The markets are a battlefield, and every quarter, the generals of finance march their armies into the Securities and Exchange Commission with Form 13Fs. These filings are the smoke signals of Wall Street-coded messages revealing where the big money is moving. And if you’re smart enough to read between the lines, they can tell you more than any analyst’s blather.

Stanley Druckenmiller isn’t just another name on that list. He’s the guy who once stepped out of Nvidia too early, leaving millions behind like loose change in a parking lot. It stung him, sure, but he’s not the type to let regret keep him down. No, when Druckenmiller saw the artificial intelligence boom coming, he didn’t chase the obvious names like Nvidia or AMD. Instead, he went straight for the jugular: Taiwan Semiconductor Manufacturing (TSM).

In Q2, Duquesne Family Office upped its stake in TSM by 28%. That brings their total exposure to around 765,000 shares. A move like that doesn’t come from guesswork-it comes from seeing something others don’t. So what does Druckenmiller see? Let’s peel back the layers.

Taiwan Semi: Silent, Deadly, Unstoppable

TSMC doesn’t make headlines the way Nvidia does. It doesn’t have the swagger of Advanced Micro Devices or the glitz of Broadcom. But it doesn’t need them. This company owns 68% of the global foundry market, operating like a shadow government for chip manufacturing. Samsung and Intel try to catch up, but it’s like watching two kids chasing a freight train.

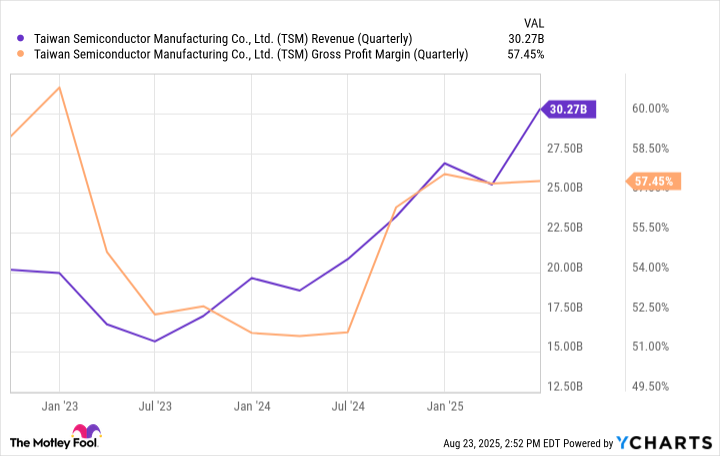

Momentum Like a Freight Train

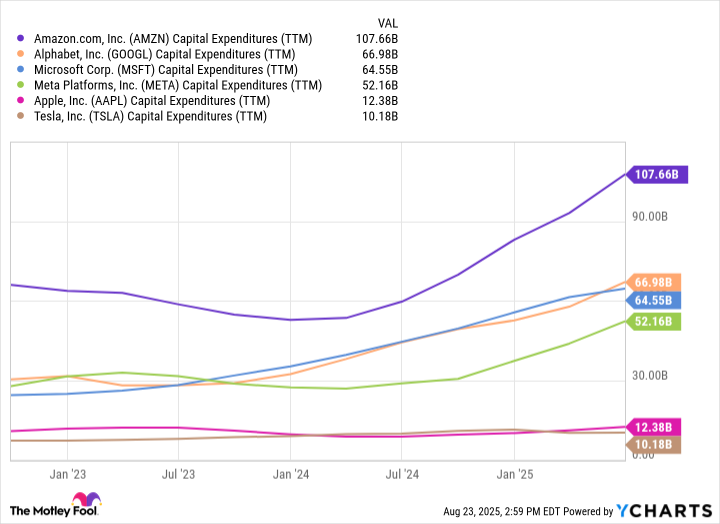

You might think TSMC’s growth story has peaked. You’d be wrong. Enterprise spending on AI infrastructure is exploding faster than a cheap suitcase full of TNT. Amazon, Alphabet, Microsoft-they’re all throwing billions at GPUs and networking gear for next-gen data centers. Even Meta Platforms, Apple, and Tesla are piling in, each trying to outspend the other in robotics, autonomous driving, and consumer tech.

All those shiny GPUs? They’re made possible because TSMC exists. Nvidia and AMD get the applause, but TSMC gets the checks. In many ways, buying TSMC stock is like betting on the stagehands while everyone else cheers for the actors. And sometimes, the stagehands are the ones holding up the whole damn show.

Is TSMC Stock Worth Your Money?

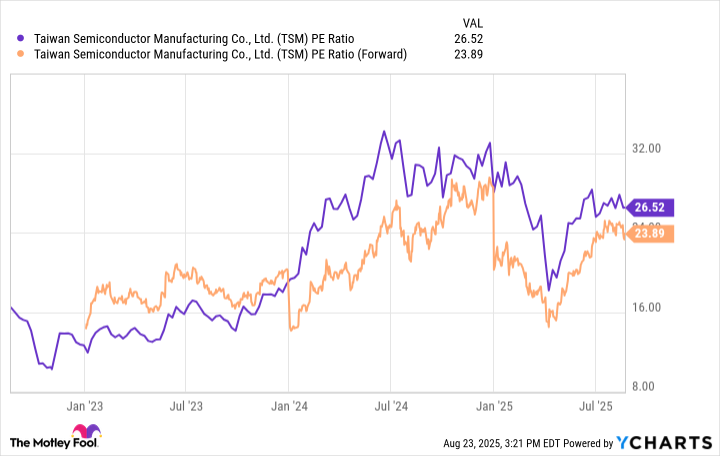

Valuing TSMC isn’t as simple as running numbers through a spreadsheet. Sure, its P/E ratio looks lofty compared to some peers. But dig deeper, and the cracks start to look more like opportunities. The company trades at a PEG ratio below 1, suggesting it might actually be undervalued against its future growth potential. For savvy investors like Druckenmiller, this is catnip-a chance to buy tomorrow’s profits at today’s prices.

For long-term players, TSMC is the kind of stock you tuck away and forget about-until one day, you realize it’s quietly turned your portfolio into a fortress. It won’t grab headlines, but it will build wealth. And in this game, wealth is the only headline that matters. 🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Best Actors Who Have Played Hamlet, Ranked

- 9 Video Games That Reshaped Our Moral Lens

2025-08-26 18:10