It is an idea as captivating as it is distant-a dream of humanity’s boundless reach. Everyone has heard of the revered Starlink, its name drifting like a whisper through the winds of the internet age. But what if I told you there exists another contender, quietly approaching the horizon, one that promises a more elegant answer to global satellite connectivity?

Enter AST SpaceMobile (ASTS), a fledgling company with ambitions as grand as its technology. With its sights set on delivering internet access directly to devices anywhere on Earth-without the cumbersome terminals that define its competitors-AST SpaceMobile is not merely stepping into the arena; it is redefining it. Over the past few years, its stock has mirrored this ascent, soaring from a modest $5 to a lofty $44.50 by August 20.

In the mid-summer heat of August 11, AST SpaceMobile unveiled a revelation to its investors-a promise to launch its service in the United States by 2025. From there, the vision expands, as a global network beckons on the horizon. But should one place faith in this soaring stock, or is it another echo of a market folly?

Satellite Internet, Unencumbered

Imagine, if you will, an array of satellites-each as vast as a small room-floating serenely in the heavens, tethered only to the world below by their delicate beams of connectivity. AST SpaceMobile has developed a system that promises to connect smartphones and other internet-enabled devices directly, bypassing the need for terrestrial wires, unwieldy terminals, or ground-based towers. In this, it stands as a stark contrast to the industry norms.

AST SpaceMobile has begun forging partnerships with telecommunications giants, including the well-known AT&T, positioning itself as an indispensable player in the global connectivity landscape. With 3 billion combined customers waiting in the wings, the potential market looms large-yet, the question remains: when will this great vision materialize?

According to its most recent earnings report, the company promises to enable satellite internet service in the United States in 2025. With anticipated revenues between $50 million and $75 million by year’s end, the company, currently with almost no revenue, has turned its eyes to the skies. As satellites gather like constellations in orbit, they are set to expand the service across Japan, the United Kingdom, and Canada, eventually encircling the globe.

The Investment Horizon: A Market of Infinite Promise

One must pause and consider the vastness of the opportunity. If AST SpaceMobile can capture even a fraction of the global market, it is not difficult to imagine revenues reaching into the tens of billions. A mere 100 million customers, each paying $10 per month, would yield an annual revenue of $12 billion-a sum so vast it might be mistaken for fantasy, were it not for the company’s ambition and the promise of its technology.

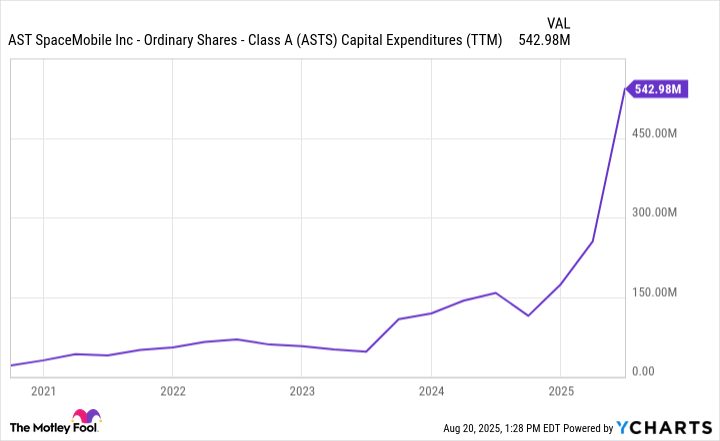

However, such a vision comes with the weight of significant investments-some $543 million spent in the past year alone, as the company labors to bring its satellite fleet to fruition. The upcoming quarters will demand further capital to hasten its expansion, and thus, AST SpaceMobile has wisely raised $575 million through a convertible debt offering, ensuring that it has ample liquidity to fulfill its ambitious plans.

Should One Place Their Faith in AST SpaceMobile?

Currently, AST SpaceMobile boasts a market capitalization of $16 billion-a figure that, when combined with the inevitable dilution from future fundraising efforts, could see it rise to $20 billion or beyond. This valuation seems a curious one, particularly for a company that has yet to prove its revenue-generating potential on a grand scale.

The question, then, is one of patience and faith. If the company succeeds in its mission, the revenue streams from tens of millions of customers would produce margins so high that they might evoke the poetry of some bygone era. However, this is not a risk-free endeavor. The company’s substantial capital expenditures may continue for years, even as it grapples with a market cap that has yet to justify its lofty aspirations.

Thus, while the allure of such a bold venture is undeniable, one must proceed with caution. A valuation of $20 billion might seem exorbitant for a company still in its infancy, its satellites but specks in the vastness of the sky. Yet, as with all great ventures, the potential for greatness lies hidden within the unseen, in the spaces where the future is imagined but not yet realized.

In the end, the decision rests upon a delicate balance of faith in the future and a recognition of the present’s uncertain reality. Perhaps one should wait, watch, and see how this dream of satellite connectivity unfolds, like a distant star slowly emerging from the night.

📈

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- TON PREDICTION. TON cryptocurrency

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Ray J Pushes Forward With Racketeering Accusations Against Kim Kardashian and Kris Jenner

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Elder Scrolls 6 Fans Got Excited When The Game Awards Showed Mountains

2025-08-24 16:37