Archer Aviation (ACHR) peddles a vision as beguiling as it is perilous: electric vertical takeoff and landing aircraft, those metallic songbirds of the urban canopy. Imagine, if you will, a world where 45-minute commutes dissolve into 10-minute glides above the asphalt labyrinth. A dream, certainly. Yet the FAA, that stolid sentinel of the skies, has yet to grant its blessing. Thus, we are left to ponder: does this fledgling company stand on the precipice of revolution, or is it merely a feather in the cap of a rival like Joby Aviation? Though its market cap-$6 billion-pales beside Joby’s $12.7 billion, I find myself drawn to Archer’s narrative, a tale of ambition and arithmetic.

What, then, is Archer Aviation? A purveyor of eVTOLs, those electric chariots meant to ferry souls through the smog-choked arteries of cities. Its flagship, the Midnight, is a five-seat, 12-rotored marvel, a creature of both promise and peril. A recent test flight, spanning 55 miles in 31 minutes, hints at its potential. Yet, for now, Archer remains a bird in a gilded cage, its wings clipped by regulatory scrutiny and the inexorable burn of cash.

Strategic partnerships are keeping Archer aloft

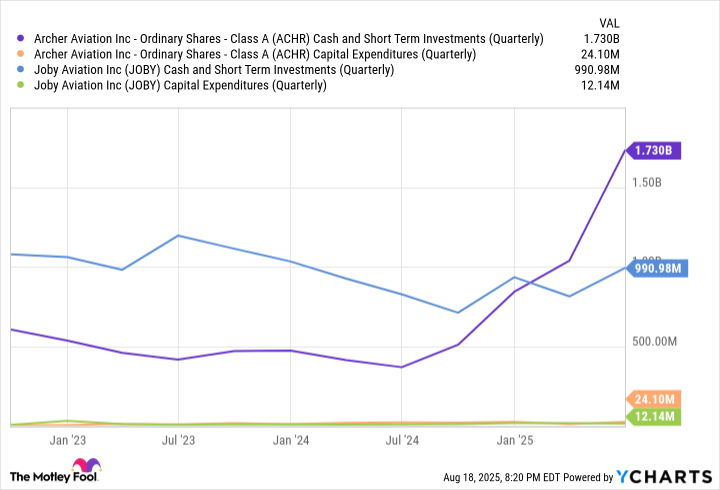

Archer’s balance sheet, one might say, is a portrait of paradox. At the close of June, it boasted $1.73 billion in cash, a reservoir swollen by capital infusions. Toyota, that titan of terrestrial transport, has pledged $250 million to Joby, yet Archer’s coffers remain deeper. The chart, that silent witness to financial tides, reveals a disparity: Archer’s liquidity outstrips its rival’s. At a current burn rate of $400 million annually, the company could endure four to five years before needing fresh funds-a luxury Joby, with its higher expenditure, lacks.

But cash is a fickle companion. As testing intensifies and production looms, Archer’s runway will shorten. The FAA’s type certification, a gatekeeper’s nod, is years away. And should the company turn to equity to sustain itself, shareholders will find their stakes diluted, a bittersweet cost of progress.

Yet Archer is not without allies. United Airlines, Stellantis, Boeing-giants of yesteryear-stand beside it, their partnerships a bridge between past and future. And there is the tantalizing prospect of defense contracts, unshackled from FAA’s labyrinthine rules. Should the White House’s recent embrace of eVTOLs bear fruit, Archer might yet find itself in the crosshairs of opportunity.

Losses, of course, widen. Q2’s $206 million deficit, a 93% increase from the prior year, is a grim testament to the cost of innovation. But such is the price of flight. The company’s liquidity, its partners, and the shadow of military contracts render it, in my estimation, a stock worth buying. At 32% below its recent high, the price whispers of possibility.

Investors, take heed: the road ahead is strewn with turbulence. Yet patience, that rarest of virtues, may yet reward those who hold fast. For Archer’s story is but a prologue, its wings still unfurled. 🌤️

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Worst Black A-List Hollywood Actors

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2025-08-23 13:42