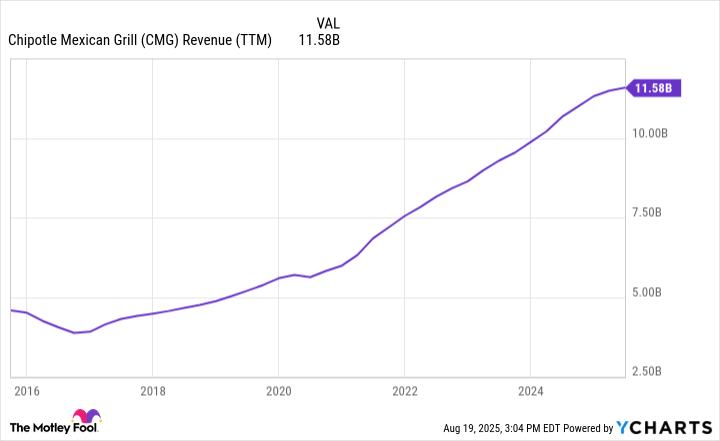

Behold, dear reader, the curious case of Chipotle (CMG), a creature of the fast-casual realm that once soared on wings of burrito-stuffed ambition. Alas, its quarterly financials in July brought forth not triumph but a great sigh from the heavens above-or perhaps it was merely the collective groan of Wall Street analysts clutching their spreadsheets like talismans against ruin. The numbers were grim; customer traffic had fled as though chased by ghosts, and same-store sales growth wilted like a forgotten avocado left too long in the sun. Profitability? It crumbled like stale tortilla chips beneath the weight of inflationary woes.

And so, the stock plummeted-a descent of 37% from its lofty peaks, leaving investors to ponder whether this calamity presents an opportunity or simply another chapter in the tragicomic opera of modern capitalism. Is Chipotle stock a can’t-miss bargain, you ask? Ah, what a question! Let us peer into the murky depths of this matter with skepticism as our lantern and irony as our guide.

The Vanishing Customers

CMG”>

One cannot help but marvel at the absurdity of it all. Here stands a company whose very name has become synonymous with bowls of rice and beans served with mechanical precision, yet even such a paragon of efficiency is not immune to the whims of fate. As if to mock its plight further, input costs rise unchecked, fueled by the insidious specter of inflation. Surely, there exists somewhere a ledger wherein these injustices are recorded, though whether any mortal hand shall ever balance it remains to be seen.

Dreams of Global Empire

Yet despair not entirely, for Chipotle’s management clings steadfastly to dreams of expansion. They speak of 7,000 stores across North America, a number so vast it seems plucked from the fevered imaginings of some mad cartographer. And beyond? Ah, beyond lies the true prize: Western Europe, the Middle East, and even Mexico itself, where Chipotle plans to plant its flag later this year. One location in Mexico, they say, will suffice to prove the concept-a notion so audacious it borders on farce. If an American-Mexican chain can thrive in the land of its culinary forebears, surely it can conquer any corner of the globe!

But let us temper our enthusiasm, for such dreams require time, patience, and no small measure of luck. Should average restaurant volume climb from $3.1 million to $3.5 million, and should the brand reach the hallowed milestone of 10,000 locations, annual sales could swell to $35 billion. Such figures dazzle the eye and quicken the pulse-but they also demand faith in a future fraught with uncertainty. Faith, I might add, is a commodity often in short supply among skeptical investors.

A Home-Run Buy? Hardly.

At present, Chipotle commands a market cap of $58 billion and trades at a price-to-earnings ratio of 38.5-a valuation neither modest nor particularly enticing after its recent decline. To justify such a multiple, one must believe fervently in the company’s ability to maintain a 15% net income margin while scaling to unprecedented heights. Even then, the promised land of $5.25 billion in earnings lies decades hence, assuming all goes according to plan.

By that point, dear reader, who can say what the world will look like? Perhaps flying carriages will ferry commuters through skies thick with smog, or perhaps humanity will have abandoned restaurants altogether in favor of nutrient pellets dispensed by machines. In either scenario, the prospect of waiting 10 to 15 years for Chipotle’s P/E ratio to drop to a mere 10 feels less like investing and more like penance. No, Chipotle is no home-run buy-not at today’s price, and certainly not for those whose nerves are easily frayed. 🤷♂️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- Banks & Shadows: A 2026 Outlook

2025-08-23 11:28