One might be forgiven for imagining the cruise ship sector a stately drawing room where all the fashionable chums gather to sip gin and debate the merits of different stock tickers. Yet curiously, amidst the clamor surrounding Carnival’s booming megaphone and Viking Holdings’ sprightly IPO waltz, Royal Caribbean (RCL) has been quietly rearranging the furniture like a butler with a penchant for practical jokes.

The share price, having doubled in twelve months with all the exuberance of a debutante at her first ball, now demands our attention. Let us peer through the looking glass at this nautical enterprise that seems determined to outpace its rivals while dodging economic tempests with the grace of a flamingo in a hurricane.

Royal Caribbean’s Market Positioning: The Art of Not Being First, But Still Being Splendid

Those with long memories may recall Jack Welch’s “number one or number two” doctrine – a theory so beloved by boardrooms it practically has its own zip code. By this logic, Royal Caribbean’s silver medal in the cruise Olympics should place it in fine fettle. With 27% of passengers under its striped awnings (per Cruise Market Watch), it trails only Carnival’s 41.5% like a gallant steed just behind the leader at Tattenham Corner.

While other industries fret about recessionary thunderclouds, Royal Caribbean’s cabins have been filling faster than a vicar’s collection plate on Sunday. The second quarter of 2025 saw occupancy reach 110% – a mathematical impossibility that would baffle Euclid himself, though apparently standard when two people per cabin becomes three with the addition of a particularly determined stowaway.

Ever the proactive host, the company has launched new ships with the regularity of a London bus schedule. This 5.8% capacity bump in Q2, coupled with plans for two more vessels, suggests management has taken to heart the old adage: “If you build it, they will come – preferably with sunscreen and a thirst for piña coladas.”

Royal Caribbean’s Financial Condition: Debt, Discounts, and Dashing Profits

With demand at fever pitch, the need for discounting has evaporated quicker than a martini in the hands of Bertie Wooster. First-half revenue of $8.5 billion represents a 9% climb year-over-year, while net income vaulted from $1.2 billion to $1.9 billion like a springbok startled by a leopard.

Of course, there’s the small matter of that $19 billion debt – a figure that makes one’s eyes water like a particularly aggressive onion. But let us not forget this is a vast improvement from the $24 billion albatross of 2022. The pandemic, that pestilential interloper, forced the industry into borrowing binges that would make a Regency dandy blush. Yet Royal Caribbean has managed this burden with the aplomb of a valet packing a wardrobe for a world tour.

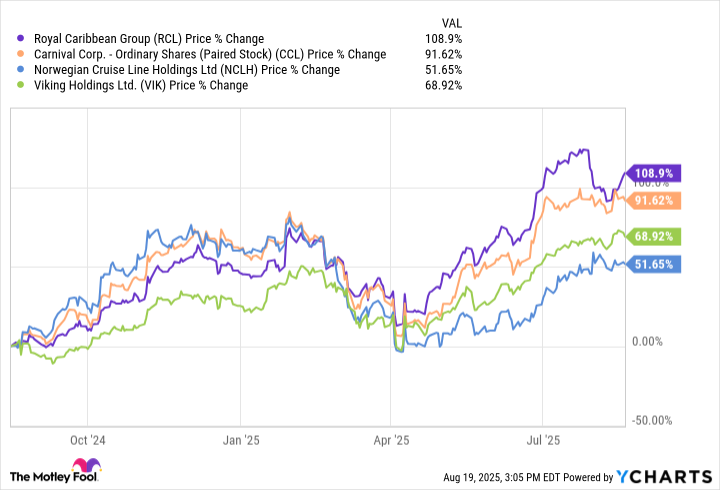

Investors, ever the fickle creatures, have taken notice. The stock has outperformed peers with the enthusiasm of a puppy chasing a squirrel, though its P/E ratio of 24 might give pause. But compared to the S&P 500’s average 30, it’s positively thrifty – like buying a Rolls-Royce at a Morris Minor price.

Moving Forward: A Cruise Through Rosy Possibilities

For those considering dipping a toe in these nautical waters, Royal Caribbean offers a compelling cocktail. It maintains the debt-reduction discipline of a monk, the demand-generation powers of a magician, and the capacity expansion plans of a particularly ambitious wedding planner.

True, the company carries more debt than a Shakespearean tragedy’s third act. Yet with 100%+ occupancy rates and ships launching faster than champagne corks at a society wedding, it seems the captain has both chart and compass firmly in hand. This virtuous cycle of profit, stock appreciation, and balance sheet improvement spins with all the elegance of a perfectly mixed gin fizz.

So while Carnival plays the barker and Viking waves its IPO banner, Royal Caribbean quietly polishes its brass fittings and books full cabins. For the discerning investor – that rare creature who enjoys both growth and dividends with their morning tea – this stock might just prove the jewel in the crown. 🚢

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

2025-08-24 11:18