as a growth investor, I know this isn’t just about shiny new tech toys-it’s about how these innovations are reshaping society. Cloud computing? Streaming? Automation? These aren’t trends; they’re tectonic shifts. And yet, as exciting as all this is, there’s a part of me-a very loud, anxious part-that keeps whispering, “Remember the dot-com bubble?” Because, friends, history doesn’t repeat itself, but it sure does rhyme.

Echoes of the Dot-Com Era?

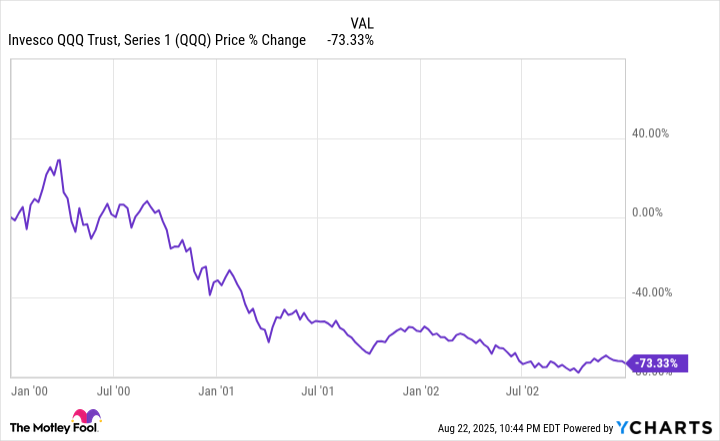

Oh, you thought we were done talking about the late ’90s? Think again. Right now, tech stocks are behaving in ways that feel eerily familiar to anyone who lived through the original internet gold rush. Back then, people were throwing money at anything with “.com” in the name, only to watch it all come crashing down in spectacular fashion. By the time the dust settled, the Nasdaq had dropped nearly 80% from its peak. Oof. It was like the financial equivalent of trying to explain Beanie Babies to your grandkids.

How Frothy Are Tech Stocks?

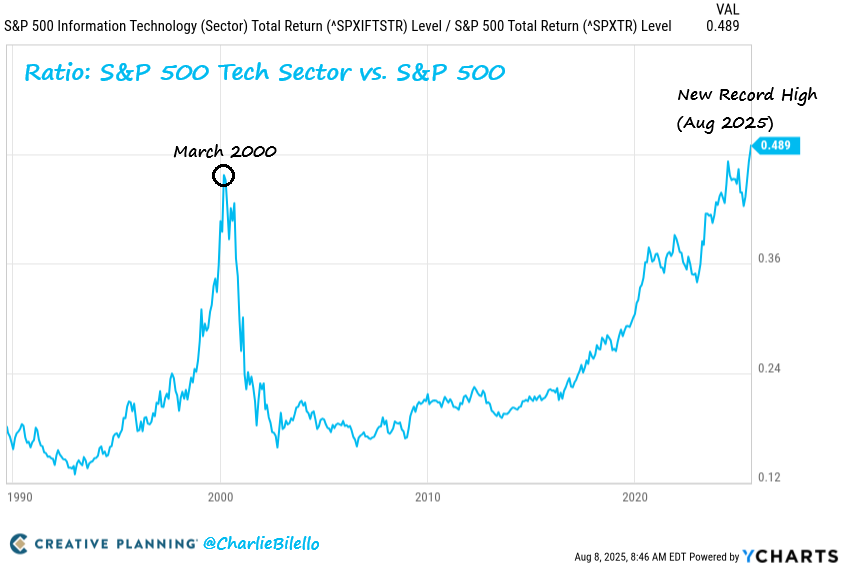

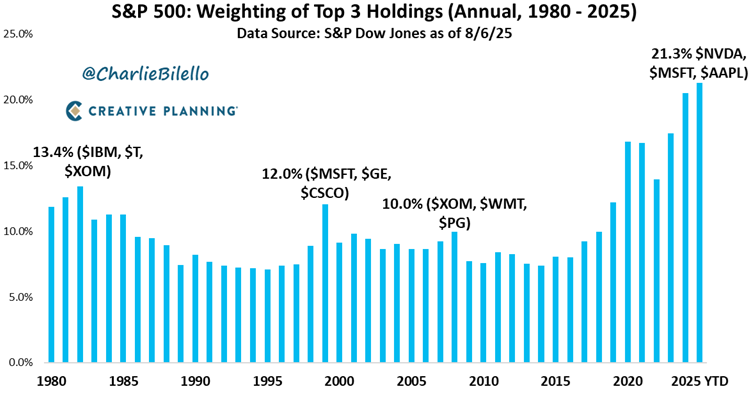

Let’s get real for a second. When Charlie Bilello, the Gandalf of market data, says tech stocks are outperforming even their dot-com-era selves, you sit up and take notice. Look at this chart:

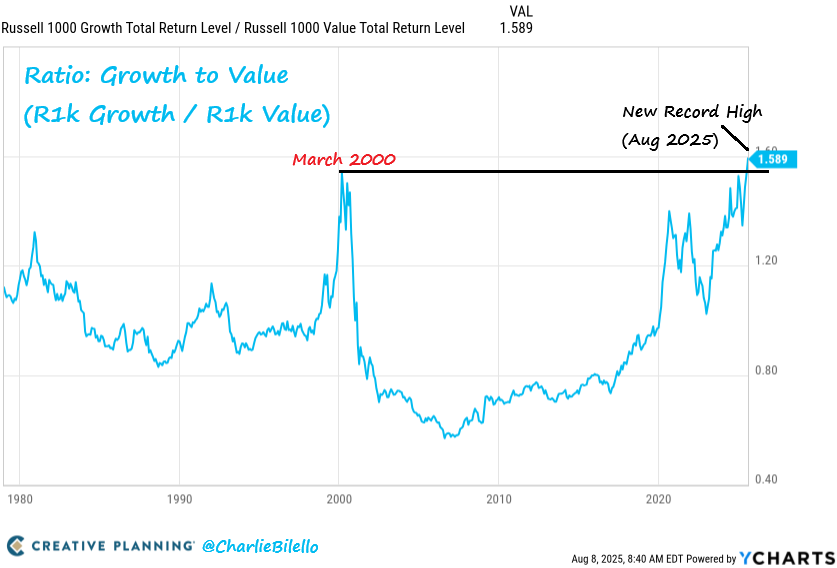

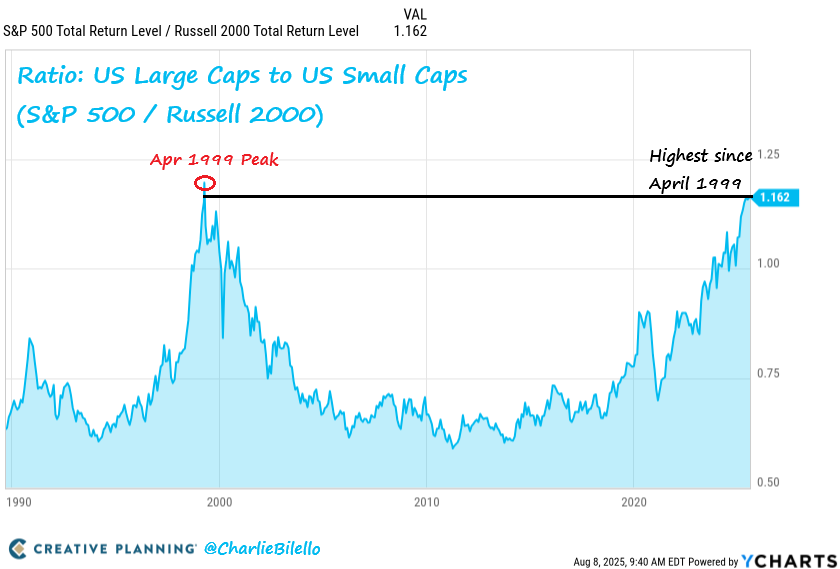

And it’s not just performance-it’s valuation. Large-cap tech stocks are dominating small caps, and growth stocks are leaving value stocks in the dust. Sound familiar? It should. This is the exact same playlist the market was jamming to before the dot-com crash. If the Nasdaq were a person, it would currently be wearing parachute pants and yelling, “Buy my IPO!”

Is It Time to Panic?

//media.ycharts.com/charts/28bf51c3b5c2523005e4620848e5e905.png”/>

Counterpoints to the Bubble Thesis

Before you start liquidating your portfolio and buying canned goods, consider this: today’s tech giants aren’t the fragile startups of yesteryear. Companies like Microsoft (MSFT) have diversified income streams, mountains of cash, and global reach. They’re less “bubble boy” and more “corner office with a view.” Plus, index concentration-where a handful of big names dominate the market-isn’t necessarily a red flag anymore. It might just be the new normal.

So maybe the Magnificent Seven aren’t an anomaly-they’re just the Avengers of the modern economy. Still, let’s not kid ourselves. Some of these valuations are stretched tighter than yoga pants on a juice cleanse.

What Investors Should Do Now

Here’s the deal: timing the market is harder than explaining TikTok to your Boomer parents. Peter Lynch once said, “Far more money has been lost by investors preparing for corrections than has been lost in corrections themselves.” Translation: don’t abandon your long-term plan because the market looks frothy. But if you need cash in the next year or two, maybe park it somewhere safer-like Treasury bills or under your mattress.

If you’re consistently investing, consider diversifying beyond tech. Small caps, non-tech sectors, and value stocks could use some love right now. And remember, the goal isn’t to predict the future-it’s to prepare for it. Or, as I like to say, invest like you’re planning a dinner party: balance the flashy dishes with some comfort food, and always leave room for dessert 🍰.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Top 15 Insanely Popular Android Games

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-08-25 01:44