Realty Income (O), aptly dubbed “The Monthly Dividend Company,” seems to have pirouetted into the spotlight with a bravado that would make even the most audacious charlatans blush. It beckons to the weary traveler of financial endeavors, offering a veritable treasure map to long-term income investors yearning for a steady hand upon the ship of dividends sailing toward the horizon of prosperity. Let us embark on an exploration of this appealing high-yield investment opportunity-a veritable oasis in the desert of market volatility.

What Curiosities Does Realty Income Present?

Realty Income, the maestro of net leases, holds a curious assortment of single-tenant properties, deftly ensnared under contracts that elevate tenants to the status of property-level custodians. One might wonder: what earthly delight would spur tenants to shoulder such burdens? Yet, therein lies the charm; they gain a semblance of dominion over their rented domains-a fair trade in the mercurial world of leases.

Often, a net lease occurs when a company relinquishes a property to Realty Income only to whisk it back into the fold under a long-term lease, orchestrated to include regular rent increases. This delicate dance allows sellers to liberate their funds, rekindling their zest for growth while Realty Income revels in its role as the financial benefactor, grasping the levers of income with a gentle but firm hand.

As the uncontested giant of its realm, Realty Income commands a market capitalization of $53 billion-nearly quadrupling its closest rival. With a staggering 15,600 properties in its possession, it derives approximately 75% of its rents from uniform retailers, making these assets reminiscent of a well-worn script, easily adapted for resale or repurposing. The remaining inventory comprises a blend of industrial properties and dazzling “other” entities, featuring the likes of data centers and casinos, for those with a penchant for the thrilling.

Moreover, Realty Income excels not merely in property type but in geographical dexterity. Unlike its net-lease compatriots, it has curiously set foot across the Atlantic, gently immersing itself in North American markets while flirting with opportunities in Europe. Management, ever hungry for growth, has locked eyes on offering elite services to institutional investors and dispensing debt financing to tenants-a well-calibrated strategy aimed at amplifying its avenues of expansion. Realty Income’s business acumen is as resilient as a well-tempered sword.

The Blessings and Curses of Grandeur

The sheer scale of such an enterprise is not without its challenges. A great lumbering giant, Realty Income requires immense investments in new properties to breathe life into its income statement. Hence, the company’s ventures into Europe-a land where net leases are still wearing their Sunday best-may appear bold, even foolhardy to some. Meanwhile, management’s flirtation with asset management services and debt financing can be likened to a clever juggler, desperately seeking to maintain a barrage of spinning plates.

However, let us not overlook the silver linings within this grandeur. Realty Income’s stature grants it an armory of resources in capital markets, bolstered by an investment-grade-rated balance sheet that would make even the most shrewd financier nod in approval. Its elevated position in the market’s hierarchy allows it to consider every pertinent deal that wafts into view, deftly snatching undertakings too daunting for smaller progeny.

It is this very context that nourishes a dividend cultivated through three decades of steadfast dedication. And oh, what a delightful narrative it weaves! Realty Income generously dispenses its dividends not quarterly, as one might expect, but monthly-transforming the humble notion of dividends into the closest semblance of a regular paycheck. Among the 30-year tradition of annual hikes, a remarkable quarterly streak now boasts 111 consecutive quarters-an impressive feat to tickle the fancies of dividend connoisseurs.

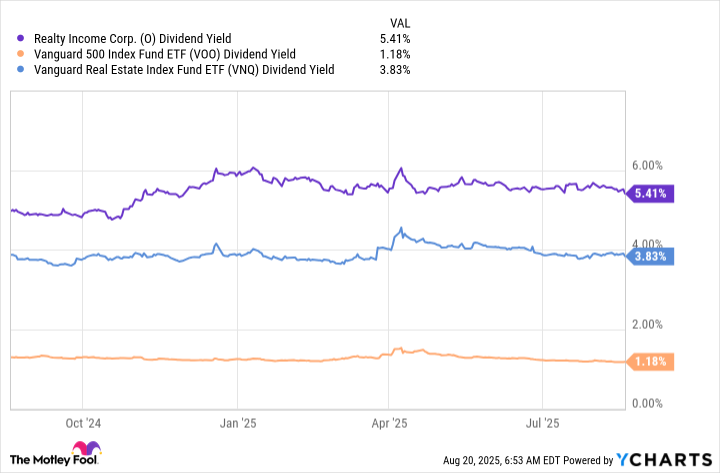

Now, infusing this magnificent narrative is a well-above-market yield of 5.4%, making Realty Income a veritable treasure chest for income-seeking investors wishing to secure a lifetime of dividends. So, steadfast investors, would you forgo the opportunity to add this multifaceted gem to your portfolio?

Realty Income: A Pillar of Stability and More

An investment in Realty Income not only rests upon a sound fiscal foundation but also erects a towering bastion for your portfolio. Envisage the possibilities-while those tempting growth stocks whisper promises of tomorrow, you can anchor your venture with the steady cadence of Realty Income’s yield. Therein lies the brilliance: a high-yielding leader sowing steadfast income, while you remain free to gallivant across the meadows of the stock market, seeking quicker growth with contrarian stocks. In the symphony of investments, Realty Income plays its melody with grace, and, dear reader, one must appreciate such artistry amidst the chaos of the market.

🎩

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- TON PREDICTION. TON cryptocurrency

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- Is Kalshi the New Polymarket? 🤔💡

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

2025-08-24 15:23