Folks, gather ’round, and let me tell you a tale about a man who’s been richer than Croesus since before most of us were born-Warren Buffett. Now, Warren ain’t just some Wall Street wizard in a three-piece suit; no sir, he’s more like the farmer who knows exactly when to plant his corn and when to harvest it. He don’t gamble with the markets-he dances with them, slow and steady, while the rest of us trip over our own feet trying to keep up.

See, Berkshire Hathaway (BRK.A) (BRK.B), that empire of his, has averaged nearly 20% annual returns since ol’ Buffett took the reins back in ’65. Compare that to the S&P 500’s (^GSPC) measly 10%, and you’ll see why folks pore over every move this man makes like he’s Moses parting the Red Sea. But here’s the rub: should you copy him? Well, not always. Truth be told, most of us ain’t built for that kind of patience. Still, if you’ve got a cool thousand bucks burning a hole in your pocket, there are two stocks from Buffett’s playbook that even the greenest investor can sink their teeth into. Let’s talk turkey.

1. Amazon: The Giant That Keeps Growing

Amazon (AMZN) is one of those companies so big, so sprawling, it’s hard to know where to start. Even Buffett himself once admitted he was shy about jumping on board-but credit where it’s due, his deputies talked some sense into him. And thank heavens they did, because Amazon ain’t just an online store anymore. It’s become something of a modern-day octopus, its tentacles reaching into e-commerce, cloud computing, advertising, entertainment-you name it.

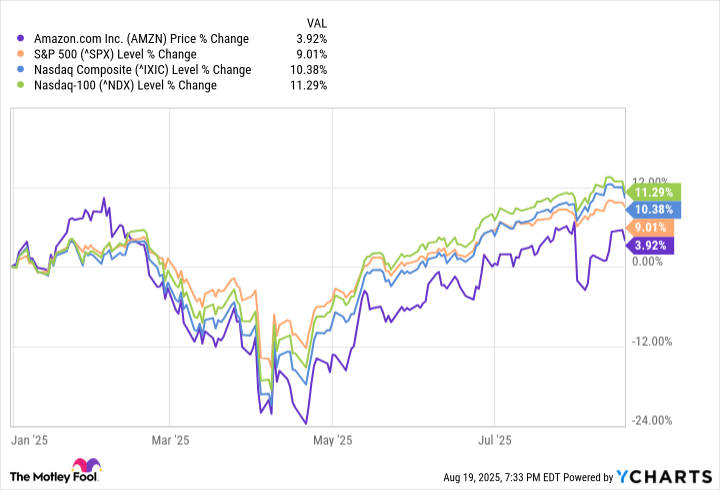

Now, I won’t lie to you-Amazon’s stock hasn’t exactly set the world ablaze this year. Year-to-date, it’s only up around 4%, lagging behind both the S&P 500 and the tech-heavy Nasdaq Composite (^IXIC). What gives? Blame it on the cloud-or rather, Amazon Web Services (AWS). Investors were expecting fireworks, but instead, they got sparklers. AWS revenue grew by 17% last quarter-not bad, mind you, until you compare it to Microsoft Azure’s 39% or Google Cloud’s 32%.

But hold your horses before you jump ship. AWS is still king of the hill when it comes to cloud platforms, and any business that size is bound to hit a speed bump eventually. Besides, Amazon’s other ventures-like its booming ad business-are quietly chugging along, adding fuel to the fire. Mark my words: this company’s got legs longer than a Texas highway.

2. Visa: The Quiet King of Commerce

If Amazon is the flashy showman of the stock market, then Visa (V) is the quiet old-timer sitting in the corner, sipping coffee and watching everyone else make fools of themselves. Buffett loves businesses with what he calls “economic moats,” and Visa? Oh, it’s swimming in one wider than the Mississippi.

Let me paint you a picture: Visa works with over 150 million merchants worldwide, partners with roughly 14,500 financial institutions, and processed more than $16 trillion in payments in the past year alone. Sixteen trillion! If that number doesn’t make your eyes pop out like saucers, nothing will. And here’s the kicker-it benefits from what we call the network effect. Merchants take Visa because everyone uses Visa, and people use Visa because everywhere takes Visa. It’s a virtuous cycle, as unstoppable as a runaway train.

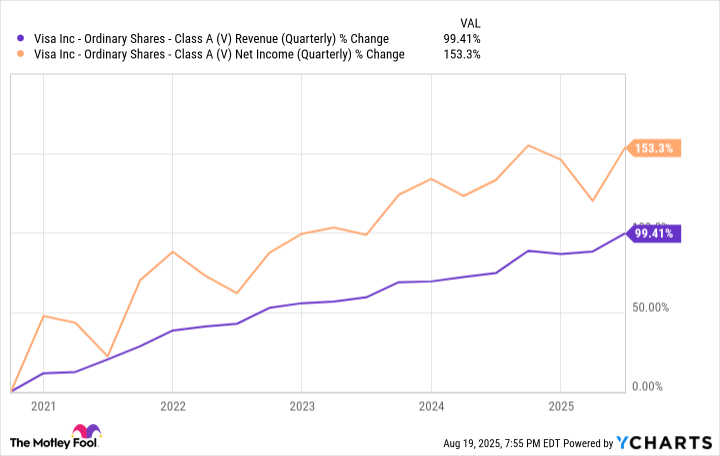

Even with consumer spending cooling off a touch, Visa keeps raking it in. In its latest quarter, revenue climbed 14% year-over-year, and net income rose 8%. Not too shabby for a company that doesn’t actually lend money or take deposits. And get this-they’re not resting on their laurels. No sir, Visa’s busy dabbling in stablecoins and artificial intelligence, ensuring they stay ahead of the digital payment curve. As long as folks keep swiping plastic-or tapping phones-Visa’s going to keep printing money.

So there you have it, friends: two Buffett-approved stocks worth considering if you’ve got a grand to spare. Whether you plunk it all down on one or split it between the two, either choice could pay dividends in the long run. Just remember, investing ain’t a sprint-it’s a marathon. Take a page out of Buffett’s book, and play the long game. 🌟

Read More

- Gold Rate Forecast

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- TON PREDICTION. TON cryptocurrency

- 39th Developer Notes: 2.5th Anniversary Update

- ‘The Conjuring: Last Rites’ Tops HBO Max’s Top 10 Most-Watched Movies List of the Week

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- New Sci-Fi Movies & TV Shows Set to Release in December 2025

2025-08-23 13:59