Dividends don’t always beat the market. They’re more like a steady rain, not a storm. The higher the yield, the more likely the stock is a tired old dog, not a sprinting hare.

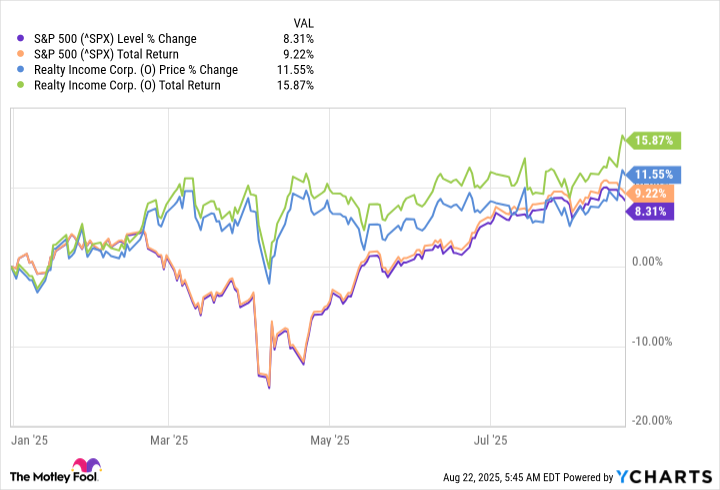

Realty Income (O) is a dividend dog with a pedigree. It’s been paying for 55 years, and it does it monthly. That’s more reliable than your local post office. Even when the real estate market is a disaster, it’s beating the market this year. So it goes.

Realty Income is a REIT, which is like a landlord with a stock ticker. It owns 15,600 properties and pays out 90% of its profits as dividends. That’s a lot of rent money. But high interest rates are a storm. Realty Income’s stock is a boat that’s weathered the storm, though it’s still a bit leaky.

The economy is a stubborn old man, but he’s starting to smile. Realty Income’s adjusted funds from operations are a heartbeat-slightly slower than last year, but the doctor says it’s stable. Investors are like kids at a carnival, reaching for the prizes they think are still there.

Realty Income leases to 1,600 tenants, each a tiny star in a vast galaxy. It’s like a librarian with a thousand books, each story different, but all in the same building. Its top tenants are 7-Eleven, Dollar General, and Walgreens. But it’s branching out, like a tree trying to grow in concrete.

The addressable market is $22 trillion. That’s enough to make a squirrel dizzy. Management says it can keep buying properties, but only if the interest rates stop acting like a fickle lover. So far, it’s managed to avoid bankruptcy. So it goes.

Realty Income’s dividend yields 5.4%, which is more than three times the S&P 500 average. That’s like getting a free coffee every day. It’s not flashy, but it’s reliable. Long-term investors might call it a “safe bet.” Activist investors might call it a “sleeping giant.” So it goes.

If interest rates drop, Realty Income could climb again. Until then, it’s just a steady step. So it goes. 📈

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ETH PREDICTION. ETH cryptocurrency

- Why Nio Stock Skyrocketed Today

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Games That Faced Bans in Countries Over Political Themes

2025-08-25 01:03