AGNC Investment (AGNC) – it’s like that tantalizing dessert on the menu that you order thinking, “This is going to be life-changing,” and it ends up being just a lump of cake that doesn’t even taste like cake. Sure, it dangles a mouth-watering monthly dividend yield of nearly 15%, which is a staggering 10 times the piddling 1.2% from the S&P 500 (^GSPC). In theory, you double your money every five years! Who wouldn’t be enticed?

Imagine investing $10,000 and 30 years later, poof! More than $633,000. And an annual dividend income that would allow you to sip piña coladas on a beach, raking in over $92,000 a year just from the dividends. Sounds fantastic, right? But hold your horses. Reality check: The odds of nabbing those kinds of returns? Slimmer than a slice of supermarket pizza. Let’s dissect this mess.

A not-so-lucrative dream

AGNC Investment operates as a real estate investment trust (REIT) that snuggles up to residential mortgage-backed securities (MBS), all wrapped in a government-protected security blanket courtesy of Freddie Mac and Fannie Mae. These mortgage pools are supposed to be “lower risk,” with fixed income yields slightly above what you’d find in a savings account. But let’s keep our expectations grounded.

Now, AGNC likes to play the leverage game, using repurchase agreements to pile up more MBS. Sure, it sounds fancy-earning returns close to 19% on new investments. But when you need to keep your cash flow chugging along smoothly for the monster dividend, it’s like trying to make a soufflé without a proper oven. All depends on the heat, which in this case, is your cost of capital.

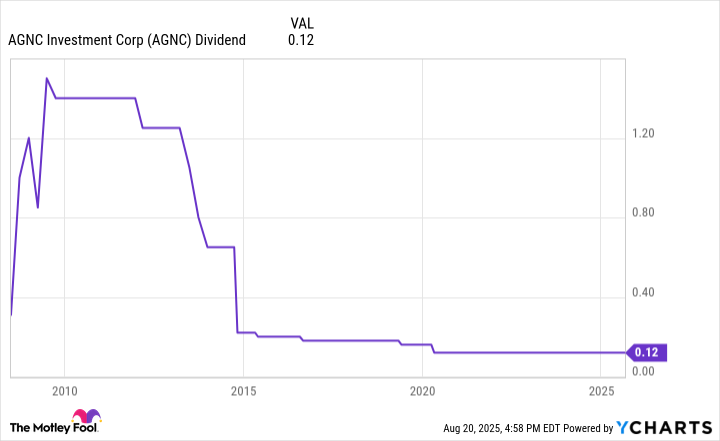

AGNC has done a commendable juggling act, maintaining that hefty dividend for over five years despite interest rate fiascos. But if you think it’s all sunshine and rainbows, think again. Eventually, you have to confront the reality of the circus that is financial markets.

The sticky nuances of risk

AGNC employs some pretty snazzy risk management strategies to keep its portfolio in decent shape against unexpected interest rate rollercoasters. But let’s face it, volatility is that annoying acquaintance who always crashes the party, and it’s never a pleasant surprise.

Take interest rate changes, for instance. You’d think they’d get the memo that stability is key. When rates drop, homeowners refinance. AGNC’s earnings shrivel faster than a balloon forgotten at a birthday party, leading to difficulties in reinvesting those repaid capital bits into new investments.

On the flip side, when interest rates have the audacity to rise, AGNC grapples with increased borrowing costs. And if its returns dare to slip below a certain level, well, let’s just say the dividend might take a hit-a harsh reminder that even dividends can have a bad hair day.

If AGNC decides to cut that dividend down the road, the impact on an investor’s income could feel like stepping on a LEGO. Not pleasant, and definitely not something anyone signs up for.

The price of stock

Then there’s the stock price-which you can think of as the lifeblood of AGNC’s charm offensive. If it wants to maintain the glitzy total return wrapped up in its hefty monthly dividend, it has to play nice with the stock price. But lo and behold, stock prices are fickle beasts!

Since its IPO in 2008, AGNC’s stock price has practically lost half its value. Ever seen someone try to return a slightly used loaf of bread to the store? That’s how a declining stock price feels-a tacit admission of a decision gone wrong. A major factor? The company has a tendency to issue new shares like they’re going out of fashion, which dilutes value faster than you can say “diminishing returns.”

This issuance introduced 92.6 million new shares in the second quarter, netting $799 million. Huh? So, instead of everyone getting their slice of the pie, it feels more like crumbs on the floor.

Consequently, AGNC’s average annual return since its launch has settled at a modest 10.7%, not the promising 15%. It’s like when a friend hypes a movie, and you walk out wondering if that’s the best they could come up with. A $10,000 investment growing to about $200,000 in 30 years? Sure, that’s fine, but isn’t it a tad underwhelming?

Chances are it’s not life-changing

To wrap this up: AGNC Investment shimmies with alluring monthly dividends, yet it carries the baggage of real risks. If the dividend or stock price takes a nosedive, investors could find themselves in a long-term financial pickle. With those odds, AGNC isn’t quite the earth-shattering investment you might have expected.

So, unless you’ve got a penchant for financial drama, investing in AGNC might just be a scenario you want to sidestep, preferably while dodging onlookers and muttering under your breath. 🥴

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

2025-08-23 20:19