In the most recent span of thirty days, the realm of decentralized finance (DeFi) has concluded its affairs with a most impressive total value locked (TVL), a veritable sea of green flourishing across the leading chains, and trading activities concentrated upon a select few decentralized exchange (DEX) venues, as if they were the belle of the ball.

From Swap to Tsunami

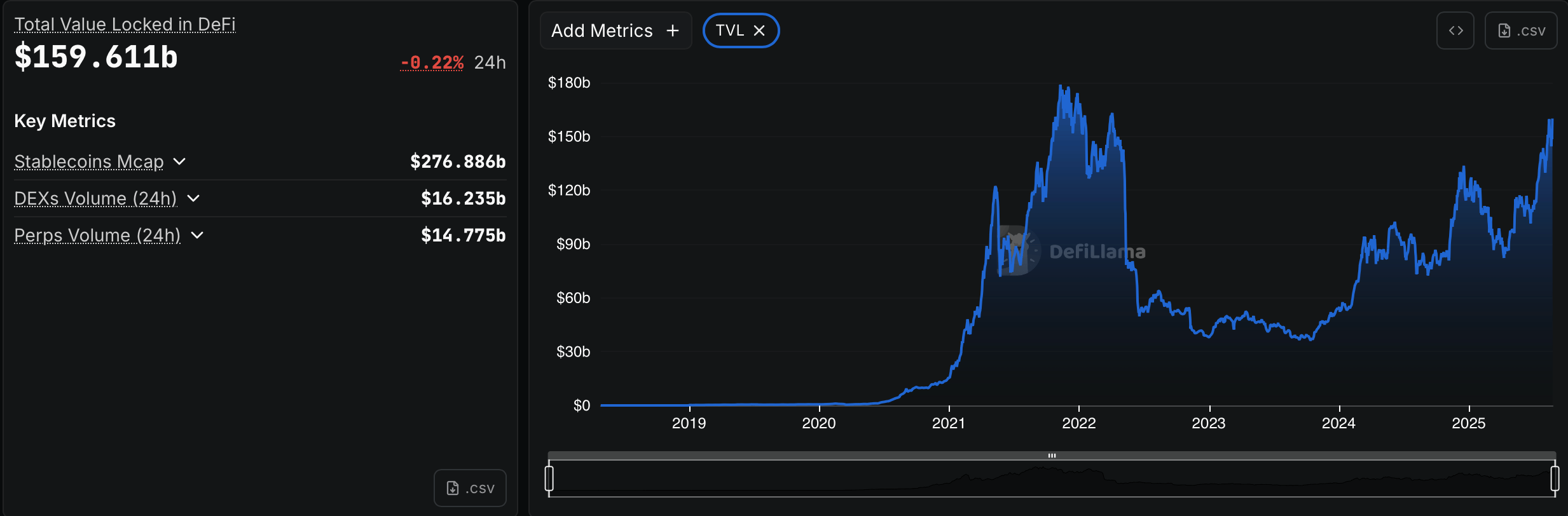

In this past month, the aggregate DeFi TVL has reached a staggering $159.6 billion. This figure is most consistent with Ethereum’s own $96.697 billion, which constitutes a rather impressive 60.57% of the sector’s TVL, suggesting a marketwide figure of approximately $159.6 billion when one extrapolates from the most reputable defillama.com stats. Quite the mathematical feat, I must say!

Month-over-month, the leading chains have all posted gains: Ethereum +18.62%, Solana +14.01%, Bitcoin +14.16%, Binance Smart Chain +12.13%, and Tron +12.79%. In terms of absolute dollars, the leaders have been Ethereum at $96.697 billion, Solana at $11.307 billion, Bitcoin at $7.921 billion, BSC at $7.59 billion, and Tron at $6.545 billion. One might say, it is a most competitive affair!

Solana

boasts 2.39 million, Tron 2.49 million, and BSC 2.07 million, whilst Ethereum languishes with a mere 505,081 active addresses. The divergence between address counts and TVL highlights a rather amusing split between large-balance settlements on Ethereum and the higher-frequency transactional activities on

Solana

, Tron, and BSC. Quite the social gathering, indeed!

Shorter-interval snapshots reveal a steady near-term activity as well, with one-day and seven-day changes generally positive across the larger networks, even if individual days feature some rather unfortunate red prints for certain chains. As far as DeFi protocols are concerned, the TVL leaderboard is familiar yet not static. Lido, categorized as liquid staking, leads the pack at $41.958 billion after a 27.27% rise over the past 30 days. Aave, the grand lending market spanning many chains, follows closely at $40.3 billion with a 22.69% monthly gain. One might say, the competition is quite spirited!

Eigenlayer, the restaking platform, claims the third position at $22.434 billion, up 25.72% in a month. Rounding out the top six are Binance Staked ETH at $15.799 billion (+44.43%), Ether.fi at $12.428 billion (+24.40%), and Ethena at $12.204 billion (+65.61%), the strongest 30-day percentage increase among the top dozen. A most impressive display of growth, if I may say so!

Further down the list, Pendle (yield) holds $10.285 billion after a remarkable 61.15% monthly climb, Spark sits at $8.446 billion (+4.03%), Morpho (lending) is at $7.066 billion (+20.23%), Sky is at $6.316 billion (+9.51%), Uniswap is at $6.26 billion (+12.39%), and Bitcoin’s Babylon Protocol (restaking) is at $6.145 billion (+19.35%). Liquid staking, lending, and restaking continue to define the bulk of locked collateral, whilst yield platforms add incremental heft during these risk-on phases. A delightful dance of numbers!

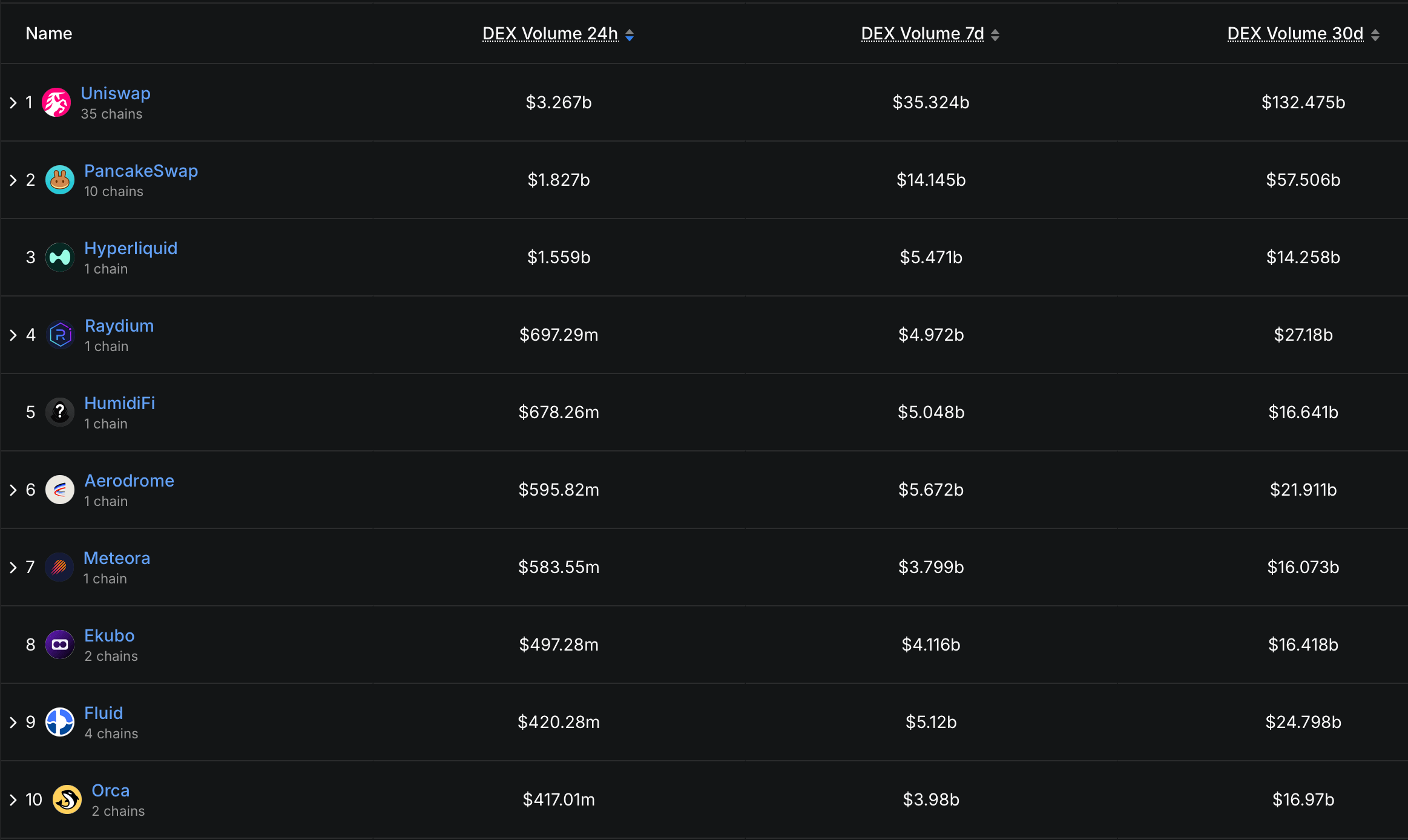

The DEX action carries the month’s most telling number: across the top 30 platforms, 30-day trading volumes sum to a staggering $425.139 billion. Uniswap reigns supreme with $132.475 billion in 30-day volume, capturing roughly 31% of the top-30 turnover. Pancakeswap ranks second at $57.506 billion, equal to about 13.5% of the top-30 total. Hyperliquid posts $14.258 billion, and Raydium on Solana is around $27.18 billion. Quite the impressive display of prowess!

Statistics further reveal that HumidiFi is at $16.641 billion, Aerodrome at $21.911 billion, Meteora at $16.073 billion, Ekubo at $16.418 billion, Fluid at $24.798 billion, and Orca at $16.97 billion. Together, the top five DEX venues-Uniswap, Pancakeswap, Hyperliquid, Raydium, and HumidiFi-clear a remarkable $248.06 billion, or about 58.35% of the 30-day total across the top 30 DEX platforms shown on defillama.com. A most impressive feat, indeed!

Uniswap’s lead reflects its multichain coverage (35 chains) and deep liquidity in core pairs. Pancakeswap anchors BSC spot flow and spans 10 chains. On Solana, Raydium, Meteora, and Orca jointly account for roughly $60.22 billion in 30-day activity, a material slice of the month’s trading that helps define Solana’s on-chain order flow during this window. A most delightful arrangement!

Shorter-interval figures align with the month’s distribution and provide helpful color. Uniswap shows $35.324 billion over seven days and $3.267 billion over 24 hours, whilst Pancakeswap shows $14.145 billion and $1.827 billion, and Raydium shows $4.972 billion and $697.29 million, respectively. Quite the bustling marketplace!

Protocol momentum over the month favors a select few names. Ethena’s 65.61% TVL increase leads the pack among the top dozen, followed by Pendle’s 61.15% rise and Binance Staked ETH at 44.43%. The larger incumbents advanced at a steadier pace-Lido up 27.27%, Aave 22.69%, and Eigenlayer 25.72%-extending gains that reflect ongoing demand for staking, restaking, and over-collateralized lending. A most intriguing development!

Uniswap’s TVL gained 12.39% even as it dominated trading share, a pairing that points to stickier liquidity provision supporting monthlong volumes. DeFi’s 30-day run reads as consolidation rather than frenzy: capital gravitated to a few DEXs while staking-driven collateral deepened Ethereum’s anchor role. If these trends persist, liquidity and execution routes may harden, and challengers will need advantages to redraw share. A most curious turn of events!

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-08-25 18:24