![]()

One might say that the past three years have been something of a carnival for Wall Street, with artificial intelligence (AI) playing the role of both ringmaster and tightrope walker. The notion of software making decisions without so much as a by-your-leave from us mere mortals has proven to be a multitrillion-dollar opportunity-a figure large enough to make even the most jaded investor sit up and take notice.

And yet, amidst this grand parade of technological marvels, one company finds itself perched atop the pedestal like an overfed canary at a bird show: Nvidia (NVDA). With its graphics processing units (GPUs) acting as the “brains” behind AI-accelerated data centers, Nvidia has added a cool $4 trillion in market value since the end of 2022. Not bad for a firm whose name sounds suspiciously like it could belong to a Scandinavian furniture brand.

But now, as the clock ticks toward the closing bell on Aug. 27, all eyes are fixed upon Nvidia’s quarterly operating results. While Wall Street habitually delights in how handily Nvidia surpasses consensus revenue and earnings-per-share (EPS) estimates-often by margins wide enough to accommodate a small tea party-there exists another, less-talked-about metric that shall determine whether today’s news is champagne-worthy or causes investors to reach for their smelling salts.

A Stage Fit for a Technological Hamlet

When Nvidia lifts the proverbial curtain later today, analysts will be expecting no less than $46 billion in second-quarter sales for fiscal 2026, along with EPS of $1.01. Such figures would represent yet another dazzling performance, akin to watching Pavarotti sing while juggling flaming torches. And let us not forget that Nvidia has outpaced consensus EPS projections by $0.04 to $0.06 in each of the previous four quarters-an achievement that would make even Jeeves nod approvingly.

Yet beyond these headline numbers lies a veritable treasure trove of intrigue. Consider, if you will, the recent green light given by the Donald Trump administration for Nvidia to export its H20 chip to China-a nation whose GDP places it firmly in the No. 2 spot globally. For nearly two-and-a-half years under Presidents Biden and Trump alike, such exports had been restricted, leaving Nvidia somewhat in the lurch. Now, however, the floodgates appear to have reopened, and investors will surely be agog to see how this development shapes the company’s full-year sales guidance.

Then there is CEO Jensen Huang, who seems determined to bring a new AI-advanced chip to market every year-a schedule rigorous enough to exhaust even the most industrious of inventors. Investors will undoubtedly wish to hear updates regarding Blackwell Ultra shipments in late 2025, as well as tidbits about Vera Rubin and Vera Rubin Ultra, slated for arrival in 2026 and 2027 respectively. Both chips promise to operate on the all-new Vera processor-a name that conjures images of a particularly sprightly aunt hosting garden parties.

And should Mr. Huang choose to regale us with tales of newly forged partnerships or collaborations-in-progress, we may expect mention of his close relationship with Taiwan Semiconductor Manufacturing (TSMC), whose high-bandwidth memory packaging technology is rather indispensable for AI-accelerated data centers. Indeed, TSMC plays the part of Jeeves here, ensuring that Nvidia’s ambitions do not collapse into chaos.

Still, despite all these glittering prospects, there looms a single metric that towers above them all like a particularly ambitious cucumber sandwich tower at a garden fête.

Gross Margin: The Unsung Hero of Our Drama

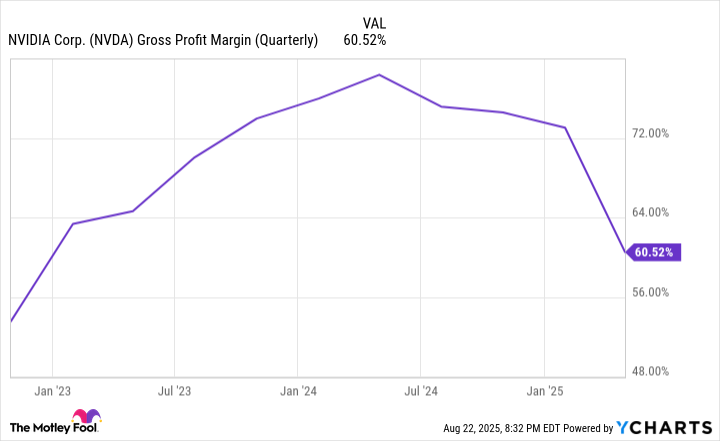

Yes, dear reader, I speak of Nvidia’s GAAP gross margin guidance-a figure so pivotal that it could either elevate the company to heights hitherto unseen or send it tumbling into the metaphorical soup bowl. Thanks to the AI revolution, Nvidia’s gross margin soared to a peak of 78.4% during the first quarter of fiscal 2025, driven largely by demand for its Hopper chip vastly outstripping supply. This scarcity allowed Nvidia to charge premiums ranging from 100% to 300%, thus transforming its balance sheet into something resembling a magician pulling rabbits from a hat.

It is little wonder, then, that Mr. Huang harbors dreams of releasing a new AI-GPU annually. For what better way to maintain one’s competitive edge-and justify those lofty price tags-than through relentless innovation? Yet one cannot help but wonder whether this strategy might eventually backfire. After all, bringing advanced chips to market every 12 months risks turning prior-generation models into relics faster than you can say “depreciation.”

Nvidia’s GAAP gross margin has fallen for four consecutive quarters, excluding a hiccup related to charges on H20 chips destined for China. Whether this trend continues or reverses will serve as a barometer for the company’s ability to sustain its premium pricing power-and thus, its dominance in the AI arena.

So, as the closing bell tolls and the numbers come pouring forth, remember this: beneath the surface-level dazzle of revenues and EPS lies the true star of our show. It is gross margin, that humble yet vital metric, which holds the key to Nvidia’s fortunes-or misfortunes, as the case may be. Keep your eyes peeled, dear reader, for the drama unfolding is sure to be nothing short of riveting. 😊

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-27 11:04