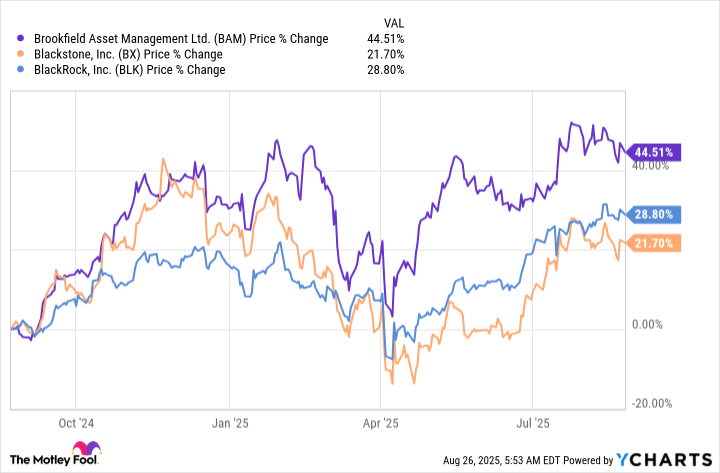

Brookfield Asset Management (BAM) presents a compelling case for investors seeking both growth and income. However, with its stock surging 45% over the past year-outpacing the S&P 500 index (^GSPC)-the question arises: is further upside contingent upon future execution, or has Wall Street already priced in the opportunity? This analysis evaluates the company’s strategic positioning and valuation metrics to inform long-term capital allocation decisions.

Core Operations and Growth Trajectory

As a global asset manager, Brookfield Asset Management monetizes third-party capital through fee-based structures, with a historical focus on infrastructure investments. Recently, the firm has diversified into clean energy, real estate, private equity, and credit markets. Collectively, these segments support a fee-bearing capital base of approximately $550 billion-a figure management aims to double to $1.1 trillion by 2030.

- Growth is underpinned by three macroeconomic trends: digitization, decarbonization, and deglobalization.

- Fee-related earnings are projected to grow at a compound annual rate of 17%, supporting a 15% dividend growth trajectory.

- A 15% annual dividend increase implies a doubling of payouts within five years, assuming consistent execution.

This ambitious expansion plan hinges on the firm’s ability to capitalize on secular tailwinds while maintaining operational discipline.

Valuation Metrics and Peer Comparison

Despite its robust performance, Brookfield Asset Management’s valuation metrics warrant scrutiny. The stock’s current dividend yield of 2.9% aligns favorably with peers such as Blackstone (BX), which yields 2.5%, and BlackRock (BLK), yielding 1.8%. This suggests that, on a relative basis, Brookfield may offer a modest valuation advantage within its peer group.

- The price-to-earnings (P/E) ratio of 42 exceeds BlackRock’s 28 but remains below Blackstone’s 46, indicating a balanced yet elevated valuation.

- If dividend payouts were to double, maintaining the current yield would necessitate a commensurate rise in the stock price-an outcome contingent upon sustained earnings growth.

While not egregiously overvalued, Brookfield’s premium pricing reflects investor confidence in its growth narrative. Yet, this optimism leaves limited margin for error in execution.

Risk Factors and Market Dynamics

The rapid ascent of Brookfield Asset Management’s stock raises concerns about near-term volatility. A parabolic rise often precedes periods of consolidation, particularly in the event of broader market downturns. Additionally, the firm’s reliance on fee-bearing capital exposes it to regulatory headwinds and competitive pressures in an increasingly crowded asset management landscape.

- Potential downside risks include slower-than-expected capital deployment and adverse shifts in global economic conditions.

- Investors must assess whether the company’s projected growth justifies its current valuation multiple.

While the long-term thesis remains intact, short-term fluctuations could test investor resolve.

Conclusion: A Calculated Bet on Long-Term Growth

Brookfield Asset Management represents a calculated bet on structural shifts reshaping the global economy. Its diversified platform and disciplined approach to capital allocation position it well for sustained growth. However, the stock’s recent outperformance introduces near-term uncertainty, requiring investors to adopt a patient, contrarian mindset.

For those with a multi-year horizon, the firm’s growth prospects and dividend trajectory may justify current valuations. Nevertheless, prudent risk management dictates caution in the face of potential market turbulence. As always, the decision to invest should be informed by a comprehensive assessment of individual risk tolerance and portfolio objectives. 📈

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Best Actors Who Have Played Hamlet, Ranked

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Games That Faced Bans in Countries Over Political Themes

2025-08-27 13:34