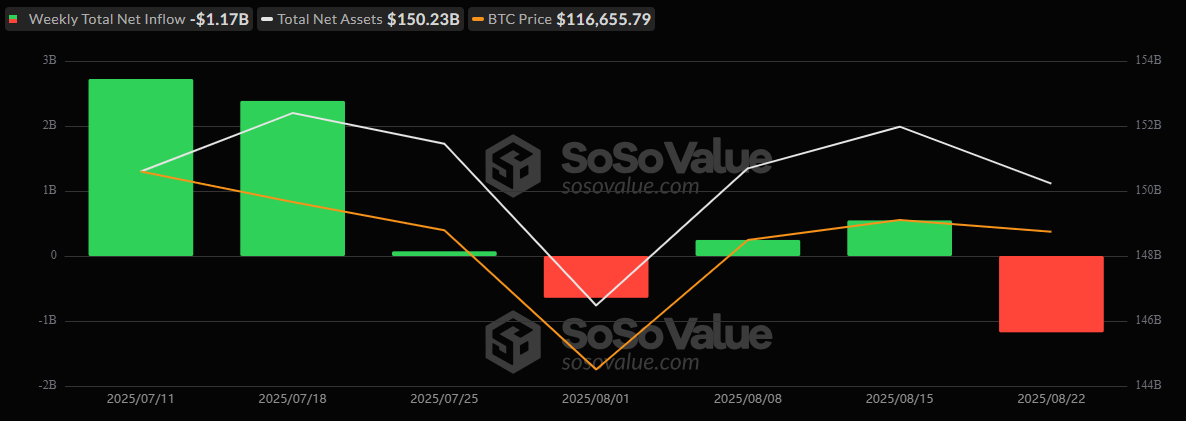

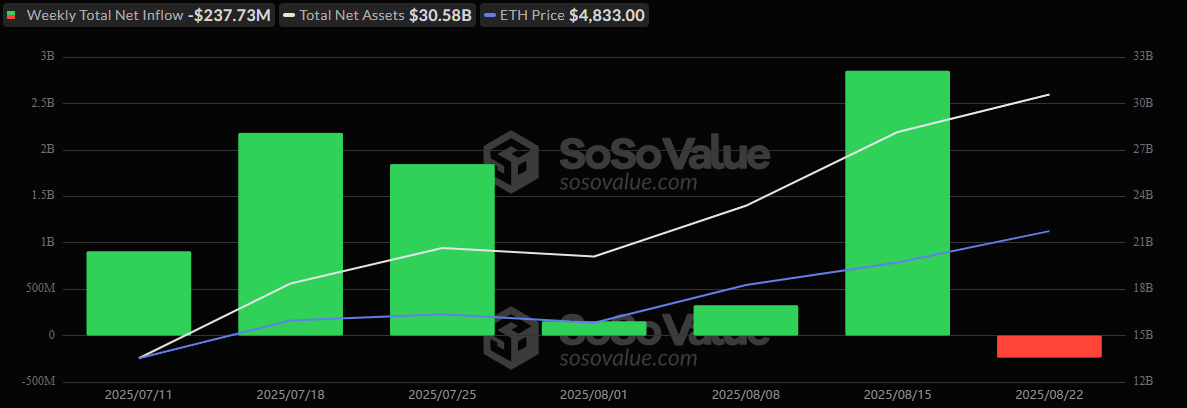

Looks like the big boys of crypto decided to have a bad week. Bitcoin ETFs, that glamorous show of wallets and dreams, took a nosedive, bleeding out a hefty $1.17 billion. Meanwhile, ether ETFs, the loyal understudy, finally bowed out after a staggering 14-week marathon of inflows, vanishing with $238 million like a ghost at dawn. Even with midweek cheer, heavy early exits set the tone-it’s a classic case of ‘get your popcorn ready’ but not in the way you wanted.

ETF Shake-up: Bitcoin Funds Post Second-Highest Weekly Loss While Ether Snaps Record Inflow Run

The tide? Oh, the tide turned with the grace of a drunken sailor. After nearly three months of steady gains, ether ETFs, the good old reliable, finally turned red. Bitcoin funds? They went full hemorrhage mode, spilling their guts in the form of a record-setting $1.17 billion exit. Yes, every single day of that week closed with red ink, like a bad painting. Tuesday was the real kicker, with a heartbreakingly dramatic $523.31 million yanked out in one gulp-like stealing the last slice of pizza.

The bloodshed didn’t stop there. By Friday, Bitcoin was on a six-day losing streak-hard to believe, I know. Investors looked as wary as a cat in a room full of rocking chairs, even with trading volumes that could make a whale blush.

Ether ETFs – poor things – weren’t spared either. Tuesday’s $429.73 million outflow kicked their week off with the subtlety of a slap. Their attempts at a comeback on Thursday and Friday were like trying to patch a leaky boat with duct tape: cute but ultimately futile. By week’s end, ether ETFs had surrendered another $237.73 million, ending their 14-week streak of inflows like a sitcom that’s finally canceled.

Fund-by-Fund Weekly Flows

The bloodbath was led by Blackrock’s IBIT, which hemorrhaged a staggering $615.02 million-probably planning its getaway. Fidelity’s FBTC dropped $235.24 million, Ark’s ARKB was not spared with $182.37 million, Grayscale’s GBTC bled out $118.09 million, and Bitwise’s BITB coughed up $60.78 million. Grayscale’s Bitcoin Mini Trust bowed out with $2.55 million lighter, like losing pennies in a fountain.

Meanwhile, the brave few-supporters who still believe-Vaneck’s HODL managed to add $26.41 million, and Franklin’s EZBC chipped in with $13.49 million, but it was like trying to put out a fire with a garden hose. By the week’s end, Bitcoin ETFs’ net assets shrank from a mighty $153.43 billion to a not-so-mighty $150.23 billion-ouch, someone call the financial therapist.

Ether’s story? Picture a slo-mo movie where the villain-Grayscale’s ETHE-stole the show with an $88.97 million exit. Fidelity’s FETH joined the party in the sad caravan with $79.65 million out. Even the tiny Ether Mini Trust lost $50.42 million, making it look like even the coins were crying. But hold on-just when you thought it got worse, Bitwise’s ETHW sneaked in with a modest +$2.52 million, and Vaneck’s ETHV tagged along with a $1.91 million boost. Trading? Oh, that was on fire! Friday, August 22, saw a record $7 billion dancing across screens in a single day-talk about a financial firework show.

The pattern? Clear as a cracked mirror. Bitcoin outflows were broad, heavy, and dominated by Blackrock’s IBIT, which alone shed over half a billion. Ether’s stumble was smaller, cushioned somewhat by tiny inflows from Bitwise and Vaneck, like a paper towel attempting to mop a flood.

With these wild swings, the coming week promises more excitement, or at least a fresh round of despair. Will money flow back again? Or are we in for another week of ‘what just happened’ moments? Stay tuned, because the crypto rollercoaster isn’t done yet-grab your snacks.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2025-08-25 22:03