasional stock buyback. Frankly, it’s all quite thrilling.

Brookfield Asset Management: A Multibagger in Waiting

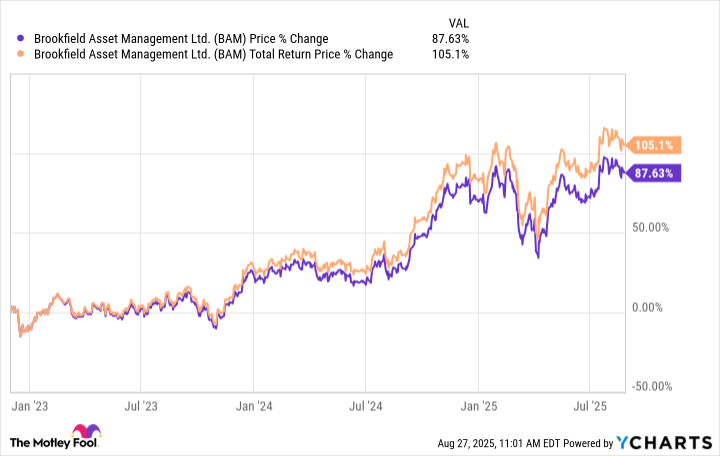

Neha Chamaria (Brookfield Asset Management): Ah, Brookfield Asset Management-a name that rolls off the tongue like a fine claret. Born from the spinoff of Brookfield Corporation in late 2022, this asset management prodigy has already doubled investors’ money. And yet, management coyly insists that “the best is yet to come.” One almost suspects they’re teasing us.

Consider the facts: over $1 trillion in assets under management, long-term fee-based contracts ensuring stability, and megatrends like digitalization and decarbonization opening doors faster than a butler during tea time. Fee-based earnings per share are projected to grow at a compound annual rate of 17%, with dividends rising by 15% annually. Really, it’s all frightfully exciting.

Verizon Communications: For Those Who Prefer Their Investments Dry

Keith Speights (Verizon Communications): If frothy valuations leave you feeling faint, Verizon Communications may be the tonic you need. Trading at a forward P/E ratio of 9.4, it’s practically giving itself away compared to the S&P 500’s giddy 22.8. Even AT&T, Verizon’s perennial rival, looks expensive at 13.8.

Verizon’s beta-a mere 0.36 over the past five years-suggests it’s about as volatile as a sleepy cat in a sunbeam. Its wireless network quality? Impeccable, according to J.D. Power, who’ve awarded it top honors no fewer than 35 times. And the dividend yield? A positively decadent 6.16%. It’s enough to make one feel terribly smug.

Target: A High-End Retailer at a Bargain Price

Anders Bylund (Target): Wall Street appears to have mistaken Target for a failing opera house, pricing it as though curtains will soon descend. At 11.3 times trailing earnings and 0.4 times sales, the stock resembles a distressed aristocrat selling family heirlooms. Meanwhile, rivals Walmart and Costco prance about like nouveau riche heirs, basking in inflated valuations.

To be sure, Target has stumbled, particularly after the inflationary chaos of 2022. But darling, it’s dusting itself off with aplomb. Rather than engaging in a vulgar price war, it’s leaning into its slightly upscale image-the infamous “Tar-zhay” moniker. Offer a superior shopping experience, and customers will happily pay a bit more. Clever, non?

With leadership changes on the horizon, some fret, but incoming CEO Mike Fiddelke is hardly a novice. He’ll glide into his role with the grace of a practiced dancer, supported by outgoing CEO Brian Cornell. Meanwhile, shareholders enjoy a dividend yield of 4.7%. Surely, this is a bargain too delicious to resist.

Procter & Gamble: Steady as She Goes

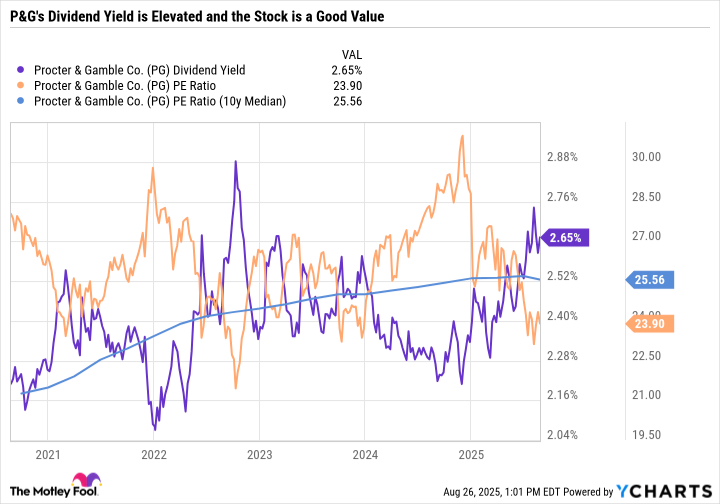

Daniel Foelber (Procter & Gamble): Procter & Gamble, my dears, is the epitome of reliability-a veritable grande dame of consumer staples. Tide, Gillette, Bounty, Charmin-all household names that evoke nostalgia and trust. Yet, alas, even P&G cannot escape the vagaries of cost pressures and sluggish consumer spending.

Recent results have been, shall we say, unremarkable. Sales grew by a meager 2%, earnings per share increased by 8%, and guidance remains tepid. And yet, P&G continues to reward shareholders handsomely, boasting a dividend streak stretching back 69 years. The stock, currently hovering near a 52-week low, offers a yield near the high end of its five-year range.

For those seeking safety and value, P&G is a splendid choice-a reliable friend in uncertain times. Buy it now, tuck it away, and let it work its quiet magic.

And so, dear investor, as we sip our metaphorical gin and tonics, let us remember: markets may rise and fall, but opportunity, like wit, is eternal 🍸.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Top Actors Of Color Who Were Snubbed At The Oscars

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

2025-08-31 14:33