Pray, What Should One Know:

- Bitcoin, in a curious fashion, rebounded 2.6% from $111,800 to $114,800, following Mr. Powell’s hint about potential rate cuts. How delightful!

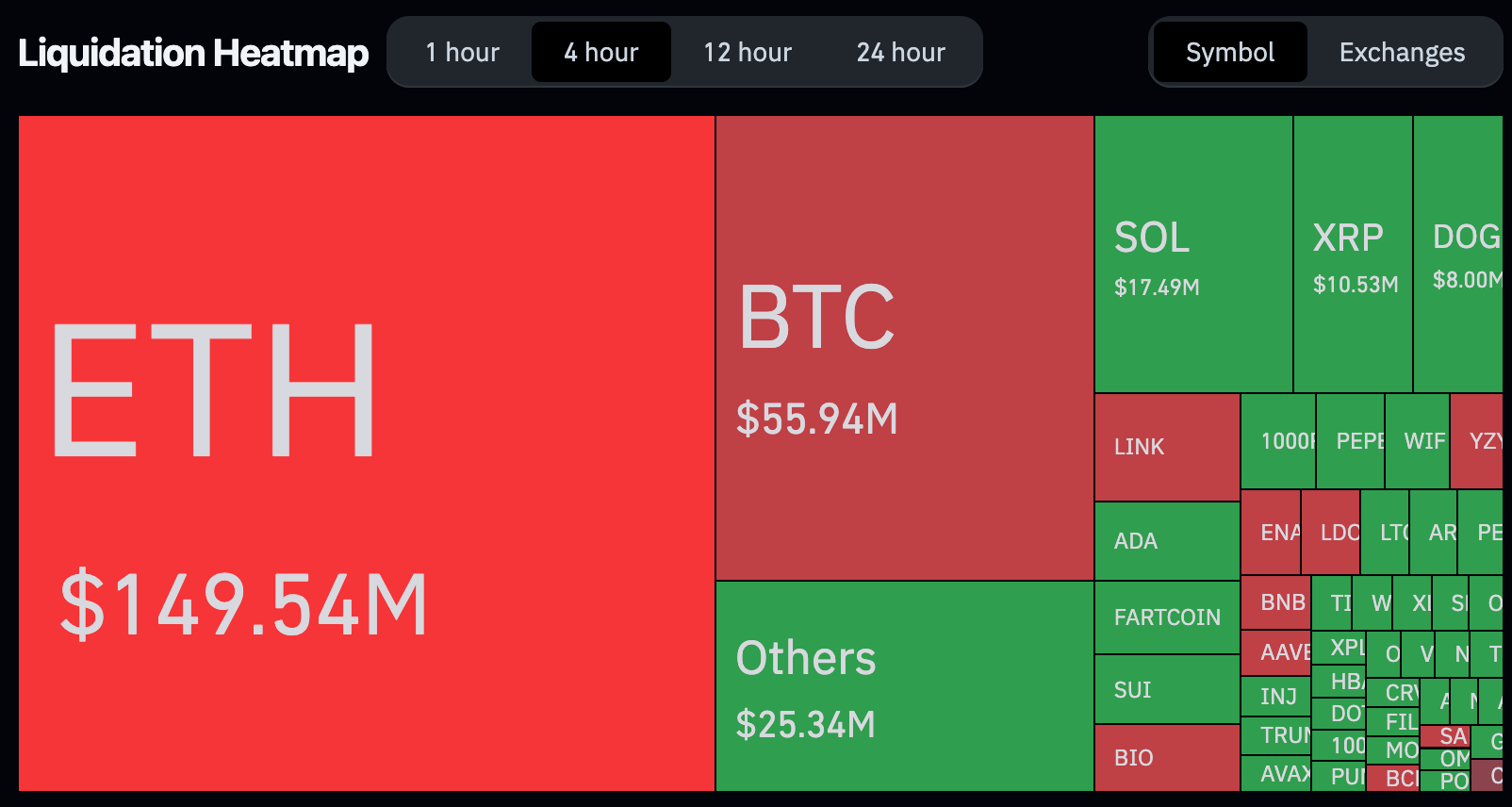

- Alas, $375 million in crypto positions were wiped away, with the brunt of it-$150 million-falling upon ETH shorts, as Ether leapt 10%. How the mighty fall!

- Volatility, dear reader, is still the reigning theme, with leverage rising and ETH, LDO, and ENA leading the altcoin charge. Truly, a spectacle of financial drama!

In This Articulation:

BTCBTC$116,943.46◢3.66%

BTCBTC$116,943.46◢3.66% ENAENA$0.7254◢16.33%

ENAENA$0.7254◢16.33%

Ah, Bitcoin, that fickle creature, bounced off the $111,800 support level on Friday. A curious rise of 2.6%, reaching $114,800, as Federal Reserve chairman Jerome Powell hinted at possible rate cuts during his speech at Jackson Hole. It seems even the most volatile of assets are swayed by such political whispers.

The swift ascension, following a prior sell-off, led to the liquidation of no less than $375 million in crypto derivatives positions. The majority of these, sadly, belonged to those poor souls holding short positions, who were swept away in the tide. Truly tragic.

As for Ether (ETH), it faced its own calamity. A staggering $150 million in ETH positions were liquidated over a mere four hours, as its price soared from $4,200 to $4,650-an increase of 10%. One wonders if traders ought to reconsider their positions more cautiously next time. A lesson learned, no doubt.

The critical nature of Bitcoin’s support level is not to be overlooked, for it marked a record high set in May. The bounce, one might say, is a sign of a bullish reversal, after a week-long downtrend from $124,500. A grand spectacle of financial movement!

Now, despite earlier fears that Mr. Powell’s speech might be a hawkish affair, he surprised all by saying, “The downside risks to employment are rising,” and, “If those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.” Surely, such words would have comforted those in the market, hinting that rate cuts could soon be on the horizon. And with that, dear reader, risk assets like Bitcoin and Ether may benefit greatly.

The market, however, remains ever so volatile after the speech, with Bitcoin pulling back slightly from $115,700 to $114,800. One can only wonder how long the turbulence will last. While liquidations have certainly cleared some positions, open interest has risen to its highest point in four days, suggesting that this bounce, much like the rise of the phoenix, is fueled by leverage, according to Coinalyze.

And, of course, the altcoin market, trailing behind Ether in its dramatic rise, finds solace only in Lido (LDO) and Ethena, both continuing their upward ascent after the SEC clarified the rules surrounding staking earlier this month. A tale as old as time-or, perhaps, just as new as the latest market fluctuation!

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- 39th Developer Notes: 2.5th Anniversary Update

2025-08-22 18:49