Ah, Target, that most enigmatic of retailers, has been languishing while its peers, notably the ever-reliable Walmart, have been performing with the poise of a well-rehearsed troupe. Investors, ever the dramatists, have grown alarmed, sending the stock into a most theatrical decline. Yet, for those with a taste for contrarian theatrics, here are three reasons to consider buying Target stock with the fervor of a man chasing a ghost.

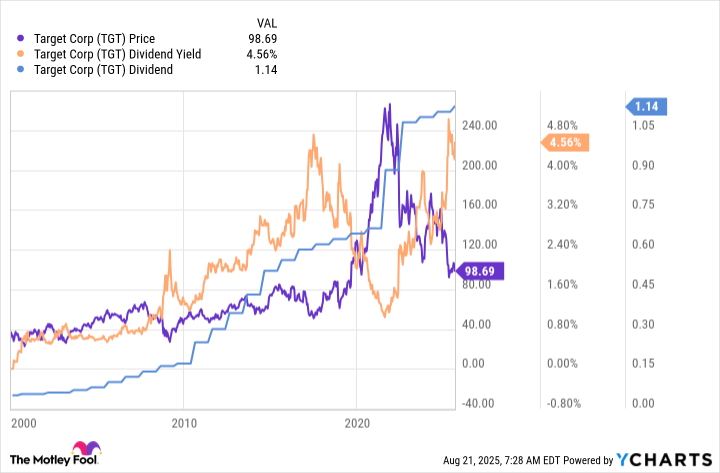

First, the dividend yield-4.2%-a figure that would make even the most jaded investor swoon. Compare this to the S&P 500’s meagre 1.2%, and one might conclude that Target has been placed on the sale rack with the flair of a seasoned shopkeeper. Traditional metrics, too, suggest a bargain: price-to-sales, price-to-earnings, and price-to-book ratios all languish below their five-year averages. To be fair, the second quarter of 2025 saw sales and earnings dip, but let us not forget that even the most stately of empires have their off-years.

2. Target is a Dividend King

Target’s dividend has been increased annually for 58 years, a record that would make even the most stoic boardroom blush. A Dividend King, indeed-a title reserved for the elite. Its streak outpaces Walmart’s by six years, a fact that might inspire a touch of envy among its rivals. One might argue that such consistency is not mere luck, but the result of a business model as polished as a well-trodden stage.

History, that most fickle of companions, has seen Target weather storms from the Great Recession to the pandemic. To dismiss its resilience is to ignore the very essence of capitalism. While others might flee, the contrarian might see opportunity-a stock that has survived the worst, now trading at a discount. Yet, as with all great plays, the final act remains unwritten.

3. The Board and Management is Making Tough Calls

Attractiveness alone is not enough. Target’s leadership, however, has embarked on a boardroom shake-up of the sort that would make a Shakespearean villain weep. The elimination of the chief strategy officer, replaced by a team of seasoned insiders, and the promotion of a veteran to CEO-such moves are as dramatic as they are necessary. Change, of course, is a slow dance, but one that well-run companies must eventually undertake.

Though the second-quarter results were less than stellar, there are hints of improvement: store traffic and sales trends have shown a flicker of life. A glimmer, perhaps, in the tunnel. Yet, as with all great turnarounds, patience is the investor’s greatest ally.

For the more daring, Target’s current woes may yet prove a golden opportunity. A dividend that sings, a history of resilience, and a board willing to gamble on change. It is, of course, a risk-but then, what is life without a touch of peril? As the board’s recent 1.8% dividend hike suggests, they believe the storm will pass. And who are we to argue with those who know the market better than we do?

🎯

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-25 14:17