The semiconductor industry, a realm of silent machinery, has found itself in the throes of an unexpected transformation, orchestrated by the shadow of artificial intelligence. Its circuits, once mere conduits of data, now hum with the weight of an unspoken mandate, as if the very fabric of computation has been rewritten by an unseen hand.

From the laborious training of AI models to the quiet hum of cloud servers, from the flickering screens of personal devices to the sterile hum of data centers, chips are the silent architects of this new order. Yet the logic behind their proliferation remains as opaque as the algorithms they power, their necessity both absolute and inscrutable.

Marvell Technology (MRVL), a name that echoes through the corridors of semiconductor commerce, has found itself in a peculiar position. Its application-specific integrated circuits, those cryptic artifacts of custom design, are deployed in the hallowed halls of AI data centers, yet the company’s valuation appears to defy the very principles it claims to embody. To observe its stock is to witness a paradox: a machine of relentless growth, yet one whose price remains shrouded in the bureaucratic fog of market indifference.

Let us dissect this enigma, for it is a labyrinth of numbers and whispers, where every metric seems to spiral into deeper confusion.

Marvell’s Growth: A Descent into the Absurd

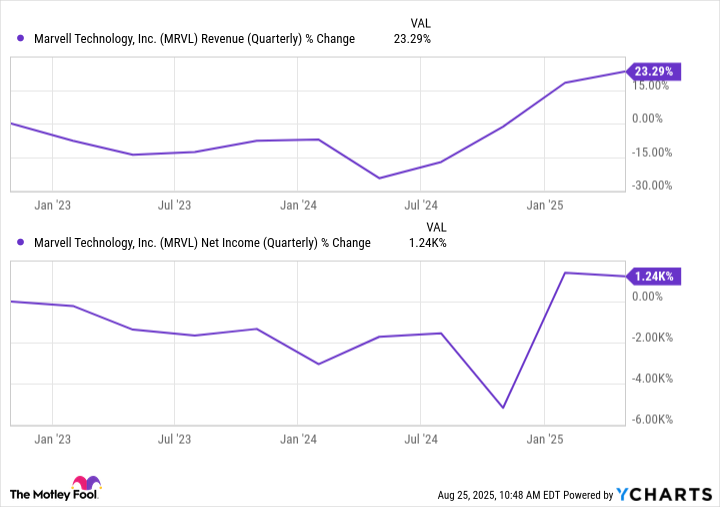

Marvell’s ascent has been nothing short of disorienting. The chart below, a tangle of lines and peaks, suggests a trajectory that defies conventional understanding. Its data center division, the supposed linchpin of this resurgence, has allegedly propelled the company forward, yet the remnants of its former segments linger like ghosts, their struggles etched into the company’s financial annals.

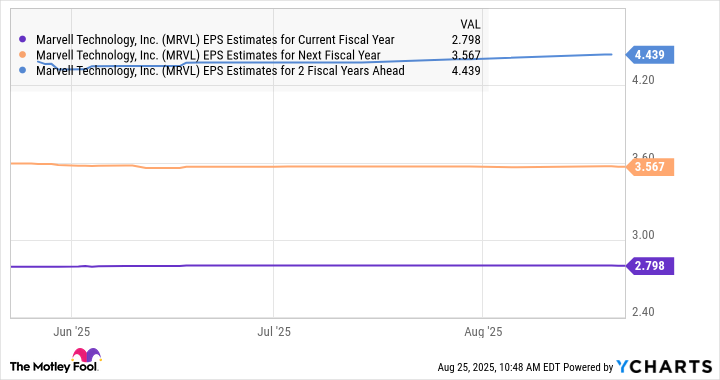

On the May earnings call, management spoke of “rapid scaling” and “robust shipments,” phrases that resonate with the bureaucratic jargon of an unseen authority. Their words, though precise, feel like the murmurs of a system that has long since ceased to answer to human reason. Revenue, they claimed, surged 63% year over year to $1.89 billion, while adjusted earnings leapt 158% to $0.62 per share. And yet, the stock trades at a mere 22 times earnings, as if the market itself is trapped in a bureaucratic loop, unable to reconcile the company’s performance with its valuation.

The guidance for fiscal Q2, a forecast of $2 billion in revenue and $0.67 per share, only deepens the mystery. To invest in Marvell is to navigate a terrain where growth is both a promise and a riddle, where the numbers themselves seem to resist comprehension.

And yet, the company’s trajectory suggests a persistence that borders on the absurd. Its ability to sustain this growth, however, remains an open question, a matter of faith in a system that offers no guarantees.

The Long Game: A System of Unseen Forces

The demand for ASICs, those custom AI processors designed by Marvell, is not driven by logic but by an inexorable force, as if the very nature of computation has been redefined by an unseen hand. These chips, tailored for specific tasks, are said to reduce costs and power consumption, yet their appeal lies in their opacity-efficiency measured not in tangible terms, but in the abstract calculus of corporate strategy.

The cloud titans-Amazon, Alphabet, Microsoft, Meta Platforms-have all succumbed to this logic, their vast infrastructures now dependent on the cryptic designs of companies like Marvell and Broadcom. To be a customer of such firms is to be enmeshed in a system that offers no clarity, only the illusion of control.

Marvell, for its part, envisions a future where the custom AI chip market expands from $6.6 billion in 2023 to $55 billion by 2028. A pipeline of 10 customers, 18 chips in development, and a target of 50 in the future-these figures are not mere numbers but the echoes of a bureaucracy that thrives on its own complexity. To invest in Marvell is to wager on a system that may never be fully understood, yet whose momentum is undeniable.

This AI stock, a relic of a system that resists analysis, may yet prove to be the most elusive opportunity in the semiconductor sector. To purchase it is to step into a world where value is both manifest and hidden, where growth is a given and its implications remain forever obscured. The market, ever enigmatic, may one day reward this patience-but for now, it remains a labyrinth, its exits unknown.

🧠

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Best Actors Who Have Played Hamlet, Ranked

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Games That Faced Bans in Countries Over Political Themes

2025-08-27 18:15