Warren Buffett, the sage of Omaha and self-proclaimed “Oracle,” once declared his undying love for the shiny fruit company known as Apple (AAPL). At one point, Apple was so firmly lodged in Berkshire Hathaway’s portfolio that it made up approximately 50% of its investment pie, as if economic diversification were merely a theoretical exercise rather than a practical reality. However, in a development that would warrant a chorus of gasps echoing through the stock exchanges (perhaps even inspiring a mildly uncomfortable silence), Buffett began divesting himself of Apple shares in the fourth quarter of 2023, pulling the plug with an alarming sense of purpose. Since that fateful decision, there’s been a steady tapering of his Apple holdings, akin to a slow, painful withdrawal from an old friend who has suddenly taken to wearing socks with sandals.

Now, here lies a conundrum worthy of the great minds in quantum physics (or, at the very least, illustrated children’s books): is Buffett privy to some cosmic truth regarding Apple that we mere mortals cannot fathom? Or has he simply decided that it’s high time to engage in some very adult financial rearranging, throwing caution-and Apple shares-to the wind?

Apple’s Stock: No Longer The Bargain of the Century

Once hailed as the darling of consumer tech in the U.S. (and perhaps a distant cousin of the exalted Galactic Government), Apple has cultivated a passionate customer cadre, both domestically and internationally. Back in the ancient lands of Q1 2016 (which, if the universe were kind, would be when we also discovered that avocado toast is, indeed, delicious), Buffett first made his bold entry into the Apple fray. At that time, Apple had the allure of an undervalued gem, deceptively shiny and begging for someone to come along and polish it until it sparkled (preferably not with a questionable Windex hack). This initial investment gleamed as a benchmark of investment acumen. However, to still label Apple as undervalued in our present epoch would be akin to claiming that an ordinary rock possesses divine attributes simply because one fondly remembers that it was once used as a doorstop, an emblem of affordability.

To add some flavor to the cosmic soup of financial metrics, Apple’s trailing price-to-earnings (P/E) ratio has recently escalated, climbing towards altitudes that would make even the most audacious mountain climber reconsider his life choices. As the universe would have it, that very P/E ratio now hovers near its zenith, not unlike a cat on a windowsill, poised to leap into the unknown, yet eyeing the ground below with a mixture of excitement and existential dread.

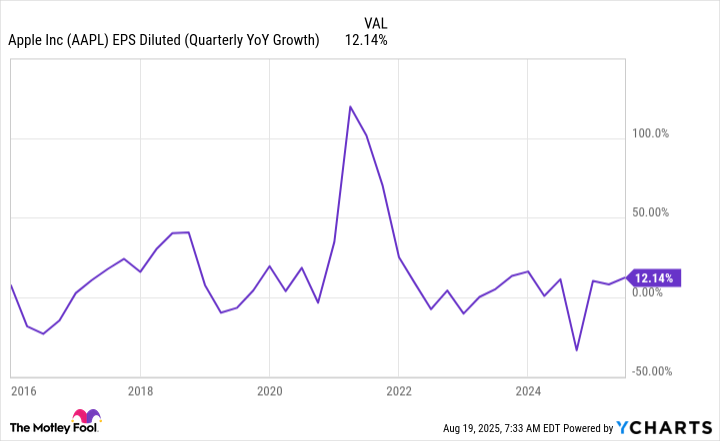

In an amusing twist of fate (as is often the case in this delightful tapestry of existence), Apple has grown over time but is now stagnating at the same unabashed growth rate it had when it was indeed affordable. This is akin to watching a once-inspiring epic saga devolve into a repetitive sitcom that overstayed its welcome on air.

Thus stands the crux of the matter: Apple’s stock now trades at a pleasingly premium price, yet lacks the juiciness of growth to justify such a valuation-a scenario that might lightly tickle Buffett’s well-tuned investment sensibilities. Of equal concern is his intriguing behavior post-divestiture. Not a single large acquisition with the proceeds from selling Apple shares! This omission suggests that he may view the current stock market as a grand bazaar where everything is priced well above fair market value, leaving his cash reserves akin to sage advice from a wise elder who has opted to avoid all but the most necessary of investments.

Yet, ponder this: could it be that our venerable leader is not simply cleaning house for his own sake, but rather orchestrating a smooth handoff to his successor, Greg Abel-a man poised to inherit the grand investment tapestry of Berkshire?

The Cash Conundrum: Preparing for a Successor

As we glide towards the year’s end, Warren Buffett prepares to step aside, allowing Greg Abel to assume the royal mantle of Berkshire’s CEO. Picture this: if Buffett painstakingly balances the portfolio in such a way that Abel is left handling a tidy cash reserve (rather than an unsightly heap of disorganized investments), Chicago-style pizza will seem less complex. Abel will then possess the freedom to navigate the investment waters without needing to consult the ancient scrolls of Buffettian wisdom for every decision he makes. With Berkshire’s cash and short-term investments soaring to an almost absurd $344 billion, Abel will have the financial clout to make bold choices-or to simply indulge in a new line of inflatable swimming pools, if he so desires.

What remains to be seen is whether Abel will follow Buffett’s cautious footsteps or embark on a rollercoaster ride of audacious investment forays. Imagining someone more conservative than Buffett-which is akin to trying to picture a quasar doing a tightrope act-might indeed be challenging. But one must never underestimate the capabilities of individuals emerging from shadowy corners of the investment cosmos.

Even now, Apple constitutes a sizeable portion of Berkshire’s portfolio, accounting for roughly 22% of its overall value, as if hedge fund managers were competing in a game of Monopoly where all the properties somehow lead back to the same beloved glowing apple. Meanwhile, the runner-up in this competition, American Express, claims approximately 19%, tantalizingly close to usurping Apple’s prime position as the crown jewel. This could lead to a delightful existential crisis for portfolio managers everywhere contemplating the veracity of their chosen investments.

Given Apple’s current lofty valuation, it wouldn’t be surprising to see more share sales sprout up like dandelions in the springtime during the next quarter. For those still perched on the Apple investment bandwagon, basking in the glow of substantial gains, it may be wise, nay, prudent, to heed Buffett’s enigmatic moves. After all, in this ever-complex universe of market fluctuations, there exist a myriad of potentially more tempting investment desserts just waiting to be gobbled up.

So, as the stars align in the cosmos of capital markets, let us remember: if Warren Buffett can sell Apple, what on Earth (or indeed off it) might be next? 🍏

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Worst Black A-List Hollywood Actors

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

2025-08-23 12:33