One might say that the author of these lines, in their humble capacity as an equity researcher, has penned a number of articles that could fill a modest library-though not, alas, one of the grander ones. To contemplate offering investment advice to the venerable Warren Buffett, that paragon of financial acumen, is akin to suggesting to a master chef that the soufflé might benefit from a dash more salt. Yet here we are, with a proposition as audacious as a well-timed cricket match at Lord’s.

Mr. Buffett, that titan of the stock market, has long been a figure of admiration, his Berkshire Hathaway a veritable fortress of consistent returns. To propose an addition to his portfolio is, in truth, a task as daunting as attempting to teach a cat to fetch. Nevertheless, the author, a self-proclaimed devotee of the Oracle of Omaha, feels compelled to present a case for MercadoLibre, a company whose merits might, with a touch of optimism, align with the principles of the aforementioned financial sage.

This missive, then, is not a bold declaration of superiority, but rather a humble inquiry into whether MercadoLibre, that Latin American juggernaut, might find favor in the eyes of Mr. Buffett. After all, as the old adage goes, even the most seasoned investor might occasionally require a nudge from a well-meaning but slightly befuddled assistant.

The Art of the Grand Gesture

Berkshire Hathaway, that colossal entity, currently sports a market capitalization that would make a modest millionaire blush, with a cash reserve sufficient to fund a small nation’s infrastructure. To move the needle, as Mr. Buffett himself has noted, requires an investment of considerable heft-akin to a man attempting to shift a boulder with a feather.

In his recent missive to shareholders, Mr. Buffett lamented the scarcity of companies capable of making a meaningful impact on Berkshire’s vast empire. A $1 billion investment, while commendable, would be as a pebble in the ocean of Berkshire’s assets. Thus, the search for a suitable candidate necessitates a company of truly monumental stature.

MercadoLibre, with its valuation hovering around $120 billion, fits the bill with the elegance of a well-tailored suit. Though Mr. Buffett has, in the past, expressed skepticism toward international ventures, the author posits that MercadoLibre, with its commanding presence in Latin America, might just be the exception that proves the rule.

Value and Velocity: A Delightful Duet

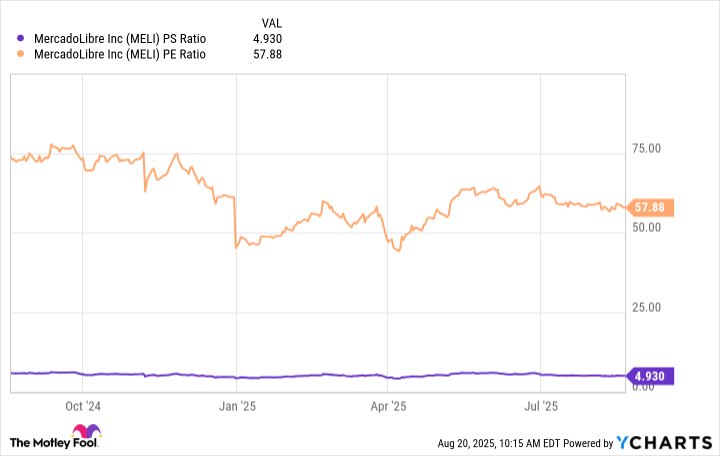

For Mr. Buffett, the concept of value is as sacred as a well-guarded secret. Yet, MercadoLibre, with its lofty price-to-sales and price-to-earnings ratios, might seem an unlikely candidate. However, as the sage himself has observed, growth is an indispensable component of value-a notion that MercadoLibre exemplifies with the vigor of a spring chicken.

The company’s revenue has grown with the consistency of a well-timed clock, surging by 38%, 37%, and 49% in recent years. Such figures are as thrilling as a surprise visit from an old friend. Moreover, its prospects remain as bright as a summer’s day, buoyed by the expansion of e-commerce and digital finance.

Thus, despite its current valuation, MercadoLibre presents a compelling case, much like a well-aged wine that improves with time.

The Moat: A Fortress of Folly

Mr. Buffett, ever the pragmatist, seeks businesses with enduring competitive advantages. MercadoLibre, with its sprawling logistics network, may just possess such a moat. The ability to deliver packages with the speed of a startled hare is no small feat, particularly in a region where such efficiency is as rare as a well-timed pause in a monsoon.

This logistical prowess, coupled with a burgeoning user base, ensures that MercadoLibre’s position is as secure as a well-locked door. The company’s growth, fueled by third-party listings and advertising, is as inevitable as the rising sun.

In conclusion, MercadoLibre, with its size, growth, and competitive advantages, might just be the missing piece in Berkshire’s grand puzzle. A dash of optimism, and all is well.

🚀

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Is T-Mobile’s Dividend Dream Too Good to Be True?

2025-08-23 03:13