As we flick through the ever-thickening annals of Warren Buffett’s market dealings, we find ourselves at once bemused and entranced. The latest spectacle reveals a striking shift: after years of passive accumulation and occasional disposals, Buffett has begun to make a decisive return to some stalwart positions. His eye, in particular, now seems to settle on Walmart (WMT)-a retail leviathan that might just make one wonder if old Warren has stumbled upon a stroke of genius, or if he’s merely chasing shadows.

Not the First Rodeo

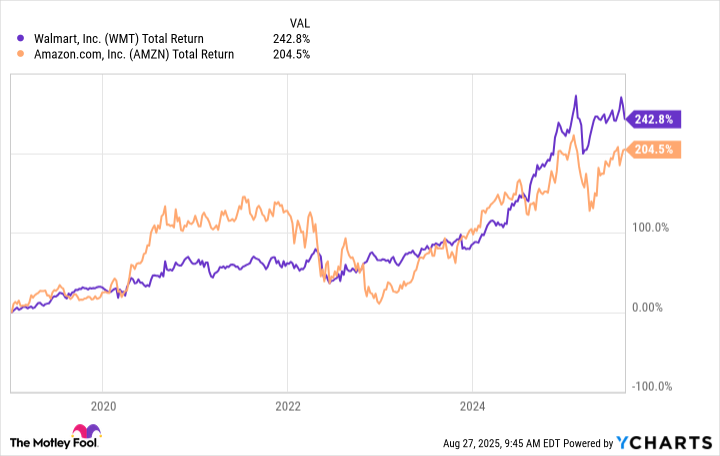

Walmart is, of course, a familiar name in Buffett’s portfolio-a dalliance that began in 2005 and, like most of his romantic entanglements, ended with a certain sense of disillusionment in 2018. For over a decade, Walmart was a principal figure in Berkshire Hathaway’s empire, only for Buffett to begin shedding the stock in 2015, his faith eroded by the siren call of Amazon’s e-commerce juggernaut. In fact, shortly after bidding farewell to Walmart, Buffett turned to Amazon, buying up shares with the same fervor as a lovesick teenager.

Buffett’s decision at the time was hardly without merit. Walmart, caught napping in the e-commerce revolution, seemed to be gasping for air as Amazon surged ahead, a trend that would surely diminish the brick-and-mortar titan’s once-unassailable supremacy. Yet, much like an old film star vainly clinging to their past glory, Walmart has refused to fade into obscurity. In fact, over the last few years, the company has been rediscovering itself, with e-commerce sales soaring by 25% in the second quarter of fiscal 2025-a pace that even Amazon might envy.

To Cut or Not to Cut

Did Buffett make a mistake? One could argue, with a rather smug sense of superiority, that his error was indeed a classic one-cutting a winner too soon. Buffett once famously remarked that the greatest sin in investing is “cutting the flowers and watering the weeds,” a sentiment often echoed by the more seasoned among us who have witnessed the ravages of premature exits. Yet here we find Buffett, perhaps with a wry smile, revisiting an old flame. The man who once declared his “forever” holding periods now finds himself guilty of indulging in a regrettable act of “selling the winners too soon.”

Walmart, for all its supposed flaws, is a survivor. The e-commerce setbacks, the early missteps, and even the rise of Amazon could not entirely undo the empire that Sam Walton built. A bitter pill indeed, but one that Buffett has likely swallowed in his return to the stock. Some mistakes are not so easily undone, but there is always room for reconciliation, especially when a profitable partner beckons once again.

The Buffett Checklist

What precisely, then, does Walmart offer that makes it such an alluring target for Buffett’s famously discerning eye? We return to the man’s oft-quoted investment philosophy: solid management, an essential role in the economy, a deep commitment to shareholder value, and, above all, a business that requires little in the way of excessive investment to generate substantial returns. For all its faults, Walmart ticks these boxes with a rather disarming nonchalance.

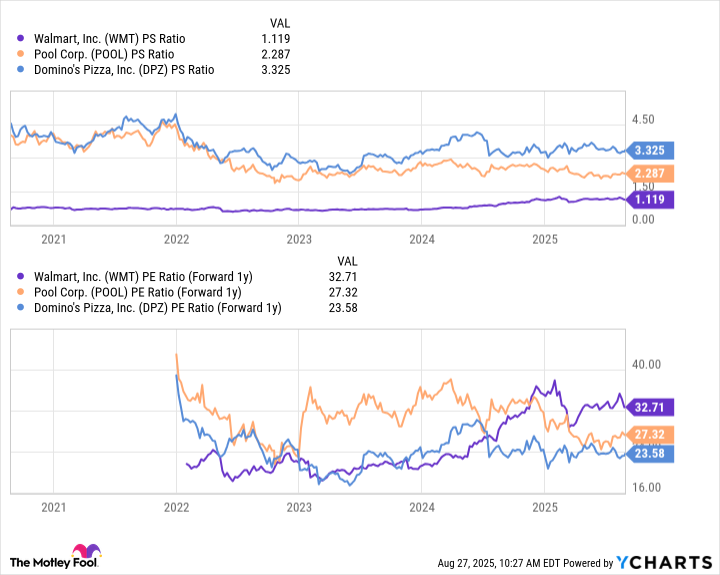

Indeed, Buffett’s investments in the likes of Pool Corp, Domino’s Pizza, and UnitedHealth Group have shown a distinct preference for sector leaders-companies that dominate their respective industries with a singular blend of dominance and innovation. While we might imagine these stocks to be bargains, they rarely are. Walmart, like its peers, is not inexpensive, but its market position is virtually unmatched. Its ability to weather the storms of inflation, tariffs, and competition speaks to a resilience that Buffett, ever the pragmatic investor, surely cannot ignore.

Walmart in 2025: The Resilient Behemoth

Why Walmart today? The answer, as we might expect, is rooted in a delicate blend of tradition and innovation. As the world’s largest retailer, Walmart has somehow avoided being swallowed whole by the encroaching online titans. Despite the creeping threats of Amazon and its ilk, Walmart’s status remains largely unshaken. And yet, unlike its more fragile competitors, Walmart boasts an impressive network of 4,600 domestic stores, which serve as nimble distribution hubs-an advantage that no online retailer can currently match.

The company is not resting on its laurels, either. Over the last year, store deliveries have surged by 50%, with one-third of them arriving in under three hours. This kind of efficiency, one might say, has the sting of a corporate serpent-quiet, steady, and devastatingly effective.

Moreover, Walmart is a Dividend King, having raised its payout for 52 consecutive years. This is not merely a token gesture; it’s a commitment to the fundamental tenet of shareholder value-a feature that Buffett, no doubt, appreciates deeply in his quieter moments of reflection.

As we consider the current trajectory of Buffett’s portfolio-stockpiling industry leaders while holding cash in reserve for future opportunities-it seems clear that he sees Walmart as more than just a retail giant. He sees it as a fortress of stability, capable of weathering the economic storms that often precipitate the kind of lucrative opportunities that attract his eye.

In conclusion, the lesson here is simple: Walmart, for all its clumsy stumbles, remains a power to be reckoned with. It is not the most glamorous of choices, but in times of uncertainty, it is the stalwart-unflinching, unwavering, and, dare we say, the next Buffett success story. Don’t underestimate it.

🛒

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR UAH PREDICTION

2025-08-30 13:48