Last May marked Shopify’s (SHOP) tenth birthday since its public debut. The company’s e-commerce platform, once a niche tool, now sits at the heart of a global shift in commerce. Its appeal-simplicity, speed, and a sprawling ecosystem-has drawn merchants away from obscurity and toward the digital frontier.

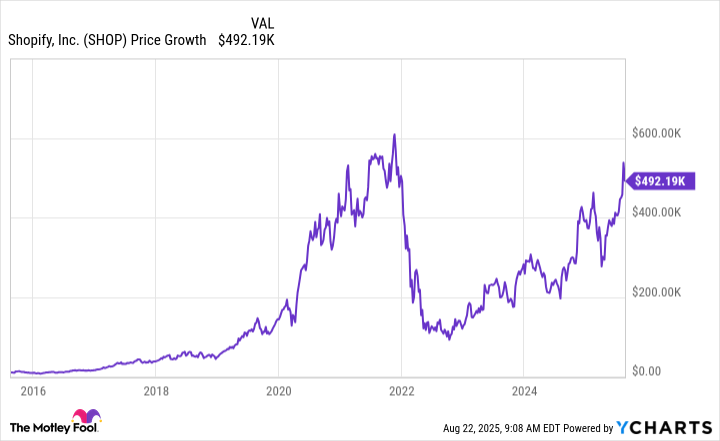

For those who bet early, the rewards have been stark. A $10,000 stake purchased near the IPO would now command just over $492,000. Such figures are not mere alchemy; they reflect a business that understood the pulse of its time.

Shopify over the last 10 years

A decade ago, $10,000 bought a gamble. Today, it buys a stake in a company that has reshaped how goods change hands.

Shopify’s advantage was never obvious. At first glance, its moat seemed paper-thin. Merchants could turn to Amazon or build their own sites. Yet Shopify offered something sharper: a no-code toolkit that bypassed the need for coders and a platform swift enough to avoid the fatal sin of slow load times. Its ecosystem, now studded with AI tools and third-party services, became a flywheel of its own making.

The path was not smooth. The 2022 slump, fueled by post-pandemic normalcy and a botched foray into fulfillment, exposed cracks. Shareholders who once cheered its meteoric rise now questioned its arithmetic. But resilience, not perfection, defines enduring businesses.

Today, Shopify dominates U.S. e-commerce and claims a corner of a market expected to balloon to $83 trillion by 2030. Its gross merchandise volume, up 26% year-over-year to $327 billion, hints at untapped potential. For a growth investor, the math is inescapable: even a small slice of such growth translates to outsized returns.

Yet clarity demands caution. Markets reward the visible, but the future belongs to the adaptable. Shopify’s decade is a case study-not in infallibility, but in the quiet power of solving real problems with relentless focus. 🚀

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2025-08-25 16:56