Bitcoin’s week? A masterpiece of mediocrity. 3% down in 7 days, 0.3% gained in 24 hours, and even the hourly chart’s throwing up its hands like, “What’s the point?” 💔

This isn’t a price chart-it’s a passive-aggressive text from your ex. Buyers and sellers are just… meandering, but on-chain data whispers, “Wait! There’s a plot twist!” 🕵️♂️

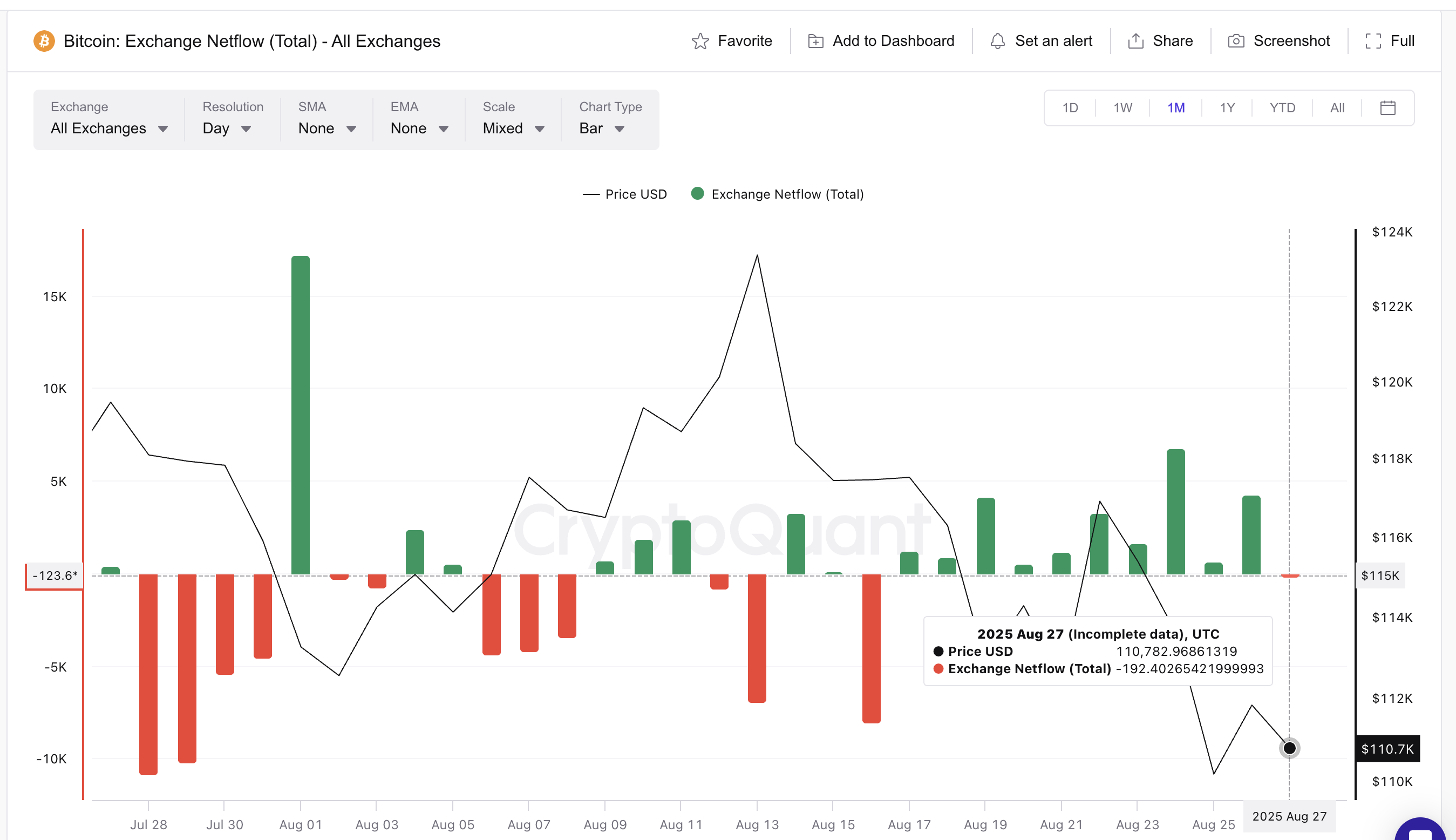

Exchange Flows: A 10-Day Horror Film 🎬

Exchange net flows are the crypto version of a passive-aggressive breakup. Positive = “I’m leaving you to sell on Binance,” negative = “I’m keeping you in a vault.”

Bitcoin’s inflows? A 10-day rom-com where the lead (BTC) keeps saying “no” but *accidentally* leaves her keys at the ex’s place. August 24’s 6,775 BTC inflow? A red flag written in glitter. August 26’s 4,239 BTC? “I’m fine, really.”

Today’s plot twist: Net flows dip to -192 BTC. Sellers gasp, “Is this… a mercy kill?” Buyers whisper, “Finally! A chance to not be the villain in this soap opera.” 🎭

If inflows return, it’s “Part 11: The Neverending Sell-Off.” If not? Maybe Bitcoin’s finally done with its midlife crisis. 🚀

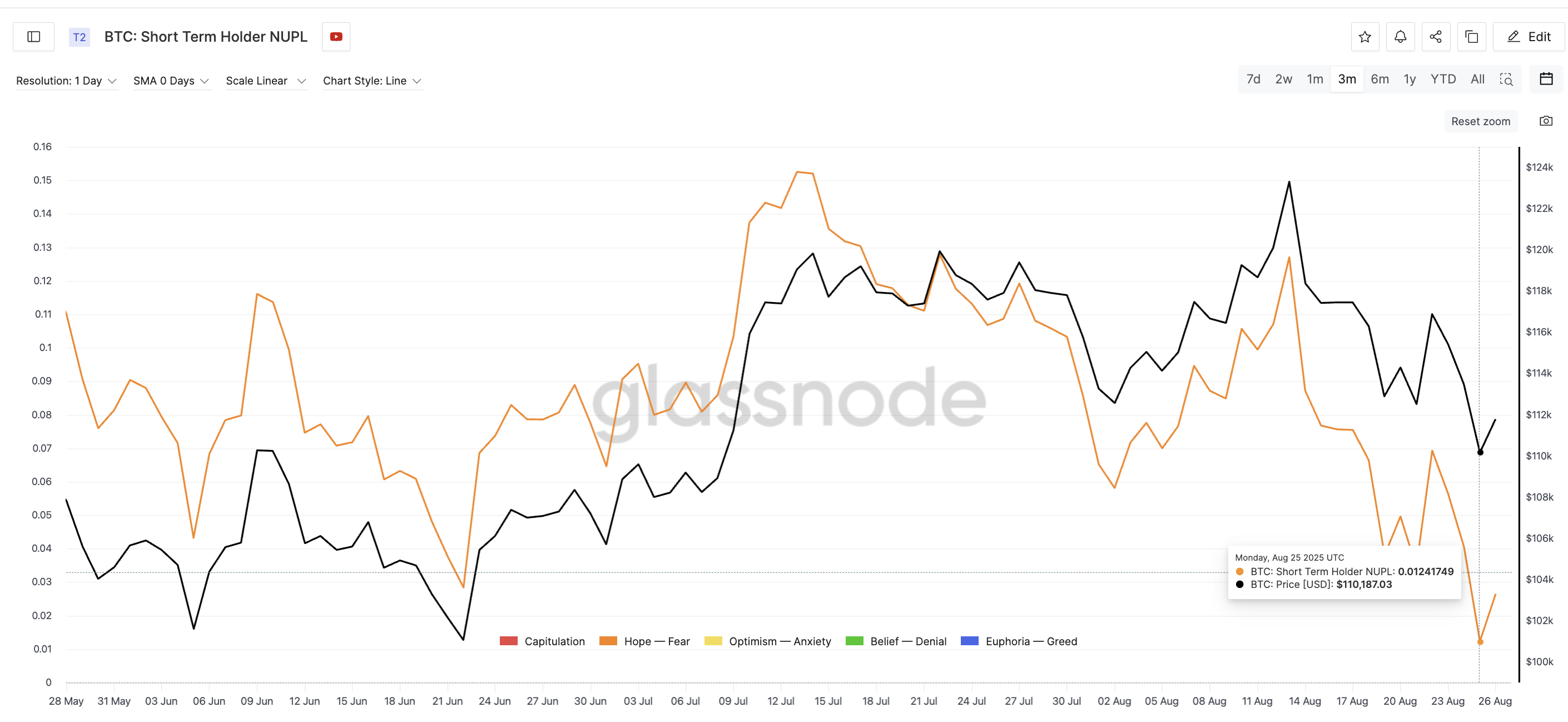

Short-Term Holder NUPL: The “I’m Fine” Energy 🤦♀️

Short-term holders (STHs) are like your friend who buys a gym membership and then uses it as a coat rack. Their NUPL metric? A tragicomedy of “I bought high, I’m okay, really.”

NUPL plummeted 90% in 40 days-mid-July’s 0.152 to August 25’s 0.012. It’s like watching your savings account during a Black Friday sale. Now at 0.026, it’s a flicker of hope that smells like a crypto bro’s last meal.

History’s whispering, “This pattern? It’s a reboot button for BTC.” June 5, 22, and August 2? All “NUPL hits rock bottom, BTC rallies” episodes. Will August 27 be the finale? Or just the prequel to another crash? 🎬

Bitcoin’s Price: A Tug-of-War with a Broken Rope 🪢

BTC’s range? $108,600-$112,300. Tighter than a bear market wallet. Sellers are like, “I’m not trying to win, I’m just not letting you win,” while buyers are “I’ll take a 0.3% gain and a standing ovation.”

If inflows return, BTC could dive below $108,600-think of it as a “deep clean for your portfolio.” But if buyers hold this outflow? $112,300’s the new “I do,” and the next stop is $116,500, where the bulls might finally get a divorce lawyer. 💍

For now, BTC’s stuck in a “Is this a comeback or a cry for help?” limbo. Break the inflow streak, and the bulls might finally get their “I’m sorry” letter. If not? Enjoy the sequel. 🎥

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-27 12:02