The investing career of Warren Buffett (a man who could probably calculate the odds of a supernova hitting a black hole and still make it sound like folksy wisdom) has lasted so long that his retirement announcement at 95 feels less like a business decision and more like a cosmic joke about human longevity. For 60 years he’s turned Berkshire Hathaway (BRK.A) (BRK.B) into a financial Death Star, compounding returns at 19.9% annually since 1965 – which, if you’re bad at math like most sentient beings in the universe, means turning $10,000 into $55 million while the S&P 500 (SPX) merely coughs up $390,000. The lesson here is obvious: time is both your best friend and the universe’s favorite practical joker.

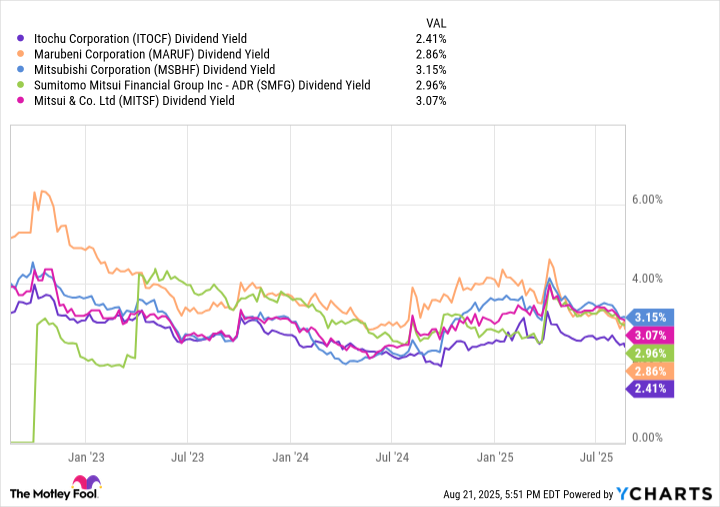

While the Oracle of Omaha’s portfolio includes obvious heavyweights like Apple and Coca-Cola (because even interstellar investors need their sugar fix), his lesser-known moves in Japan’s sogo shosha reveal a mind still hunting for cosmic bargains. These five Japanese trading houses – Itochu (ITOCF), Marubeni (MARUF), Mitsubishi (MSBHF), Mitsui (MITSF), and Sumitomo (SSUM.F) – operate across dimensions of industry from automotive to healthcare, yet trade at prices so low Buffett apparently mistook them for typographical errors in his spreadsheet.

In Berkshire’s 2024 letter (a document that reads like a financial Hitchhiker’s Guide to the Galaxy), Buffett noted these firms “reminded us that the universe is full of improbable things – like executives who prioritize shareholder value over yacht size.” Their dividend policies alone could make a U.S. CEO weep into their golden parachute: regular payouts, strategic buybacks, and compensation packages that wouldn’t shame a Quaker meeting. Berkshire’s current 2.7% stake in these companies might seem trivial (like worrying about a single atom in a black hole), but with Japan relaxing ownership limits, the conglomerate’s position could expand faster than the Big Bang itself.

The Stock That Screams ‘Abandon Ship!’

Meanwhile, Charter Communications (CHTR) is currently performing the financial equivalent of trying to sell ice to a supernova. Revenue growth flatlined at 0.6% (which even a hyper-intelligent pan-dimensional being would call “underwhelming”), cable revenue plummeted 9.9% (a decline so steep it makes the Mariana Trench look like a puddle), and their mobile division – the supposed knight in shining armor – contributes less to revenue than a hamster wheel does to a Formula 1 car. And let’s not mention the dividend situation (or lack thereof) unless we want to make value investors cry tears that could power a small moon.

In Buffett’s world, where shareholder rewards are as essential as oxygen to a human, Charter’s business model makes about as much sense as a solar-powered flashlight. While the Oracle’s $284 million stake might linger for now (like an awkward guest at a party), its absence from his final portfolio would be less surprising than discovering water is wet.

The Ultimate Takeaway

Follow the principles, not the myth. Buffett’s Japanese plays aren’t about exotic diversification – they’re about finding businesses where management treats shareholders like cherished relatives rather than disposable drones. As for Charter? It’s the universe’s way of reminding us that even legends occasionally trip over black holes. 📈

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- 39th Developer Notes: 2.5th Anniversary Update

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

2025-08-24 20:40