Palantir (PLTR) stock fell again on Monday, closing down 1% after dipping as much as 5.9% earlier. The S&P 500 (^GSPC) declined 0.4%, and the Nasdaq Composite (^IXIC) dropped 0.2%. No major news linked to Palantir’s decline, but broader market weakness likely played a role. The stock is now 10% lower over the past week and 16% below its all-time high.

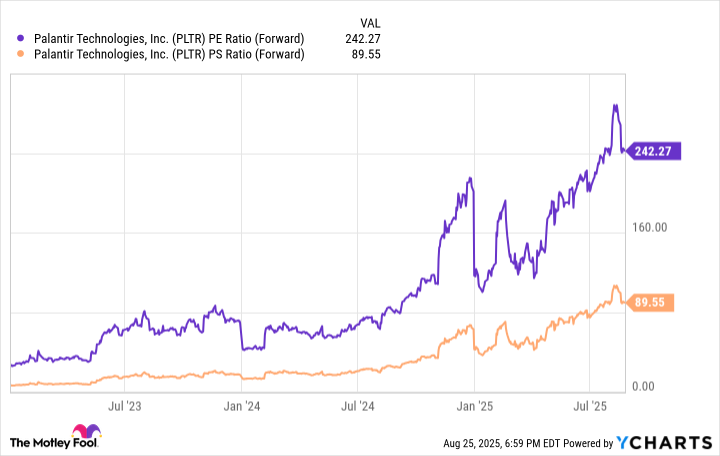

Palantir remains a prominent name in artificial intelligence software, with robust sales growth and earnings momentum. Yet its valuation-90 times this year’s expected sales and 242 times expected non-GAAP earnings-marks it as an outlier. Even after recent losses, the stock has risen 108% this year and 1,840% over three years. Such gains reflect high expectations, but also extreme vulnerability to market shifts.

Investors wary of macroeconomic risks or skepticism about AI’s practical applications may find Palantir’s trajectory unappealing. Its reliance on speculative growth makes it a gamble, not a steady bet. While its defense sector ties offer some resilience, the stock’s current price reflects optimism that may not be justified. For those seeking stability, Palantir appears overreached.

Still, the company’s momentum in private-sector contracts suggests potential for long-term gains. Yet the question remains: is this a prudent investment, or a bet on a future that may never arrive? The answer depends on one’s tolerance for risk-and the willingness to accept that even the most promising ventures can falter.

🪙

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-26 03:03