In the vast and shifting landscape of human endeavor, few forces have proven as transformative as the march of artificial intelligence. Among the many realms it touches, the domain of cybersecurity stands as a battleground where the fate of digital civilization may yet be decided. Here, the company now known as Palo Alto Networks has carved its place, not through brute force, but through the quiet alchemy of innovation and foresight.

The numbers, though cold, speak of a trajectory as inevitable as the turning of the seasons. Grand View Research, that arbiter of market tides, forecasts a surge in AI adoption within cybersecurity, a crescendo of growth that will swell the industry’s coffers by nearly $70 billion. Yet within this grand design, one name has faltered-a shadow in the light of its peers. The shares of Palo Alto Networks, though modestly up by 6% over the past year, have not yet danced to the rhythm of the market’s capricious whims.

Yet let us not mistake this for a tale of failure. For within the company’s corridors, a quiet revolution brews. The integration of AI into its platforms has begun to bear fruit, a seed planted in fertile soil. The CEO, Nikesh Arora, speaks of this transformation with the gravity of a prophet, his words a testament to the urgency of the age. “Adoption of GenAI is happening faster than any previous technology trend,” he declares, as if the very fabric of progress hinges on his pronouncement.

AI is driving solid growth in Palo Alto Networks’ future revenue pipeline

When Palo Alto unveiled its fiscal 2025 fourth-quarter results, the numbers were not merely figures but a narrative of resilience. Revenue rose 16% to $2.5 billion, while adjusted earnings surged 27%. Yet it was the remaining performance obligations (RPO) that captured the eye-a 24% leap to $15.8 billion. This metric, a barometer of future promise, suggests that the company is not merely surviving but laying the groundwork for a future where its influence will be felt in every corner of the digital world.

The role of AI in this endeavor is both profound and perilous. It is a tool that can shield the innocent from the machinations of the wicked, yet it is also a double-edged sword, capable of amplifying the very threats it seeks to vanquish. The CEO’s remarks on the 890% spike in GenAI traffic and the doubling of data security incidents underscore this duality. In the hands of the wise, AI is a shield; in the hands of the reckless, a weapon.

Palo Alto’s acquisition of Protect AI, a $500 million venture, is a masterstroke of strategy. This move, like a well-placed pawn in a game of chess, positions the company to dominate the emerging landscape of AI-driven security. The Prisma AIRS platform, introduced in April, is no mere product but a manifesto-a declaration that the future of cybersecurity lies in the seamless integration of human ingenuity and machine intelligence.

The company’s platformization strategy, a tripartite division into network, cloud, and AI-driven security, is a testament to its vision. By bundling its offerings, Palo Alto not only simplifies the complex but also creates a fortress of value for its customers. The 40% year-over-year increase in platformizations to 1,400 customers among its top 5,000 accounts is not merely a statistic but a harbinger of a new era.

The proposed acquisition of CyberArk, a $25 billion endeavor, further cements Palo Alto’s dominance. With its 8 million end users and presence in half of the Fortune 500, CyberArk is not merely a company but a titan of the digital age. Together, these entities may yet redefine the boundaries of cybersecurity, their combined strength a bulwark against the ever-evolving threats of the digital frontier.

Yet let us not romanticize this pursuit. The moral and philosophical questions that loom over AI are as pressing as the technical challenges. Is this technology a force for good, or does it, like all tools, reflect the virtues and vices of its creators? The answer, as with all great mysteries, lies not in the machine but in the human soul.

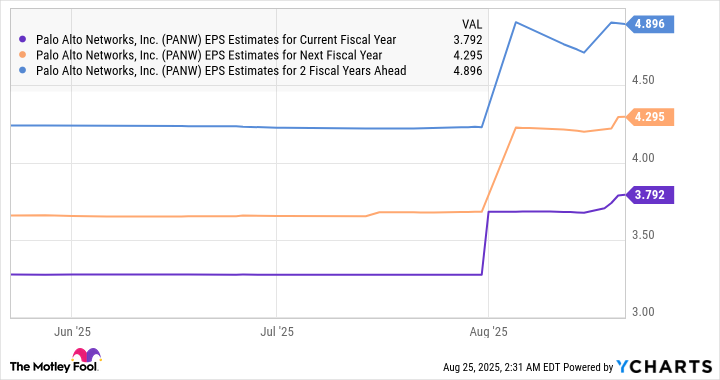

The stock’s performance should improve

For the investor, the path ahead is one of both promise and peril. The 12-month median price target of $220, a 18% ascent from current levels, is but a whisper of the potential that lies ahead. Yet in the world of finance, as in life, the true measure of success is not in the numbers but in the journey itself.

Investors who dare to look beyond the surface may yet find in Palo Alto Networks a beacon of hope-a company that, like the great empires of old, seeks not merely to endure but to thrive. Its story is not one of mere profit but of progress, a testament to the enduring human spirit in the face of an uncertain future.

And so, as the sun sets on this chapter, we are left to ponder: Will Palo Alto Networks rise to its destiny, or will it falter beneath the weight of its own ambition? The answer, like the market itself, remains a mystery-yet one that the discerning investor may yet uncover.

🧠

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2025-08-26 11:16