Few figures command as much reverence in the investing world as Warren Buffett, that alchemist of Omaha whose every move is scrutinized by sycophants and skeptics alike. His empire, Berkshire Hathaway, has long been a cathedral of capital, its spires reaching toward the heavens of market dominance. Yet even the most venerated edifices are not immune to the slow erosion of time-or the calculated retreat of a man who has spent a lifetime defying the whims of fortune.

Buffett’s net worth, a gilded monument to acumen, exceeds the market caps of entire industries. Berkshire, that colossus of capital, now ranks among the world’s 11th-largest public entities, its balance sheet a testament to the art of compounding. When such a titan shifts its weight, the financial world holds its breath, as though the outcome might determine the fate of civilization itself.

A recent maneuver has stirred particular consternation: the reduction of Berkshire’s stake in Bank of America, a holding since 2011. Once a cornerstone of the portfolio, this 8.2% slice now appears diminished, its former grandeur reduced by the sale of 41% of shares. The numbers, though staggering, speak to a man who has long viewed the market not as a game of chance but as a chessboard-each move a calculated step toward a distant, inevitable victory.

The rationale, as ever, is shrouded in the fog of speculation. Tax policy, valuation metrics, and the eternal dance of risk and reward-these are the ghosts that haunt the boardroom. Buffett’s aversion to overvaluation, that hallmark of his philosophy, may have driven the sale. Yet the irony is palpable: a man who once derided the “speculative excesses” of the market now finds himself navigating the same tempestuous waters, his hands steady but his motives opaque.

The Alchemist’s Dilemma

Bank of America is not the only victim of Berkshire’s pruning. Apple, too, has felt the scalpel’s touch, its shares shed in a bid to amass a cash hoard that now rivals the GDP of small nations. The reasons, though plausible, are as enigmatic as the man himself. The specter of rising taxes looms, as does the relentless pursuit of value-a concept that, in Buffett’s lexicon, is as elusive as it is absolute.

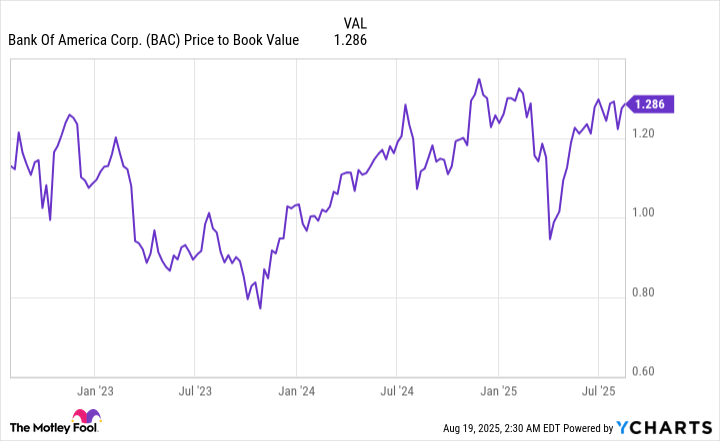

The price-to-book ratio of Bank of America, a mere 1.29, may have seemed a trifle inflated to the untrained eye. Yet in the world of high finance, even a 29% premium is a chasm. One might wonder if Buffett, ever the pragmatist, has simply concluded that the rewards no longer justify the risks-a sentiment as humbling as it is human.

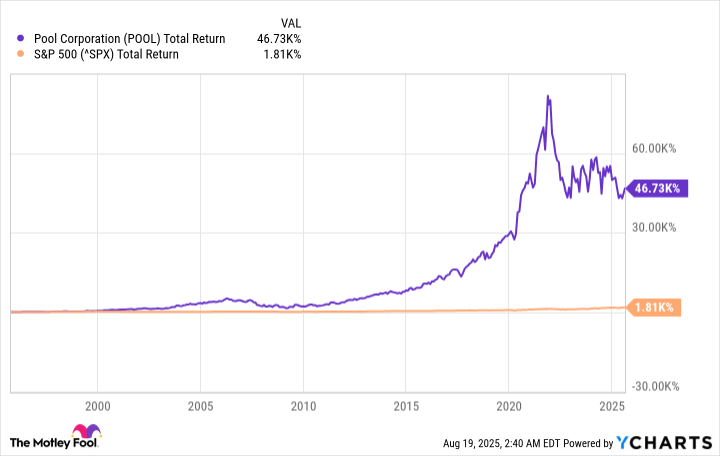

And so, the search for new horizons begins. Berkshire’s recent acquisition of Pool, a company whose stock has surged 47,000% since its 1995 IPO, is as baffling as it is bold. A wholesaler of swimming pool equipment? One might expect Buffett to favor the more glamorous trappings of industry-tech, energy, or the ever-alluring realm of finance. Yet here he is, drawn to the quiet, cyclical rhythms of a niche market, where the dividends are steady and the moat, if not formidable, is at least unyielding.

The Pool’s Paradox

Pool, that unassuming titan of backyard commerce, offers a trifecta of virtues: a competitive moat, shareholder-friendly stewardship, and a dividend that, while modest, is reliable. Its recent 8.5% decline may have been a boon for Berkshire, a chance to acquire shares at a discount. Yet the question lingers: what does this say about the state of the market? That even the most astute investors must now seek refuge in the shadows of obscurity?

To follow Buffett’s lead is to court folly. His moves, though often prescient, are not infallible. Yet for the long-term investor, the lesson is clear: the market’s caprices are as inevitable as the tides. One must choose one’s battles wisely, and sometimes, that means betting on the unglamorous.

In the end, Buffett’s actions are a reminder that even the most revered figures are subject to the same uncertainties that plague the rest of us. The market, that fickle mistress, offers no guarantees-only the promise of potential. And in that, perhaps, lies its greatest allure. 📈

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

- Ethereum Flips Netflix: Crypto Drama Beats Binge-Watching! 🎬💰

2025-08-23 10:35