Oh, Elon Musk. The man, the myth, the Twitter poll. If you’ve spent 2025 glued to his D.C. circus act-complete with political party plot twists and midnight tweetstorms-you’d think Tesla shareholders were busy knitting him a “Thanks for the Chaos” sweater. Spoiler: They’re not. They’re staring at a 21% stock dive, wondering if “disruption” was the company’s actual business model all along.

But let’s play the “What If” game, Wall Street’s favorite parlor trick. What if you’d thrown $10,000 into Tesla three years ago? Strap in, Dorothy-it’s a tornado of numbers ahead.

Recent shareholders have endured quite the winding road with Tesla stock

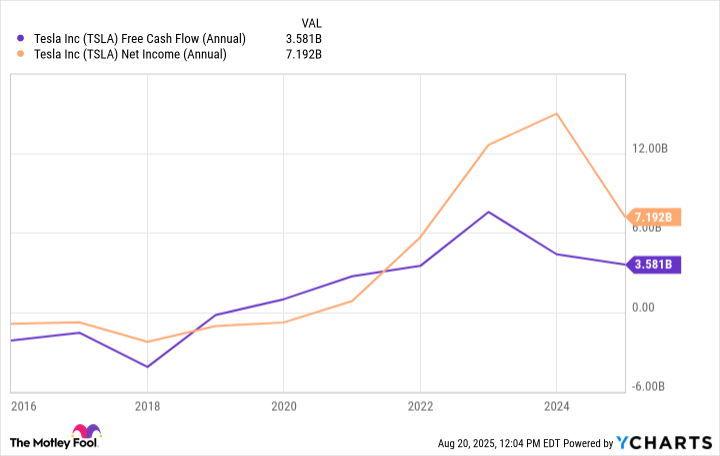

Revolutionizing the automotive industry? Child’s play. In 2020, Tesla’s first annual profit had investors humming “Happy Days Are Here Again.” Free cash flow! Profitability! The holy grail of “grown-up” metrics! It was the investing equivalent of watching your teenager finally clean their room… until they didn’t.

Fast-forward to today, and those metrics have pulled a Houdini. The bulls? Less bullish. The bears? More “I told you so.” And the stock? Let’s just say it’s been more rollercoaster than electric highway.

Longtime Tesla fans who held for a decade are up 1,900%-a feat that’d make Midas blush. But the three-year crowd? Your $10,000? Meet $10,880. Congrats! You’ve outpaced inflation by… barely enough to buy a single self-driving software update.

Has the time to power your portfolio with Tesla stock passed?

Skeptics once called Musk a “space cowboy with a PowerPoint.” Yet here we are, still debating if his next act is genius or gaslighting. Bulls say, “But the AI! The robots! The *potential*!” Cynics say, “But the margins! The competition! The *debt*!”

Yes, Tesla’s core business is sputtering like a Model 3 in a carwash. But hey-if you’ve got nerves of steel and a therapist on speed dial, maybe this stock’s still your kind of madness. 🚗💨

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- The Best Actors Who Have Played Hamlet, Ranked

- USD PHP PREDICTION

- 9 Video Games That Reshaped Our Moral Lens

2025-08-23 15:24